Solved Using Python And Tkinter Create This Following Chegg

Solved Using Python And Tkinter Create This Following Chegg Foreign currency translation is the process of expressing a foreign entity’s financial statements in the reporting currency of the reporting entity. the purpose of translation is to express a foreign entity’s functional currency financial statements in terms of the reporting currency. 1.000 fasb asc topic 830, foreign currency matters (formerly fasb statement no. 52, foreign currency translation) provides accounting guidance for transactions denominated in a foreign currency, and for operations undertaken in a foreign currency environment.

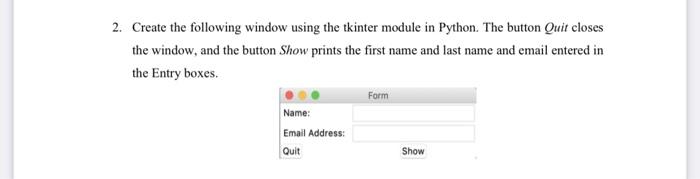

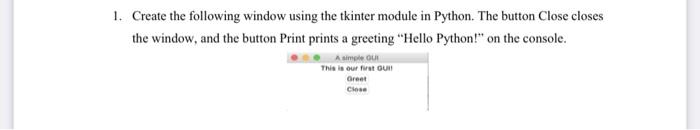

Solved Create The Following Window Using The Tkinter Module Chegg Translating foreign currency statements – foreign currency statements that are incorporated in the financial statements of the reporting entity by consolidation, combination, or the equity method of accounting must be translated into the reporting currency by use of the exchange rates. In determining whether a cta can be attributed to nci holders, the reporting entity should note that the cta exists at the consolidated level as a result of differences between the subsidiary’s functional currency and the reporting currency. Ias 21, the effects of changes in foreign exchange rates: this standard outlines how to report foreign currency transactions and operations in financial statements, and how to translate financial statements into a presentation currency. Learn how the irs requires foreign currency conversions, which rates are acceptable, and what documentation you need to stay compliant. handling foreign currency correctly is important for filing u.s. taxes when international transactions are involved.

Solved Create The Following Window Using The Tkinter Module Chegg Ias 21, the effects of changes in foreign exchange rates: this standard outlines how to report foreign currency transactions and operations in financial statements, and how to translate financial statements into a presentation currency. Learn how the irs requires foreign currency conversions, which rates are acceptable, and what documentation you need to stay compliant. handling foreign currency correctly is important for filing u.s. taxes when international transactions are involved. These adjustments account for the changes in exchange rates between the functional currency of the foreign subsidiary and the reporting currency of the parent company. below is a detailed explanation and example of currency translation adjustment journal entries. scenario: foreign subsidiary translation. Frs 102 requires entities to initially translate foreign currency transactions in an entity’s functional currency using the spot exchange rate, although an average rate for a week or month may be used if the exchange rate does not fluctuate significantly. A reporting entity with operations in foreign countries or with foreign currency transactions must report the reporting currency equivalent of foreign currency cash flows using the exchange rates in effect at the time of the cash flows. Learn the intricacies of foreign currency translation adjustment, including guidance from asc 830 and ias 29, with greengrowth cpas.

Comments are closed.