What Is Value Chain Analysis And How To Do It Discover Digital Transfer Pricing

Value Chain Analysis Transfer Pricing Tpverse In this video, we explore the idea of vca, why is it important for international tax and transfer pricing, and how you can do the vca using digital transfer pricing tools. In simple terms, value chain analysis is a systematic way of examining all of the activities performed by a business to determine the sources of competitive advantage and how these translate. your guide to digital transfer pricing aibidia.

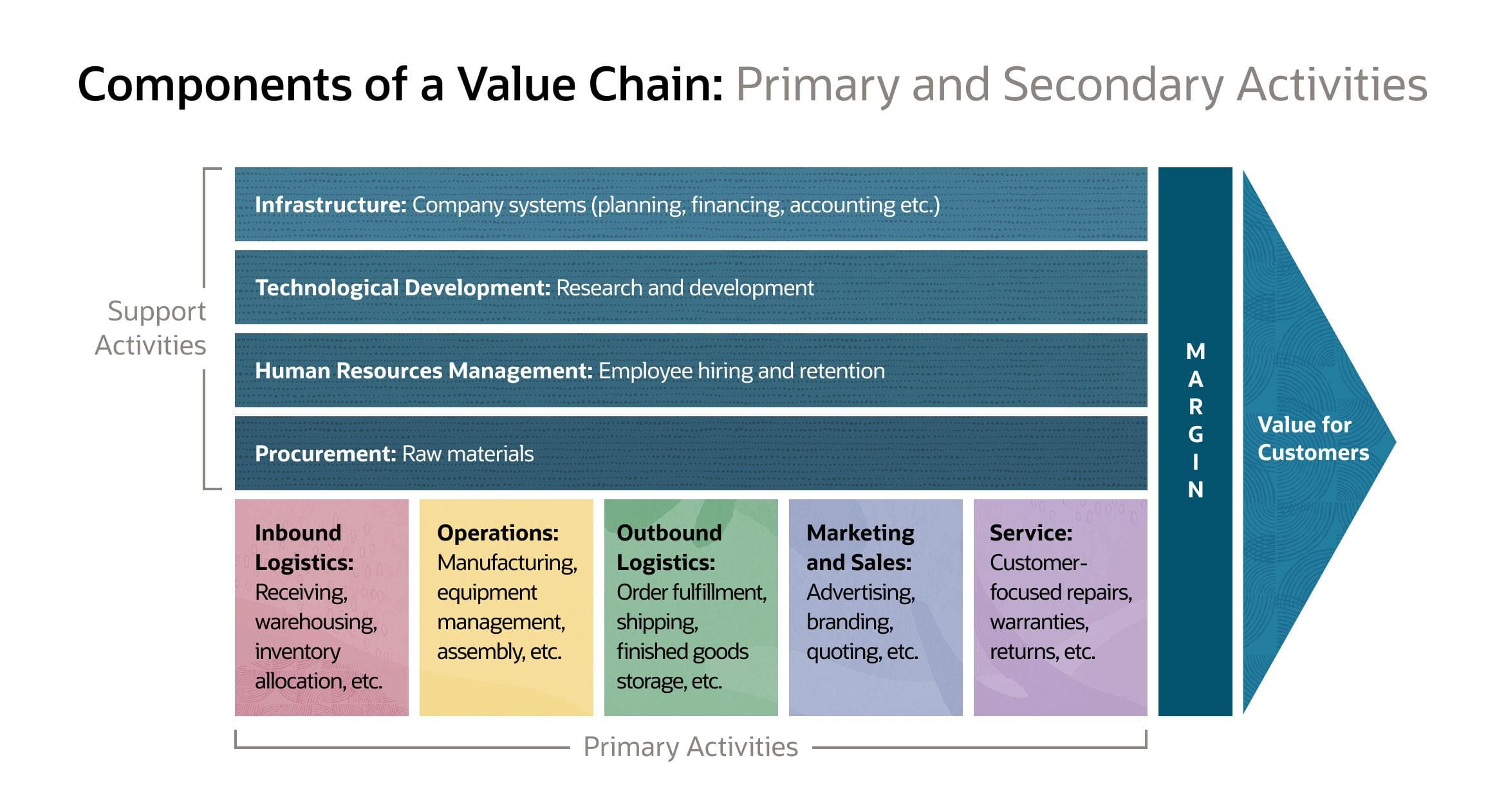

The Value In Value Chain Analysis A Transfer Pricing Perspective The evolution of international transfer pricing regulation has fundamentally transformed how multinational enterprises (mnes) approach intercompany pricing, with value chain analysis (vca) emerging as a critical tool for ensuring compliance with modern regulatory requirements 1. Value chain analysis is a means of evaluating each of the activities in a company’s value chain to understand where opportunities for improvement lie. conducting a value chain analysis prompts you to consider how each step adds or subtracts value from your final product or service. In short, transfer pricing aligned with business value through value chain analysis (vca) is key for multinationals. by understanding and applying transfer pricing and vca principles, companies can be compliant with international tax laws, and optimize financial results and competitive advantage. Many taxpayers these days are considering and often using this comprehensive approach to transfer pricing called value chain analysis (vca). the approach involves an investigation into the functions, risks, and assets of the controlled group as a whole, and an evaluation of how they integrate with the group’s key value drivers.

Value Chain Analysis The Next Generation Of Transfer Pricing Tpa Global In short, transfer pricing aligned with business value through value chain analysis (vca) is key for multinationals. by understanding and applying transfer pricing and vca principles, companies can be compliant with international tax laws, and optimize financial results and competitive advantage. Many taxpayers these days are considering and often using this comprehensive approach to transfer pricing called value chain analysis (vca). the approach involves an investigation into the functions, risks, and