What Is A Credit Score And Why It Matters

Understanding Your Credit Score And Why It Matters Envision Financial Credit scores typically range from 300 to 900 A higher score indicates better creditworthiness, which can lead to more favorable loan terms, lower interest rates, and higher credit limits Conversely Learn how to read your credit report and understand the key sections See how to identify errors, signs of fraud, and opportunities to improve your credit health

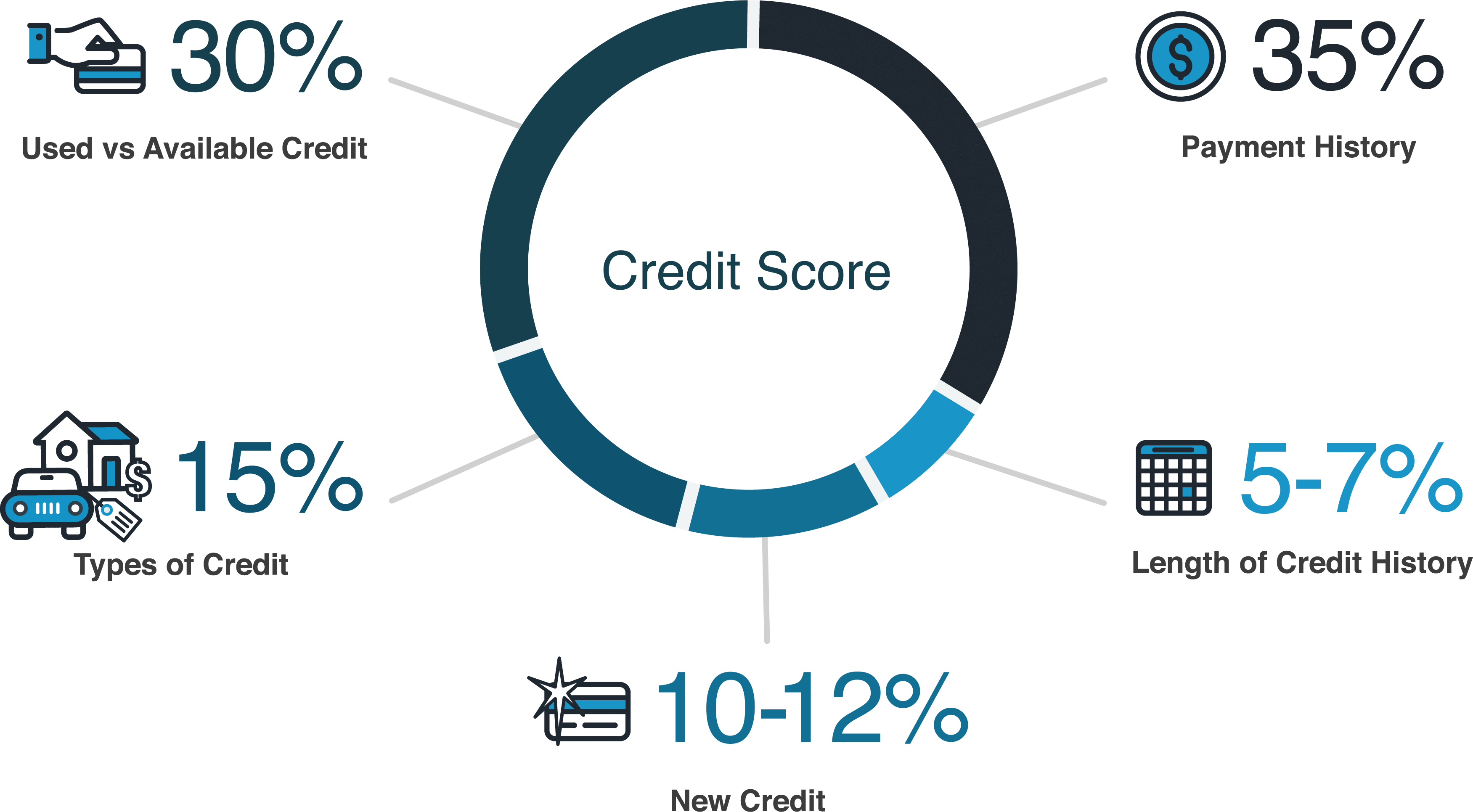

What Affects Credit Scores Infographic Equifaxв Learn how a financial advisor can assist with debt management, from devising repayment strategies to establishing financial security Knowing why credit is so important can help motivate you to work on building a good credit score Below, we outline a few major benefits of building credit, plus ways you can build a good score Most creditors do not put an account in collection status until there are several missed payments, which is why an account in collection status is so damaging to your credit score 3 Becoming an New credit can have a significant impact on your credit score, accounting for 10 percent of your FICO score That’s why it’s important to understand the difference between hard and soft

Comments are closed.