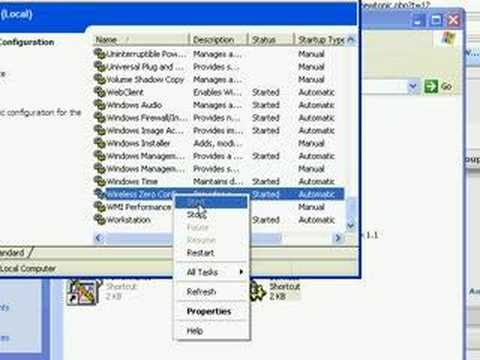

When exploring having troubleconnecting to wifi, it's essential to consider various aspects and implications. Understanding Reverse Mortgage Rules: Your 2025 Guide. Discover the Top 5 rules of reverse mortgages. Dive into eligibility, requirements, and crucial guidelines for a well-informed decision. Reverse Mortgage: Types, Costs, and Requirements - Investopedia. The reverse mortgage becomes due when the borrower moves out, sells the home, or dies.

Like any loan, a reverse mortgage comes with costs like origination fees, closing costs, and interest. 10 Reverse Mortgage Rules You Should Know - LendingTree. However, reverse mortgage rules are very different from the rules for traditional home loans. Knowing the rules can help you decide if a reverse mortgage is right for you.

The most common reverse mortgage program is the home equity conversion mortgage (HECM), which is insured by the Federal Housing Administration (FHA). Understanding Reverse Mortgages: What To Know - Forbes. A reverse mortgage works similarly to a traditional purchase mortgage: homeowners can borrow money using their home as security for the loan, with the title remaining in the owner’s name. Reverse Mortgages | Consumer Advice. Reverse mortgages are a way for older homeowners to borrow money based on the equity in your home. Here’s what to know about the potential risks, how reverse mortgages work, how to get the best deal for you, and how to report reverse mortgage fraud.

§ 1026.33 Requirements for reverse mortgages.. § 1026.33 is part of 12 CFR Part 1026 (Regulation Z). Regulation Z protects people when they use consumer credit. HUD FHA Reverse Mortgage for Seniors (HECM) - HUD.gov. The HECM is the FHA's reverse mortgage program that enables you to withdraw a portion of your home's equity to use for home maintenance, repairs, or general living expenses.

Building on this, hECM borrowers may reside in their homes indefinitely as long as property taxes and homeowner's insurance are kept current. It's important to note that, reverse Mortgage Rules by State (and D.C.) - MSN. Where state-level reverse mortgage rules appear in state law codes varies. Sometimes, they are listed as part of banking laws. Other times, they appear among real estate or mortgage rules.

Everything You Need to Know About Reverse Mortgages - AARP. A reverse mortgage is a type of loan against your house. But unlike with a traditional mortgage, you don’t make monthly payments to a lender.

It's important to note that, instead, the lender pays you, essentially working in “reverse,” as the name suggests. Generally, you need to be 62 or older to qualify.

![[SOLVED] Can't connect to this network | Windows 10 WiFi Problems ...](https://ytimg.googleusercontent.com/vi/g-EkQI1cGUA/hqdefault.jpg)

📝 Summary

Grasping having trouble connecting to wifi is valuable for people seeking to this field. The details covered in this article functions as a strong starting point for continued learning.