assets of the controlled group as a whole, and an evaluation of how they integrate with the group’s key value drivers. This article aims to present vca within the tp framework, outlining its development, core fundamentals, analysis techniques, and practical applications. our goal is to equip tp practitioners with the knowledge and strategies needed to leverage vca effectively in the post beps environment. A transfer pricing value chain analysis is a valuable exercise for taxpayers and transfer pricing professionals alike. it helps give perspective on the way a business functions and how each component of the business contributes value to the whole. In this video, we explore the idea of vca, why is it important for international tax and transfer pricing, and how you can do the vca using digital transfer pricing tools. Value chain analysis (vca) creates context for pricing transactions between entities by assessing the relative contributions made by each entity to the overall business.

Five Facts About Value Chain Analysis Every Transfer Pricing This article aims to present vca within the tp framework, outlining its development, core fundamentals, analysis techniques, and practical applications. our goal is to equip tp practitioners with the knowledge and strategies needed to leverage vca effectively in the post beps environment. A transfer pricing value chain analysis is a valuable exercise for taxpayers and transfer pricing professionals alike. it helps give perspective on the way a business functions and how each component of the business contributes value to the whole. In this video, we explore the idea of vca, why is it important for international tax and transfer pricing, and how you can do the vca using digital transfer pricing tools. Value chain analysis (vca) creates context for pricing transactions between entities by assessing the relative contributions made by each entity to the overall business.

International Value Chain Analysis Bdo In this video, we explore the idea of vca, why is it important for international tax and transfer pricing, and how you can do the vca using digital transfer pricing tools. Value chain analysis (vca) creates context for pricing transactions between entities by assessing the relative contributions made by each entity to the overall business.

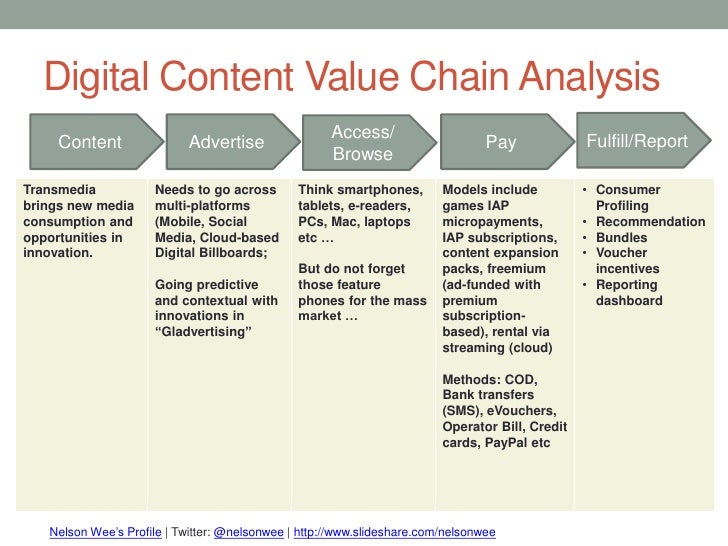

Digital Content Value Chain Analysis

Comments are closed.