Solved Find The Sum Of 1 2n 1 3n 1 Find The Sum Of Chegg

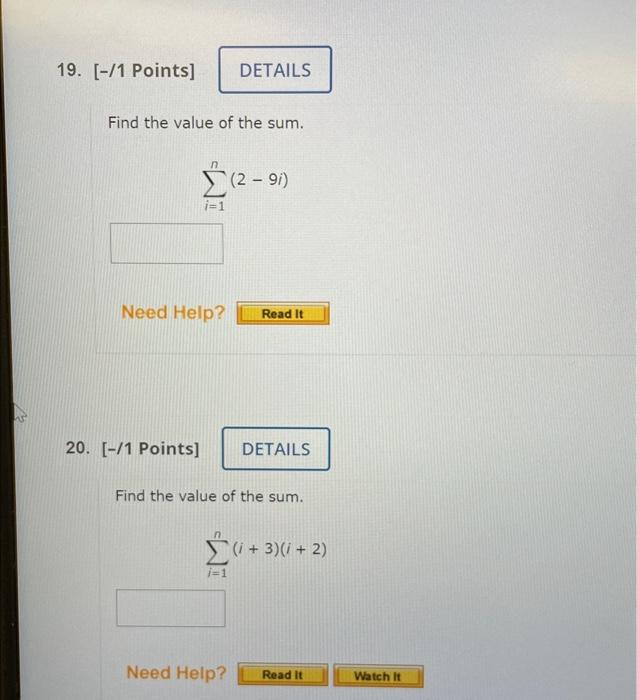

Solved Find The Value Of The Sum в I 1n 2в 9i 1 Points Chegg In 2020, the irs received nearly 5.3 million individual tax returns that showed no agi and hence no taxable income. (about 4,600 of those people ended up paying tax anyway, mainly due to the alternative minimum tax.) another 60.3 million returns showed agis of less than $30,000. For 2025, the tax policy center estimates roughly 41.4% of income tax filers will not pay any federal income taxes. the tax policy center also estimates that 57.1% of working americans in 2021 won't have to pay federal income taxes either.

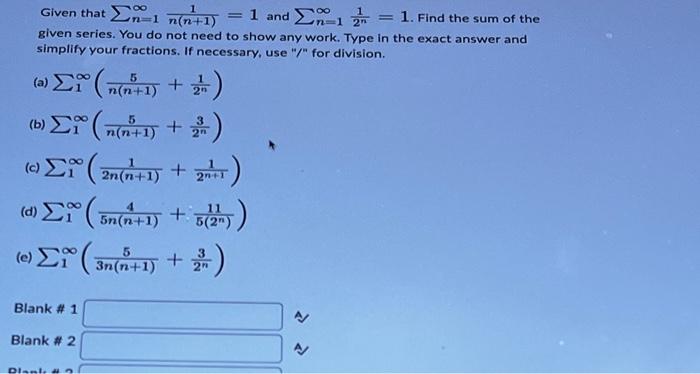

Solved Given That в N 1в ћn N 1 1 1 And в N 1в ћ2n1 1 Find The Chegg New data from the irs for tax year 2022 reveals that over 31% of all tax filers owed no federal income tax, a slight decrease from the elevated levels seen during the pandemic years when stimulus measures and expanded tax credits shielded even more taxpayers from liability. In 2025, according to the latest tax policy center estimates, 40 percent of households, or about 76 million “tax units,” will pay no federal individual income tax. Roughly half of all americans pay no federal income taxes specifically about 86% of americans pay federal taxes of some sort (because everyone who earns a paycheck pays payroll taxes). Of the 43% of households owing no federal income tax this year, about half simply earned too little income to qualify, including many retired workers who live on social security.

