Types Of Investment Instruments

Types Of Equity Investment Instruments Financial instruments may be divided into two types: cash and derivatives. they also are categorized by asset class, which depends on whether they are debt based or equity based. foreign. Basic examples of financial instruments are cheques, bonds, securities. there are typically three types of financial instruments: cash instruments, derivative instruments, and foreign exchange instruments. 1. cash instruments. cash instruments are financial instruments with values directly influenced by the condition of the markets.

Types Of Investment Instruments Fibras Financial instruments are assets investors can trade, transfer, or exchange in the financial markets. these are contractual agreements between parties that involve a monetary value. financial instruments can be categorized into various types based on their characteristics and features serving different purposes. Examples of financial instruments are bills of exchange, bond, share, stocks, futures, cheque, currency, swaps, options, etc. different types of financial instruments are described below: cash instruments have directly available market value and market forces directly determine their value. Financial instruments can be categorized into various types, including stocks, bonds, derivatives, commodities, currencies, and real estate. each type has its own set of characteristics, such as risk and return profiles, liquidity, and market dynamics. Financial instruments include most types of investments: cash, stocks, bonds, mutual funds, exchange traded funds (etfs), certificates of deposit (cds), loans, derivatives, and more. financial instruments facilitate the movement of capital through the markets and the broader economic system.

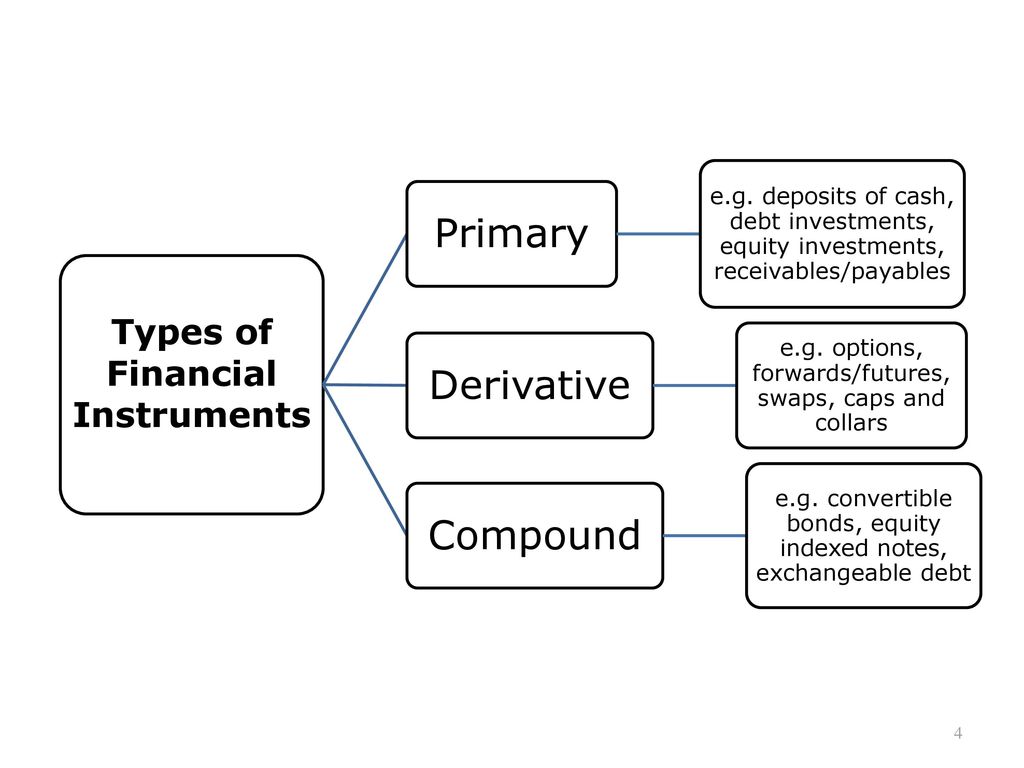

Financial Investment Instruments Types And Benefits Hedeker Financial instruments can be categorized into various types, including stocks, bonds, derivatives, commodities, currencies, and real estate. each type has its own set of characteristics, such as risk and return profiles, liquidity, and market dynamics. Financial instruments include most types of investments: cash, stocks, bonds, mutual funds, exchange traded funds (etfs), certificates of deposit (cds), loans, derivatives, and more. financial instruments facilitate the movement of capital through the markets and the broader economic system. In this article, we will outline the most important types of financial instruments like primaries, derivatives, and combinations, as well as their characteristics. you will also learn about the advantages and disadvantages of each one. Cash instruments, derivative instruments, and foreign currency instruments are the three main categories of financial products. each category serves a different function and accommodates different investment needs and risk profiles. 1. cash instruments. the market dynamics of supply and demand directly determine the value of cash instruments. Different types of financial instruments cater to various needs, from raising capital to hedging against risks. they can be classified broadly into debt, equity, derivative, hybrid, and other specialized categories. Primary instruments include stocks, bonds, and real estate, while derivative instruments, such as options and futures, derive their value from an underlying asset. but why is it so crucial to understand financial instruments?.

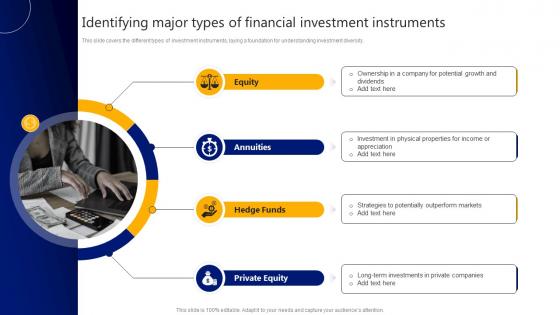

Identifying Major Types Of Financial Investment Instruments Ppt Powerpoint In this article, we will outline the most important types of financial instruments like primaries, derivatives, and combinations, as well as their characteristics. you will also learn about the advantages and disadvantages of each one. Cash instruments, derivative instruments, and foreign currency instruments are the three main categories of financial products. each category serves a different function and accommodates different investment needs and risk profiles. 1. cash instruments. the market dynamics of supply and demand directly determine the value of cash instruments. Different types of financial instruments cater to various needs, from raising capital to hedging against risks. they can be classified broadly into debt, equity, derivative, hybrid, and other specialized categories. Primary instruments include stocks, bonds, and real estate, while derivative instruments, such as options and futures, derive their value from an underlying asset. but why is it so crucial to understand financial instruments?.

Financial Instruments Different types of financial instruments cater to various needs, from raising capital to hedging against risks. they can be classified broadly into debt, equity, derivative, hybrid, and other specialized categories. Primary instruments include stocks, bonds, and real estate, while derivative instruments, such as options and futures, derive their value from an underlying asset. but why is it so crucial to understand financial instruments?.

Various Types Of Investment Instruments In Business And Finance Ppt

Comments are closed.