Unified Evaluation Of Deep Option Pricing Methods Preferred Networks

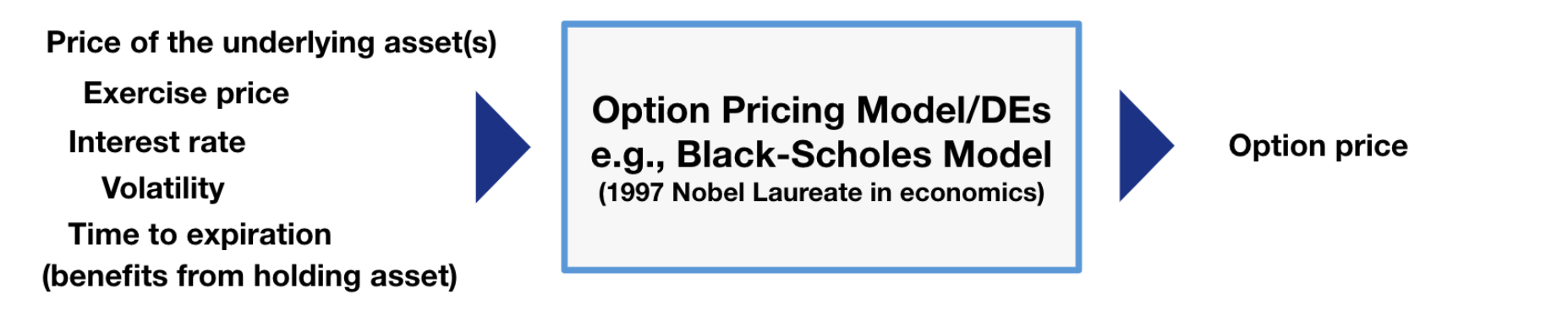

Option Pricing Using Artificial Neural Networks Pdf Option Finance When pricing an option, we essentially calculate the expected future gains (or losses) that the option will produce based on multiple economic variables like volatility and then calculate what that value would be worth in terms of today’s value. We propose a method for accelerating the pricing of american options to near instantaneous using a feed forward neural network. this neural network is trained over the chosen (e.g., heston) stochastic volatility specification.

