The Fico Score

For Consumers Fico Score Learn what a fico score is and how it's calculated using factors like payment history, credit utilization, and credit mix to assess your creditworthiness. Fico scores are a type of credit score created by fair, isaac, and company (now called the fair isaac corporation or fico) in 1989. they’re now one of the industry standards for credit scores .

Average Fico Score Fico scores are the most widely used credit scores, ranging from 300 to 850. the higher your score, the more likely you are to get approved for credit with favorable terms. if your score is on the lower end, you may face higher interest rates, deposits, or even denials. A fico score is a credit score that many lenders use to assess an applicant’s credit risk. learn how a fico score works and how you can raise your credit score. A fico® score is a particular brand of credit score. a credit score is a number that is used to predict how likely you are to pay back a loan on time. credit scores are used by companies to make decisions such as whether to offer you a mortgage or a credit card. Fico ® scores Θ and credit scores can be the same thing—but fico ® also creates different products, and other companies create credit scores. you can think of a credit score as the general name for a computer model that analyzes consumer credit reports to determine a score.

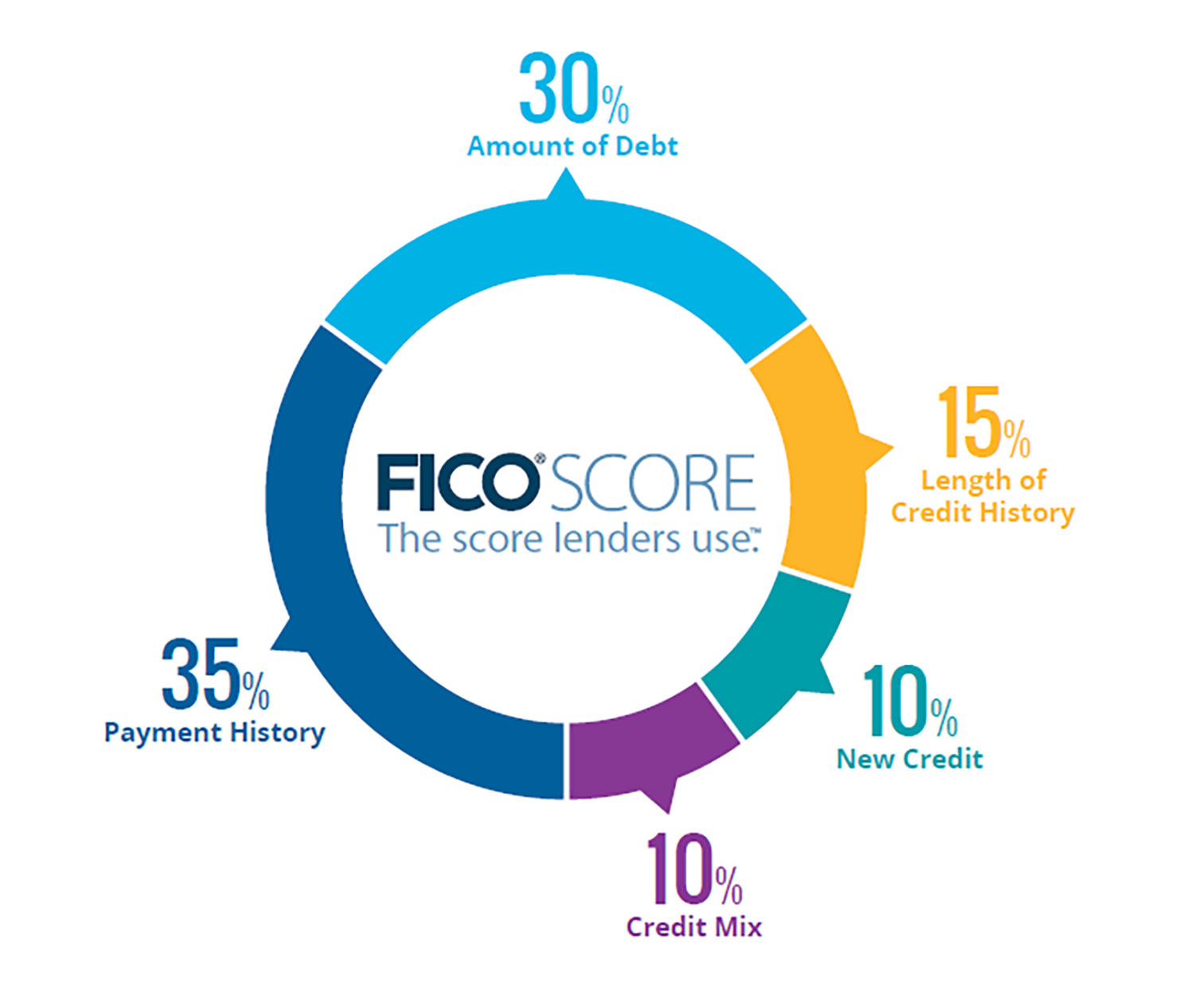

Fico Score Percentages Credit Law Center A fico® score is a particular brand of credit score. a credit score is a number that is used to predict how likely you are to pay back a loan on time. credit scores are used by companies to make decisions such as whether to offer you a mortgage or a credit card. Fico ® scores Θ and credit scores can be the same thing—but fico ® also creates different products, and other companies create credit scores. you can think of a credit score as the general name for a computer model that analyzes consumer credit reports to determine a score. In a nutshell, fico stands for fair isaac co. fico is a scoring model meant to give lenders—and sometimes employers—a pretty good idea of how consumers handle money. fico scores are based on five factors, which we’ll unpack a little later, and they typically run from 300 to 850. Get the facts about your fico® score. your credit score doesn’t define you but understanding it will empower you. fico has helped millions understand their credit and what impacts their fico® score. and when credit decisions are transparent and based on facts more people have access to the market. that's the power of a fico® score. A fico score is a three digit number between 300 and 850 that tells lenders and other creditors how likely you are to make on time bill payments. Understand how lenders evaluate credit risk for loans and other credit with fico scores. every year, lenders access billions of fico® scores to help them understand consumers’ credit risk and make better informed lending decisions.

Comments are closed.