In recent times, irs has not received my tax return has become increasingly relevant in various contexts. - Internal Revenue Service. Where’s My Refund doesn’t show that we received your return. Call us about your refund status only if Where's My Refund recommends you contact us. Your refund may be delayed if your return needs corrections or extra review.

If we need more information to process your return, we'll send you a letter. In this context, find out if your federal or state tax return was received. You can check regardless of how you filed or whether you owe taxes or will receive a refund. When to Worry if Your Tax Refund Is Delayed - U.S. Here are some reasons your tax refund may take a while to receive this year – and tips for what you can do if yours is late. Refund Inquiries | Internal Revenue Service.

If you lost your refund check, you should initiate a refund trace: Use Where's My Refund, call us at 800-829-1954 and use the automated system, or speak with a representative by calling 800-829-1040 (see telephone assistance for hours of operation). Processing status for tax forms - Internal Revenue Service. Electronically filed Form 1040 returns are generally processed within 21 days. We’re currently processing paper returns received during the months below. This does not include those that require error correction or other special handling.

We generally process paper returns where a refund is expected before all other returns. Explore options for getting your federal tax refund, how to check your refund status, how to adjust next year’s refund and how to resolve refund problems. Why My IRS Refund Not Yet Received? Understanding the Delays and Next Steps. If you’ve filed your tax return and are eagerly awaiting your refund, it can be frustrating if it doesn’t arrive as expected.

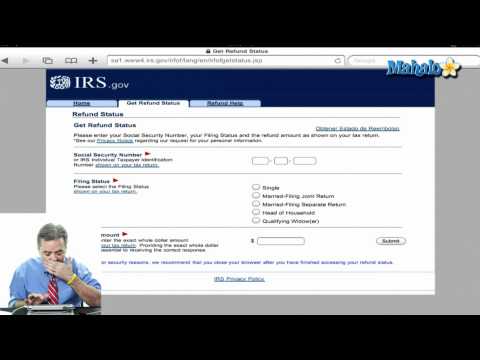

The IRS issues most refunds within 21 days for e-filed returns and 6 weeks for paper returns. However, there are several reasons why your refund may be delayed. IRS Where's My Refund. Please enter your Social Security Number, Tax Year, your Filing Status, and the Refund Amount as shown on your tax return.

All fields marked with an asterisk (*) are required. I filed my tax return, but the IRS says they didn't receive it - what now?. Resolve IRS missing return issues: learn why your tax return wasn't received, how to investigate, and steps to ensure timely filing and avoid penalties.

I Don’t Have My Refund - Taxpayer Advocate Service (TAS). In this context, we can offer you help if your tax problem is causing a financial difficulty, you’ve tried and been unable to resolve your issue with the IRS, or you believe an IRS system, process, or procedure just isn’t working as it should.

📝 Summary

Knowing about irs has not received my tax return is essential for anyone interested in this area. The information presented throughout acts as a valuable resource for continued learning.

It's our hope that this guide has provided you with valuable insights about irs has not received my tax return.

![Home [canikhita.com]](https://i0.wp.com/canikhita.com/wp-content/uploads/2023/09/IMG-7838.jpg?w=1200&quality=80)