Solved Can You Explain The Difference Between Return And Chegg

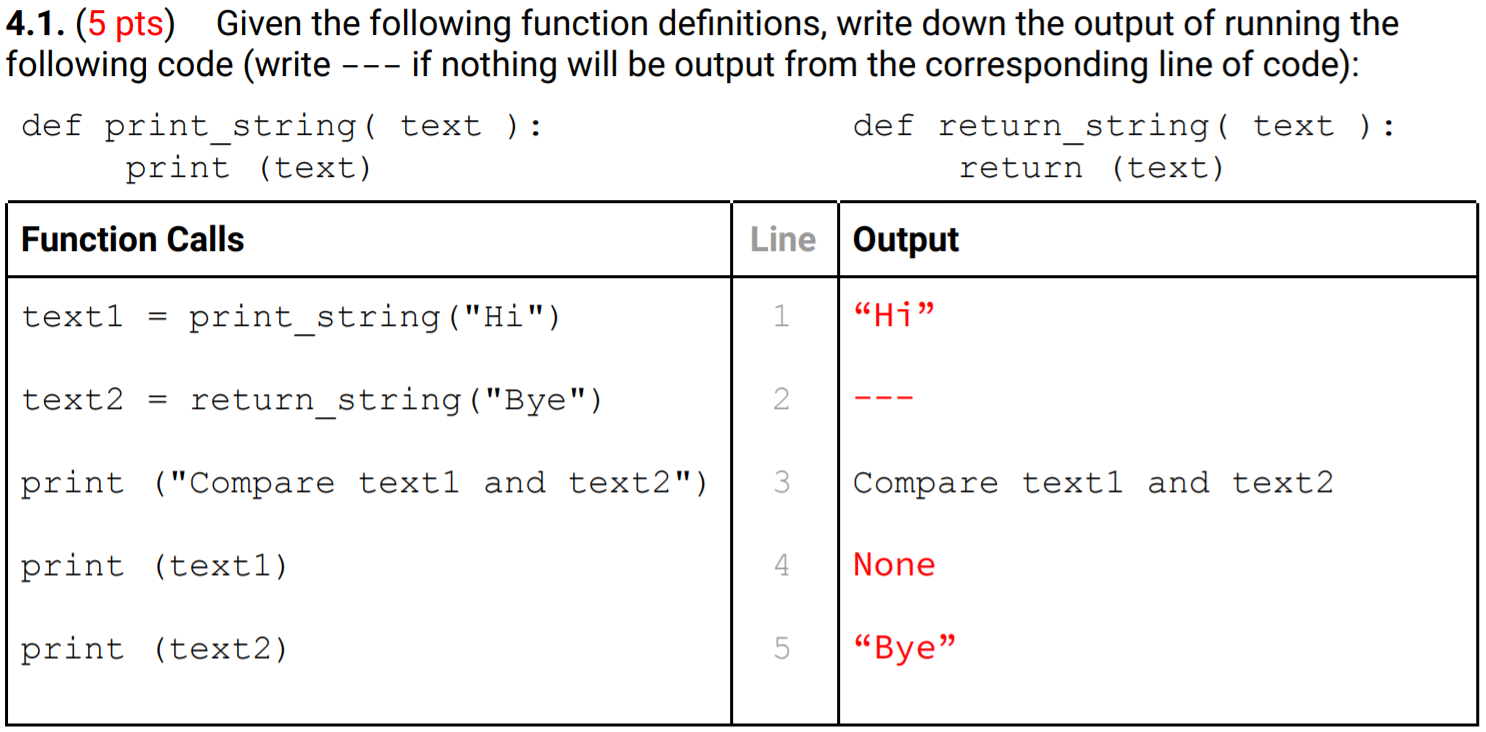

Solved Question Chegg Here’s the best way to solve it. print () is a function that takes argument and output then to the console text1= print string ("hi") calls …. At chegg we understand how frustrating it can be when you’re stuck on homework questions, and we’re here to help. our extensive question and answer board features hundreds of experts waiting to provide answers to your questions, no matter what the subject.

Solved This Is A Solved Question In Chegg Could Someone Chegg Explain the difference between return and yield to maturity of a bond. please be precise and give examples if necessary. your solution’s ready to go! our expert help has broken down your problem into an easy to learn solution you can count on. question: explain the difference between return and yield to maturity of a bond. From shaping questions into effective prompts to curating & checking solutions, you're never far from a human in the loop. we trained chegg’s ai tools using our own step by step homework solutions–you’re not just getting an answer, you’re learning how to solve the problem. There’s a difference between copying and using chegg, it can clarify things but it’s up to you to apply it. those who copy will bomb test, those who learn by seeing the problems worked out and practicing do well. Learning objectives characterize the relationship between risk and return. describe the differences between actual and expected returns. explain how actual and expected returns are calculated. define investment risk and explain how it is measured. define the different kinds of investment risk.

Solved Can You Explain The Difference Between Return And Chegg There’s a difference between copying and using chegg, it can clarify things but it’s up to you to apply it. those who copy will bomb test, those who learn by seeing the problems worked out and practicing do well. Learning objectives characterize the relationship between risk and return. describe the differences between actual and expected returns. explain how actual and expected returns are calculated. define investment risk and explain how it is measured. define the different kinds of investment risk. Our expert help has broken down your problem into an easy to learn solution you can count on. The realized return tells you what you would actually make if you held the investment over this period (month or year). you can use the average return over the period as the estimate of the monthly or annual expected return. Risk takes into account that your investment could suffer a loss, while return is the amount of money that you can make above your initial investment. in an efficient marketplace, a higher risk investment will need to offer greater returns to offset the chances of loss. Search our library of 100m curated solutions that break down your toughest questions. ask one of our real, verified subject matter experts for extra support on complex concepts. test your knowledge anytime with practice questions. create flashcards from your questions to quiz yourself.

Comments are closed.