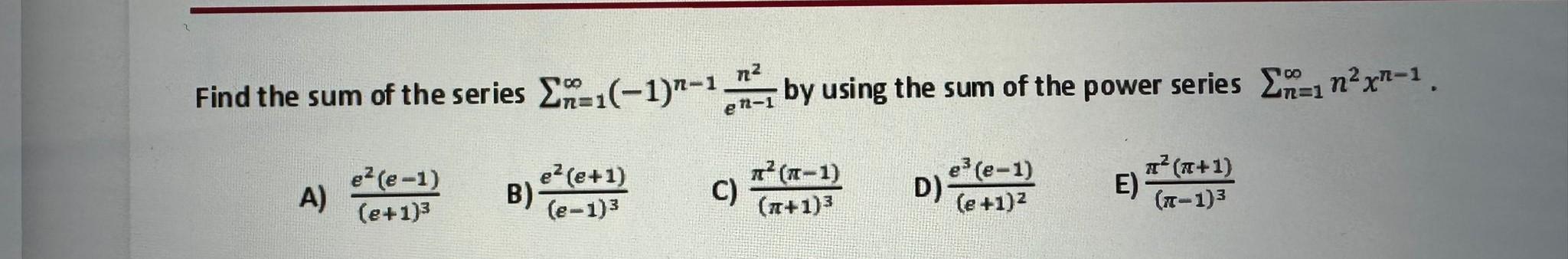

Solved Find The Sum Of The Series в N 1в ћ в 1 Nв 1enв 1n2 By Chegg Roughly half of all americans pay no federal income taxes specifically about 86% of americans pay federal taxes of some sort (because everyone who earns a paycheck pays payroll taxes). Of the 43% of households owing no federal income tax this year, about half simply earned too little income to qualify, including many retired workers who live on social security. The vast majority (83 percent) of households who owe no federal income taxes are either working households that pay payroll taxes (61 percent) or elderly (22 percent). to make those people pay federal income taxes, you’d have to take steps that would make the tax code less fair and sensible. Who pays no federal income tax? a large portion of people do not pay federal income taxes because they do not have federally taxable income after accounting for deductions. in 2018, 34.7% of all tax returns did not have taxable income and, thus, did not pay federal income taxes, up from 32.1% in 2017. Almost two thirds of the 47 percent work, for example, and their payroll taxes help finance social security and medicare. accounting for this, the share of households paying no net federal. Roughly half of americans who pay no federal income tax do so because they simply don't earn enough money. the other half doesn't pay taxes because of special provisions in the tax code that benefit certain taxpayers, notably the elderly and working families with children.

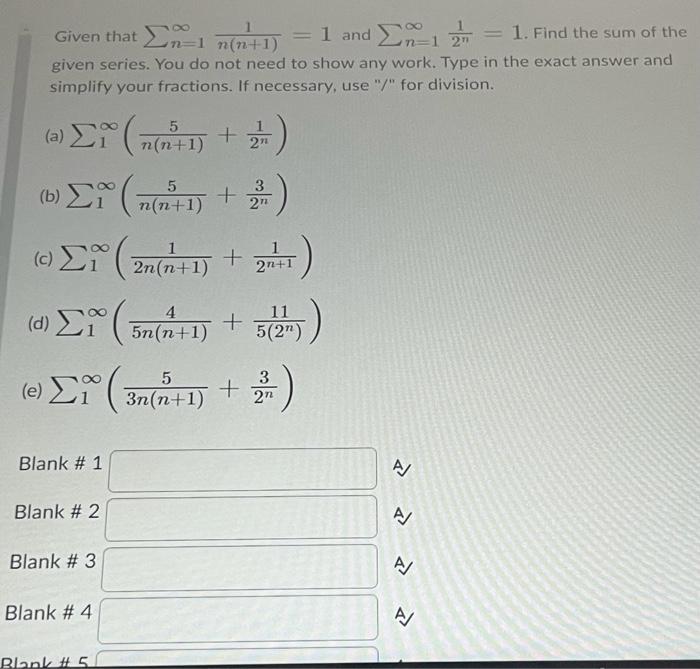

Solved Given That в N 1в ћn N 1 1 1 And в N 1в ћ2n1 1 Find The Chegg The vast majority (83 percent) of households who owe no federal income taxes are either working households that pay payroll taxes (61 percent) or elderly (22 percent). to make those people pay federal income taxes, you’d have to take steps that would make the tax code less fair and sensible. Who pays no federal income tax? a large portion of people do not pay federal income taxes because they do not have federally taxable income after accounting for deductions. in 2018, 34.7% of all tax returns did not have taxable income and, thus, did not pay federal income taxes, up from 32.1% in 2017. Almost two thirds of the 47 percent work, for example, and their payroll taxes help finance social security and medicare. accounting for this, the share of households paying no net federal. Roughly half of americans who pay no federal income tax do so because they simply don't earn enough money. the other half doesn't pay taxes because of special provisions in the tax code that benefit certain taxpayers, notably the elderly and working families with children.

Comments are closed.