The Cfpb S Complaint Database Why It Should Be A Staple In Your

Us Fsi Cfpb Consumer Complaint Database 091913 Pdf Credit Finance Through this, the cfpb analyzes consumer complaint data to identify trends and possible issues within the marketplace, helping them to both inform and empower consumers, companies, and advocates. Moving forward, the cfpb plans to explore expanding a company's ability to respond publicly to individual complaints listed in the database. it remains to be seen whether the new changes will strike an effective and satisfactory balance—between consumer protection principles and mitigating the concerns identified by financial institutions.

Cfpb Consumer Complaint Database Cheat Sheet For Compliance In this follow up to our previous blog on consumer complaints, the cba data desk team digs deeper into the cfpb’s consumer complaint database (“the database”) to understand the extent and nature of consumer experiences with fraud and scams—even when a complaint was…. Since 2011, the consumer financial protection bureau (cfpb) has been protecting consumers from the pitfalls of the financial marketplace. one of the cfpb’s singular achievements has been. The cfpb complaint database is a goldmine of real world experiences, enabling banks to proactively detect potential regulatory breaches and take corrective actions promptly. Consumers having trouble with a consumer financial product or service—such as with a mortgage, student loan, credit card, payday loan, bank account, credit reporting, or debt collection—can submit complaints to the consumer financial protection bureau (cfpb).

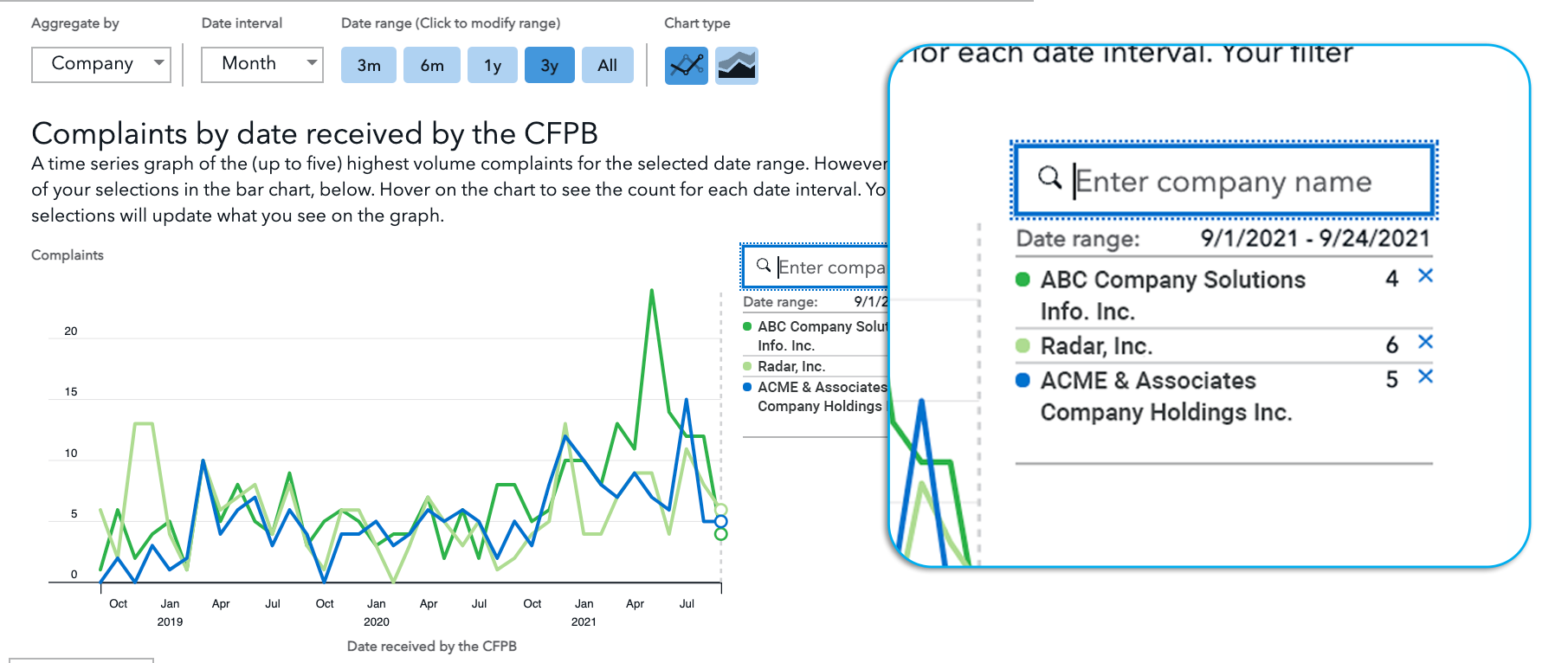

Cfpb Consumer Complaint Database Cheat Sheet For Compliance The cfpb complaint database is a goldmine of real world experiences, enabling banks to proactively detect potential regulatory breaches and take corrective actions promptly. Consumers having trouble with a consumer financial product or service—such as with a mortgage, student loan, credit card, payday loan, bank account, credit reporting, or debt collection—can submit complaints to the consumer financial protection bureau (cfpb). The cfpb complaint database is a valuable tool that provides real time insights into consumer dissatisfaction. businesses, financial institutions, and researchers can leverage this data to improve products, mitigate risks, and ensure regulatory compliance. The database is updated daily and is downloadable. this incredible resource is available to the public and can be used to improve your consumer claims. what you will learn • how to submit a complaint and see how the complaint process works • how to view, filter, search, map, and read complaint data in the consumer complaint database. Complaints factors can include errors or inaccuracies on a consumer’s credit report, including incorrect personal information or payment history. fraudulent activity, such as identity theft or unauthorized credit inquiries, can also prompt consumers to file this type of complaint. A review of the bureau’s complaint portal reveals key issues that could impact your financial institution, such as what areas are covered by the cfpb and what type of complaints might carry greater weight.

Comments are closed.