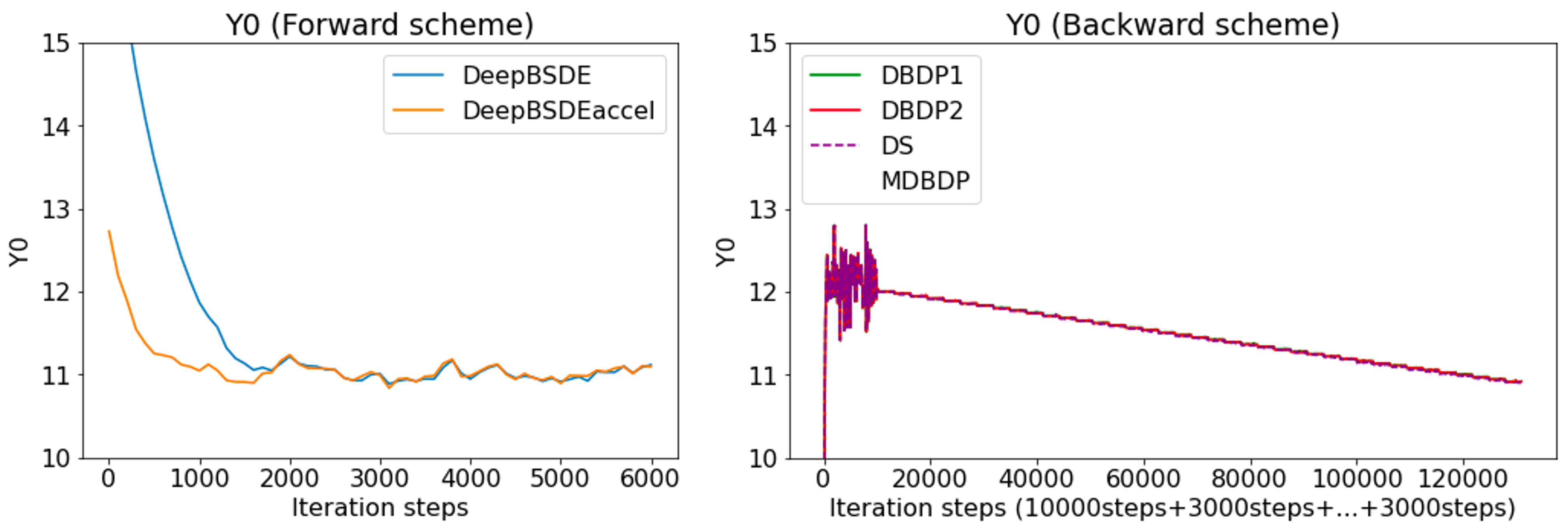

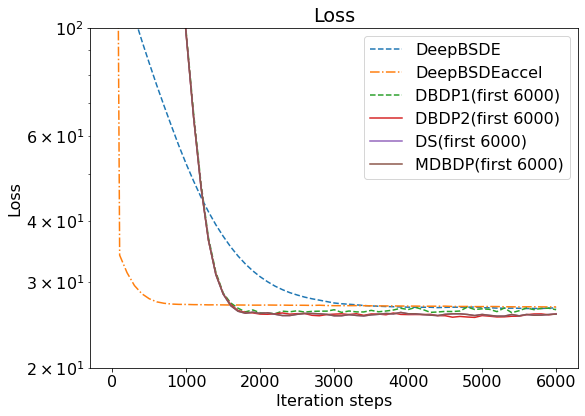

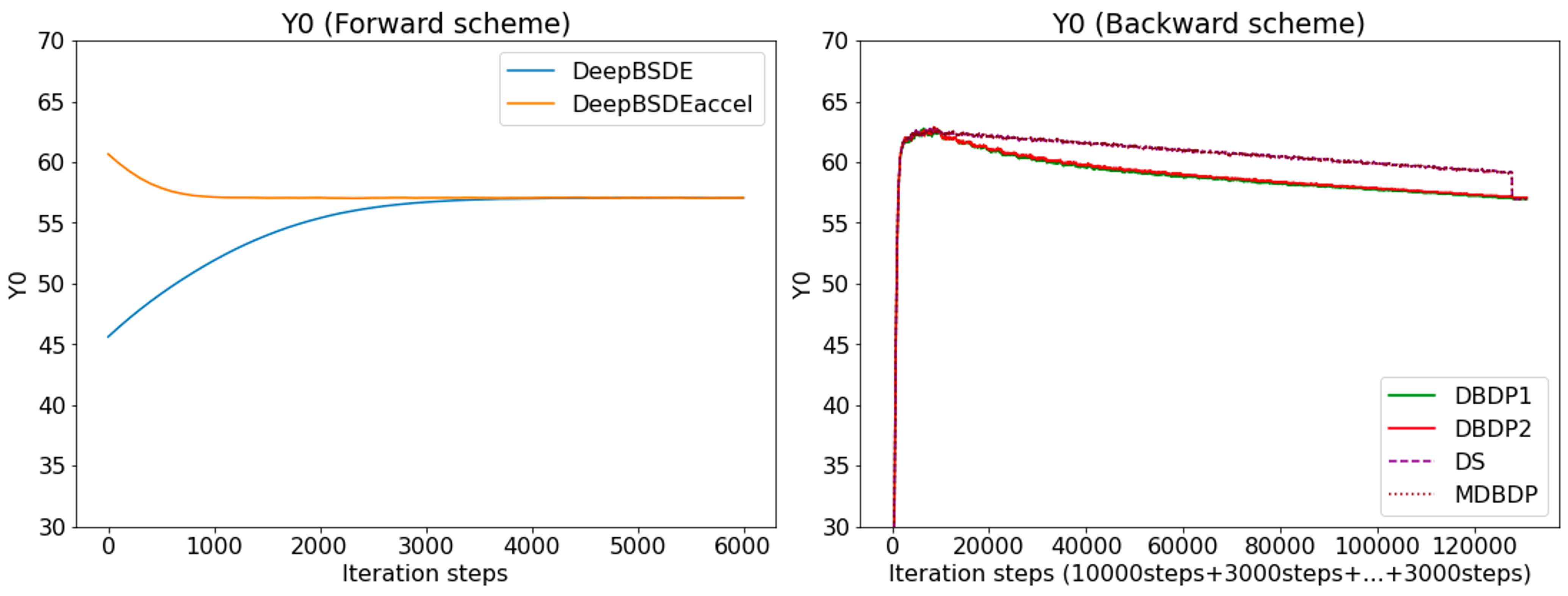

Unified Evaluation Of Deep Option Pricing Methods Preferred Networks In this section, we first describe the best known parametric option pricing methods—bs, bi, mc, and fdm—which we used to generate distilled option pricing data, and then briefly introduce the dnns applied. Our paper contributes to three strands of literature: (i) methods for constructing surro gate models in general and their application to high dimensional models in economics and nance; (ii) applications of deep learning in nance and economics; and (iii) empirical option pricing. The article presents a novel approach to option pricing using a feedforward neural network architecture trained on a dataset of historical stock prices and option prices. the model is shown to outperform traditional methods such as the black scholes formula and heston model in terms of accuracy and efficiency. By training on a diverse dataset comprising stock prices, strike prices, time to expiration, and volatility, dl models aim to capture the nuanced interactions among these variables, thus enabling more accurate and robust option pricing compared to traditional methods.

