Why Every Business Needs A Cfo One Accountancy

Why Every Business Needs A Cfo One Accountancy Ever wondered why big and successful businesses employ a full time chief financial officer (cfo), not just bookkeepers? because they realise that a good cfo makes a significant difference to their profitability and cash flow. this helps underpin the success of the business. How can a cfo help your business or organization? a cfo guides your leadership team to define and measure financial strategy and plays a key role in charting your company’s course and helping you make decisions.

Why Every Business Needs A Cfo One Accountancy Delve into how a chief execute officer helps maximize profits, manage risks, guide long term growth strategies, and unlock the power of financial stability for your business. A cfo isn’t just for big corporations. in this clip from the accounting and tax helpdesk, cfo expert hoss breaks down what a chief financial officer really does, how they help you plan ahead. A cfo’s impact on a business can be summed up simply: they help you make smarter decisions, plan for growth, attract investment, and stay compliant. a cfo enables more informed decision making while also making sure your financial plans support your growth goals so you can scale up with confidence. A cfo can play a crucial role in the growth and success of a small business by providing expert financial management and strategic guidance. whether you need a full time cfo depends on the complexity of your business, your financial challenges, and your strategic goals.

Cfo Explains Why Every Business Needs 1password 1password A cfo’s impact on a business can be summed up simply: they help you make smarter decisions, plan for growth, attract investment, and stay compliant. a cfo enables more informed decision making while also making sure your financial plans support your growth goals so you can scale up with confidence. A cfo can play a crucial role in the growth and success of a small business by providing expert financial management and strategic guidance. whether you need a full time cfo depends on the complexity of your business, your financial challenges, and your strategic goals. To help you make an informed business decision as to whether or not to bring a cfo on board, let’s break down when you need a cfo and why, what the benefits are, and how you can get the hiring process started. A cfo (even a part time or fractional one) does more than oversee numbers – they connect the dots between the figures and the future of your business. they turn raw data into insights, and insights into strategy. While basic accounting is essential for keeping your business compliant and organized, cfo services provide the strategic financial leadership needed to drive growth, optimize resources, and ensure long term success. From driving innovation to fostering relationships, and compliance, there are plenty of reasons why businesses need a cfo. finaccountants’ skilled cfo team will assist you with your business operations and the complexity of dealing with finances in your organization.

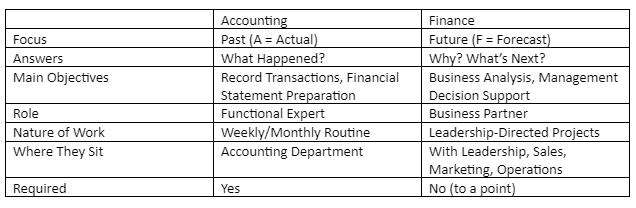

Why Every Business Needs A Cfo Data2profit Consulting To help you make an informed business decision as to whether or not to bring a cfo on board, let’s break down when you need a cfo and why, what the benefits are, and how you can get the hiring process started. A cfo (even a part time or fractional one) does more than oversee numbers – they connect the dots between the figures and the future of your business. they turn raw data into insights, and insights into strategy. While basic accounting is essential for keeping your business compliant and organized, cfo services provide the strategic financial leadership needed to drive growth, optimize resources, and ensure long term success. From driving innovation to fostering relationships, and compliance, there are plenty of reasons why businesses need a cfo. finaccountants’ skilled cfo team will assist you with your business operations and the complexity of dealing with finances in your organization.

Why Every Business Needs A Virtual Cfo Benefits And Insights Rmps While basic accounting is essential for keeping your business compliant and organized, cfo services provide the strategic financial leadership needed to drive growth, optimize resources, and ensure long term success. From driving innovation to fostering relationships, and compliance, there are plenty of reasons why businesses need a cfo. finaccountants’ skilled cfo team will assist you with your business operations and the complexity of dealing with finances in your organization.

Comments are closed.