Types Of Charts In Forex Trading Am Trading Tips

Types Of Charts In Forex Trading Am Trading Tips While there are a multitude of different charts available to trade currencies, i will be focusing on the three main ones that you see time and time again. they will be the simple line chart, bar chart, and the candlestick chart. they all have their various quirks, and of course pros and cons. Understanding how to read various chart types like line, bar, candlestick, heikin ashi, and renko charts is crucial for successful forex trading. each type of forex chart provides different levels of detail, from the simple trends in line charts to the detailed price information in candlestick charts.

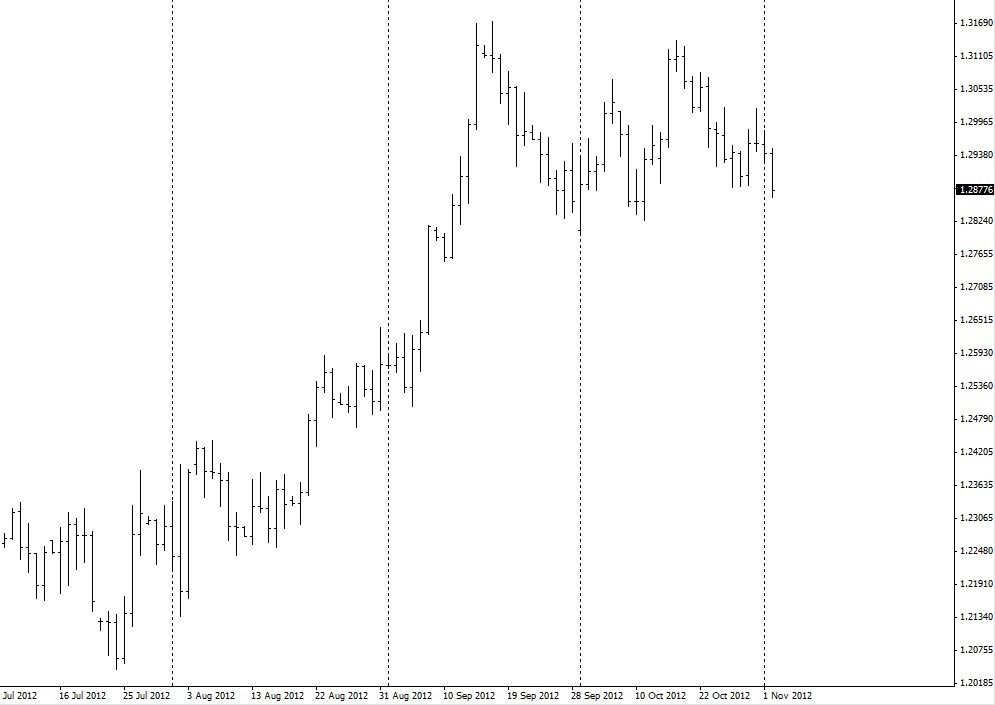

Types Of Charts In Forex Trading Investing Post Learn about different types of charts used in forex trading: line charts, bar charts, and candlestick charts, and how to read them. visit capitalxtend. Explore chart types: learn about line, bar, candlestick, heikin ashi, renko, and point and figure charts. candlestick charts give detailed price info, while heikin ashi charts help you see trends more clearly. Here is a closer look at the types of charts in forex trading and how to read them. a chart is made up of price data and timeframes. there are three types of charts that forex users rely on for trading: line charts, bar charts, and candlestick charts. There are three categories of chart types: time based, activity based, and price based. time based charts: the most widely used types of trading charts. line charts: connecting closing prices with a line. bar charts: displaying each period’s open, high, low, and close (ohlc) as a vertical bar.

Am Trading Tips Here is a closer look at the types of charts in forex trading and how to read them. a chart is made up of price data and timeframes. there are three types of charts that forex users rely on for trading: line charts, bar charts, and candlestick charts. There are three categories of chart types: time based, activity based, and price based. time based charts: the most widely used types of trading charts. line charts: connecting closing prices with a line. bar charts: displaying each period’s open, high, low, and close (ohlc) as a vertical bar. There are different types of charts used in forex trading and each have their own advantages and disadvantages. a chart in forex is a visualization of the bid and ask price movements of the currency pairs and is represented in lines, columns, or in any other form. Charts are used by the trader to conduct technical analysis and make market decisions. they are built in two coordinates: price and or tick volume (shown on the vertical axis) and time period (horizontal). some kind of data is used for building charts (except tick ones): low price – the lowest price* of the trading period. In this topic you will learn what defines a chart, how its built and what are the different chart types specifics. you can see one visualized on the screenshot below. a trading chart is a sequence of prices drawn over a certain time frame. One of the fundamental tools in a trader’s arsenal is the chart. charts visually represent the historical and real time movement of currency pairs, allowing traders to make informed decisions. they are the heart of technical analysis.

Comments are closed.