What You Need To Know About Life Insurance 1 Life Insurance Sales

Life Insurance 101 All The Basics You Need To Know About Step 1: a solid client acquisition process. the first thing you need is a solid client acquisition process, and this is where most agents miss the boat. this step sets the tone for everything else that follows. if you don't have a solid client acquisition process, you can't expect to close any deals and make money. 1. anticipate common objections: prepare for common reasons why customers might hesitate, such as cost concerns, lack of perceived need, or negative experiences with insurance in the past. 2. respond with empathy and knowledge: acknowledge the customer’s concerns and address them with empathy and clear explanations.

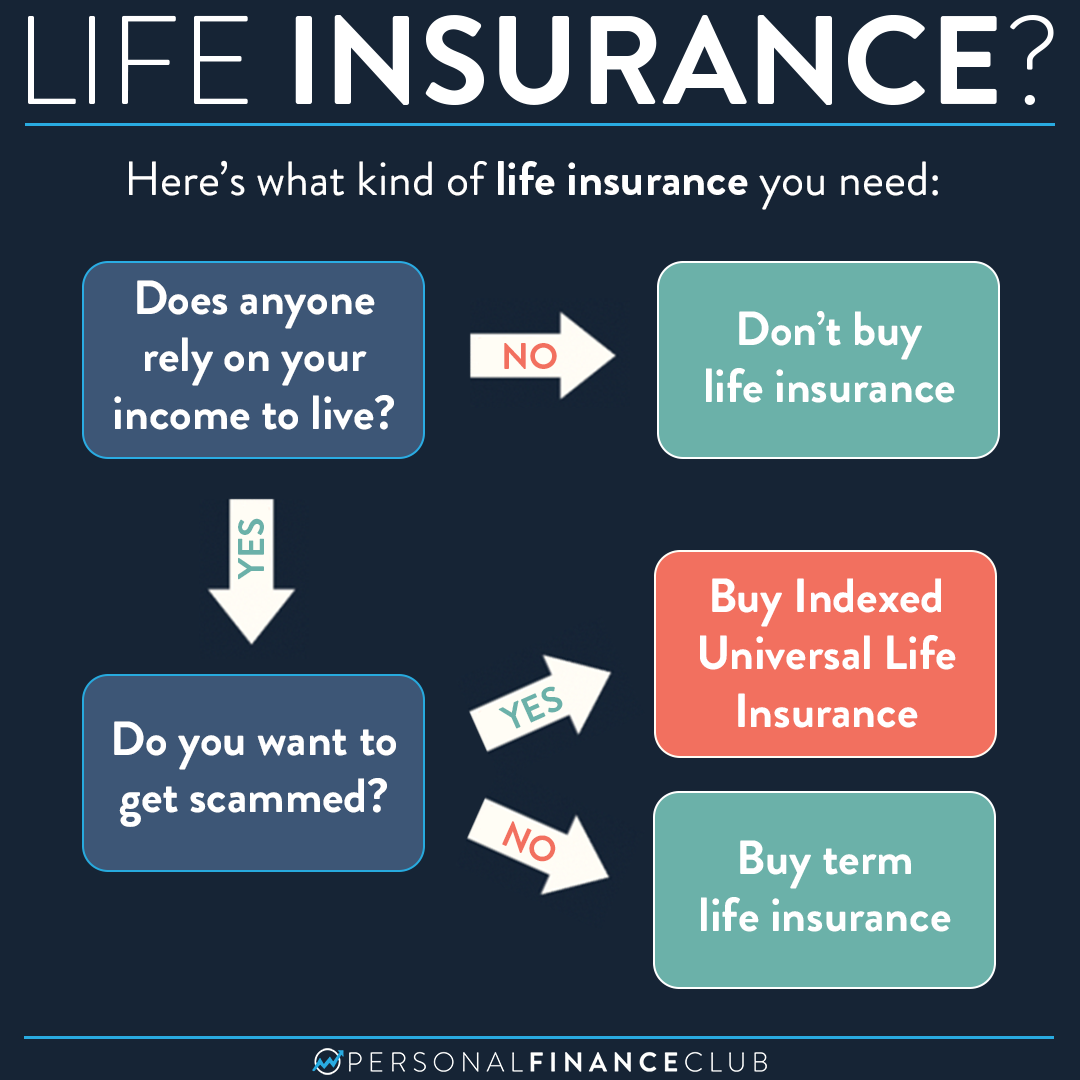

Hereтащs What Kind Of юааlifeюаб юааinsuranceюаб юааyouюаб юааneedюаб тау Personal Finance Club Pay close attention to the transaction costs, because they can easily eat up your profits. some experts indicate brokers can charge as much as 30 percent to 50 percent of the value of the policy. The u.s. bureau of labor statistics reports that insurance sales agents earn a wide range of salaries. the bottom 10% only earn an estimated $34,000 a year, but in the high range (90%) earn. Yes, selling life insurance can be difficult especially if you struggle with discussing death and have a hard time dealing with rejection. to be a successful life insurance salesperson, you should be comfortable with sales technology, get a sense of satisfaction from helping people, and possess self starter skills like persistence and confidence. Some of the life insurance 101 basics you need to know are the main differences between term and permanent life insurance. term insurance. permanent insurance. pays a death benefit to your beneficiary only if you die during the term of an active policy until age 95. pays a death benefit to your beneficiary regardless of when you die as long as.

Comments are closed.