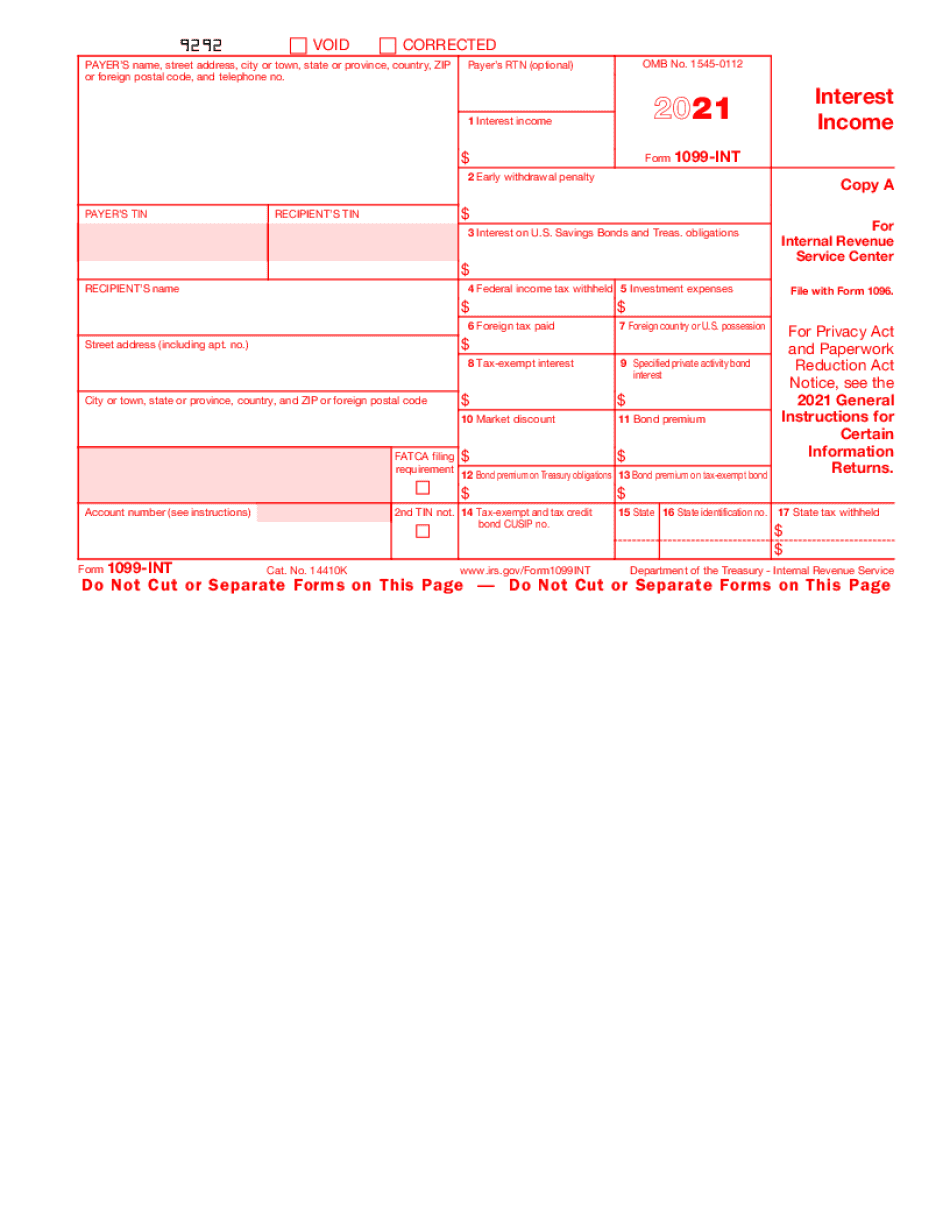

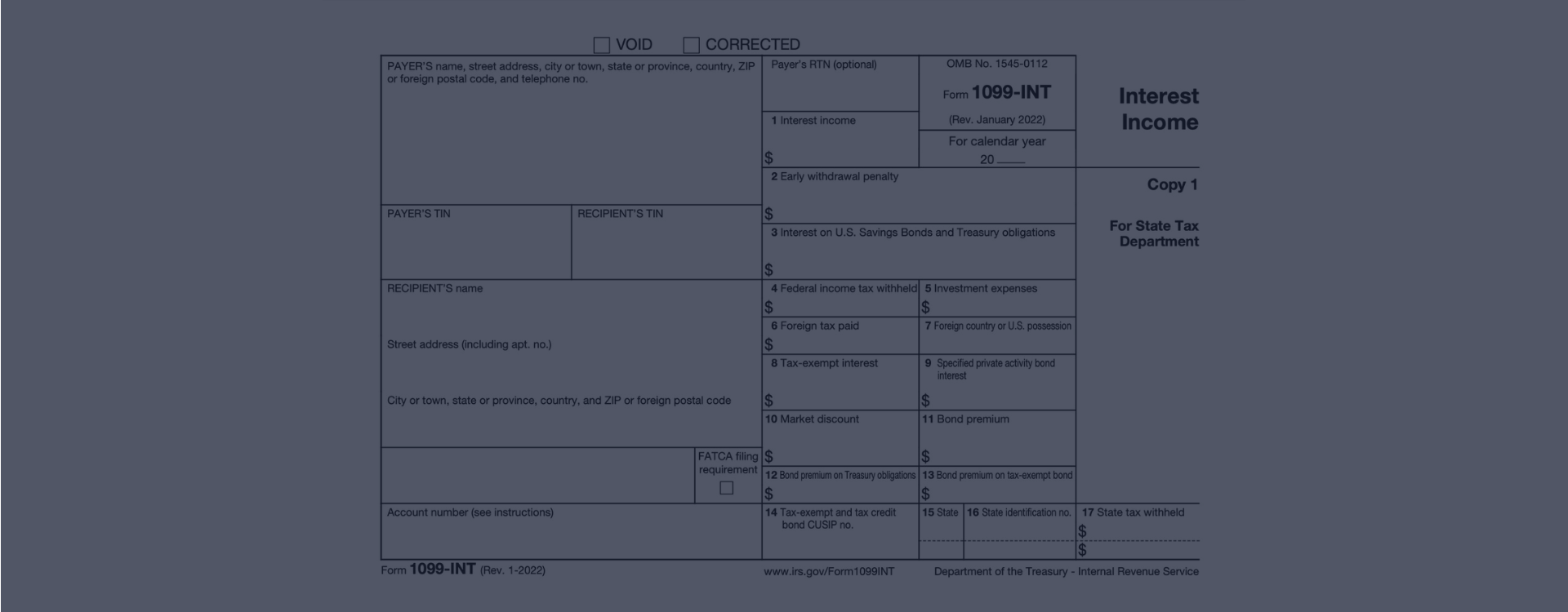

What Is A 1099 Int Form And What Is A 1099 Int Form Used For

1099int Software To Print And Efile Form 1099 Int Information about form 1099 int, interest income, including recent updates, related forms, and instructions on how to file. form 1099 int is used to report interest income. Form 1099 int is an internal revenue service (irs) tax form used to report interest income. form 1099 int is issued by all entities that pay interest income to investors.

Boost Efficiency With Our Editable Form For 1099 Int Form Form 1099 int reports any interest income you earned. you’ll receive this form if you earn at least $10 in interest during the tax year. most interest is taxable and should be reported as ordinary income on your federal tax return. what is form 1099 int from the irs?. What is form 1099 int? form 1099 int is an official tax document used to report interest income earned throughout the year. it is issued by banks, credit unions, brokerage firms, and other financial institutions to any individual who earns at least $10 in interest from a particular entity. Form 1099 int is an information return used to report interest income. financial institutions like banks, credit unions, and brokerages are required to send this form to individuals and the irs if they pay out at least $10 in interest during a calendar year. The 1099 int is a type of irs form that shows how much interest an entity paid you throughout the year. you might receive a 1099 int from your bank because it paid.

Form 1099 Int Software 289 Efile 1099 Int Software Form 1099 int is an information return used to report interest income. financial institutions like banks, credit unions, and brokerages are required to send this form to individuals and the irs if they pay out at least $10 in interest during a calendar year. The 1099 int is a type of irs form that shows how much interest an entity paid you throughout the year. you might receive a 1099 int from your bank because it paid. Form 1099 int reports