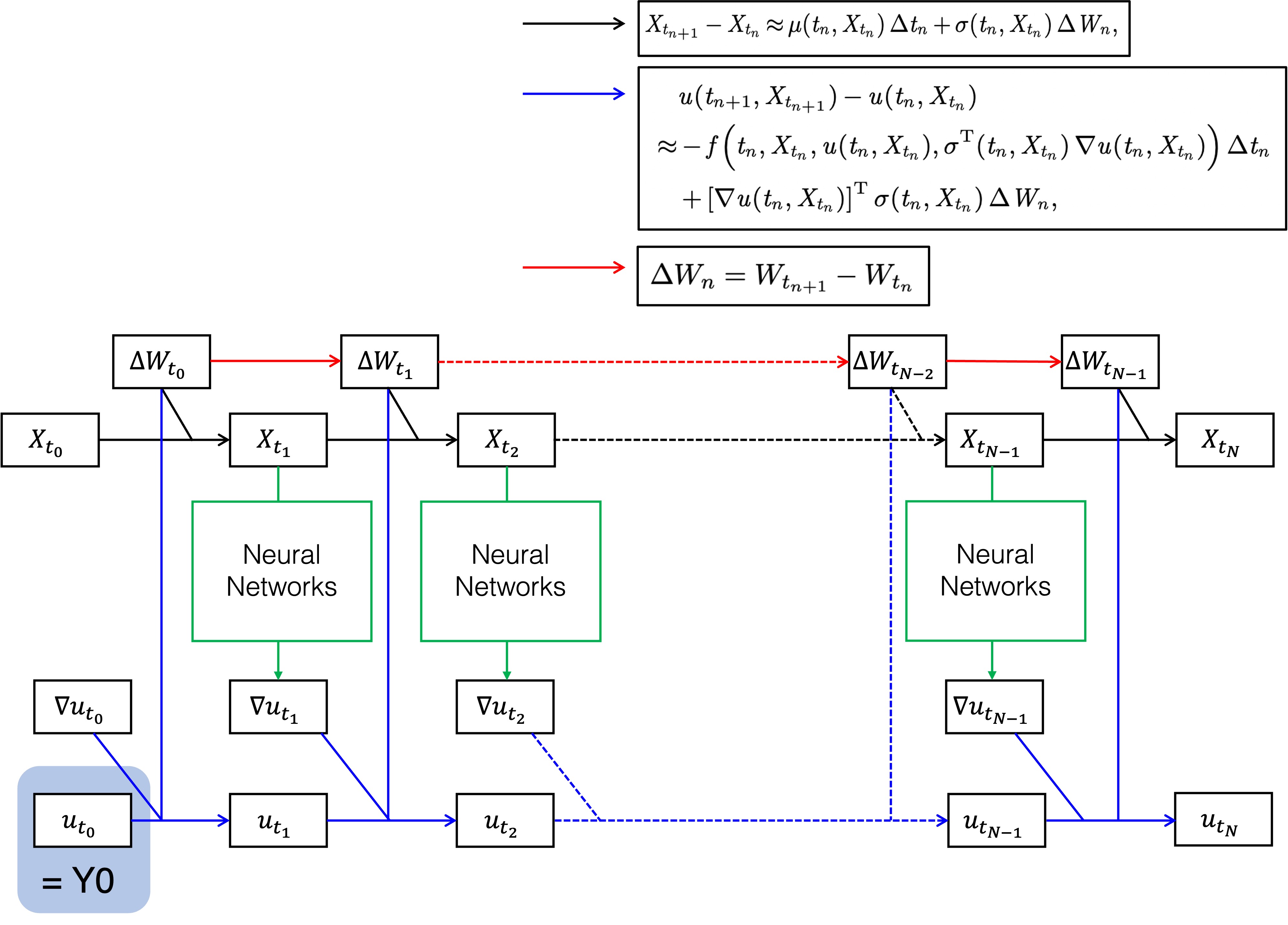

Unified Evaluation Of Deep Option Pricing Methods Preferred Networks The article presents a novel approach to option pricing using a feedforward neural network architecture trained on a dataset of historical stock prices and option prices. the model is shown to outperform traditional methods such as the black scholes formula and heston model in terms of accuracy and efficiency. By training on a diverse dataset comprising stock prices, strike prices, time to expiration, and volatility, dl models aim to capture the nuanced interactions among these variables, thus enabling more accurate and robust option pricing compared to traditional methods. A recurrent deep learning network long short term memory (lstm) and three stochastic process pricing models (black scholes merton model, heston stochastic volatility model and merton jump di usion model) are proposed so as to predict european call option prices. In it, i discuss deep pde solvers, groundbreaking methods to solve high dimensional pdes using deep learning, and their valuable applications in quantitative finance. 💹 click the link to. Unified evaluation of deep option pricing methods by : kentaro minami 2022.10.03 research. Artificial neural networks are increasingly employed for option pricing in recent years. however, the pricing ability and effectiveness of convolutional neural.

Unified Evaluation Of Deep Option Pricing Methods Preferred Networks A recurrent deep learning network long short term memory (lstm) and three stochastic process pricing models (black scholes merton model, heston stochastic volatility model and merton jump di usion model) are proposed so as to predict european call option prices. In it, i discuss deep pde solvers, groundbreaking methods to solve high dimensional pdes using deep learning, and their valuable applications in quantitative finance. 💹 click the link to. Unified evaluation of deep option pricing methods by : kentaro minami 2022.10.03 research. Artificial neural networks are increasingly employed for option pricing in recent years. however, the pricing ability and effectiveness of convolutional neural.

Unified Evaluation Of Deep Option Pricing Methods Preferred Networks Unified evaluation of deep option pricing methods by : kentaro minami 2022.10.03 research. Artificial neural networks are increasingly employed for option pricing in recent years. however, the pricing ability and effectiveness of convolutional neural.

Unified Evaluation Of Deep Option Pricing Methods Preferred Networks

Comments are closed.