to the irs how much interest you received from interest earning accounts, bonds, and the like. you should receive a 1099 int if you earned at least $10 in interest from a single entity, like a bank, life insurance carrier, brokerage firm, or bond issuer. The 1099 int form is a tax document issued by banks, credit unions, and other financial institutions to report interest income earned by individuals throughout the year. this form is crucial for tax reporting as it helps the irs track taxable interest income received from various financial sources. Form 1099 int is an irs income tax form used by taxpayers to report interest income received. interest paying entities must issue form 1099 int to investors at year end and include a breakdown of all types of interest income and related expenses. What is form 1099 int? if your earnings in interest have reached $10 or more, you’ll see this form come tax season. it serves as an official record for the irs to track the interest.

Tax Form 1099 Int Irs Fillable 1099 Int Form For 2023 Pdf To File Form 1099 int reports to the irs how much interest you received from interest earning accounts, bonds, and the like. you should receive a 1099 int if you earned at least $10 in interest from a single entity, like a bank, life insurance carrier, brokerage firm, or bond issuer. The 1099 int form is a tax document issued by banks, credit unions, and other financial institutions to report interest income earned by individuals throughout the year. this form is crucial for tax reporting as it helps the irs track taxable interest income received from various financial sources. Form 1099 int is an irs income tax form used by taxpayers to report interest income received. interest paying entities must issue form 1099 int to investors at year end and include a breakdown of all types of interest income and related expenses. What is form 1099 int? if your earnings in interest have reached $10 or more, you’ll see this form come tax season. it serves as an official record for the irs to track the interest.

Comments are closed.