Operating Model The Cfo

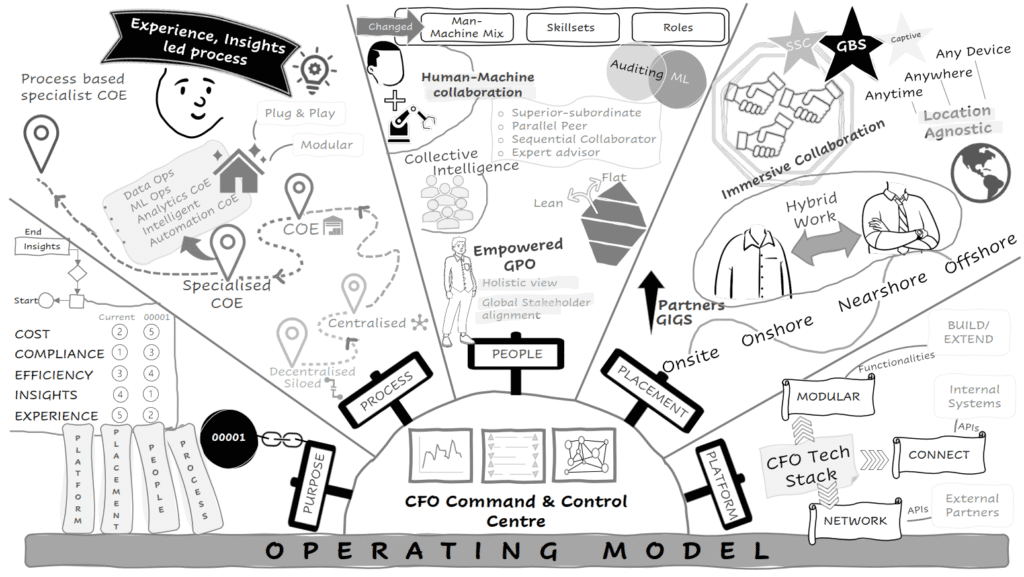

Cfo Pdf The finance target operating model (tom) is a strategic framework aimed at transforming and redefining the financial functions of companies. this model addresses the evolving role of cfos and their organization transitioning from traditional accounting tasks to strategic, analytical, and data driven roles. To design the right finance and reporting operating model, cfos should seek to balance a number of requirements, including their priorities around cost efficiency, how to add value and how to manage risk.

Cfo Function Pdf Chief Financial Officer Strategic Planning Today’s cfos are expected to play four diverse and challenging roles. the two traditional roles are steward , preserving the assets of the organization by minimizing risk and getting the books right, and operator, running a tight finance operation that is efficient and effective. To reduce complexity, companies need a specific target vision to aim for – a target operating model (tom). the transformation according to tom is carried out on the basis of a roadmap with concrete individual steps. For businesses that want to stay ahead of market shifts, a target operating model isn’t a static framework—it’s a continuously evolving strategy. smyth underscores that allocating resources, evaluating staff needs, and updating existing technology are not set and forget activities. Finance operating model: traditional vs. modern across four key aspects—organization, team skillsets, process standardization, and data—here’s a breakdown of how traditional workflows differ from a more modern approach.

00001 Operating Model The 00001 Cfo For businesses that want to stay ahead of market shifts, a target operating model isn’t a static framework—it’s a continuously evolving strategy. smyth underscores that allocating resources, evaluating staff needs, and updating existing technology are not set and forget activities. Finance operating model: traditional vs. modern across four key aspects—organization, team skillsets, process standardization, and data—here’s a breakdown of how traditional workflows differ from a more modern approach. Cfos foresee a shift towards a more strategic finance operating model, in which they embrace the need for transformation and actively contribute to value generation. below we outline the findings behind these three key messages and look at their implications, primarily for swiss businesses but also more widely. While many organizations can pull together a strategic plan, far fewer can create a sustainable operating model that delivers consistent results while adapting to changing business needs. drawing from real world experience, here's how to build planning processes that actually stick. Key characteristics of an operating cfo include: core competencies: experience in m&a, erp implementation, operational efficiency, and leveraging data analytics for decision making. background: often mbas or professionals with cross functional experience in operations, supply chain, or it. Our research reveals four leadership styles that determine how cfos execute change. take action. and gain buy in. it is critical for cfos to understand the strengths of their style, as well as the blind spots that can potentially hold them back.

Cfo Principles Cfos foresee a shift towards a more strategic finance operating model, in which they embrace the need for transformation and actively contribute to value generation. below we outline the findings behind these three key messages and look at their implications, primarily for swiss businesses but also more widely. While many organizations can pull together a strategic plan, far fewer can create a sustainable operating model that delivers consistent results while adapting to changing business needs. drawing from real world experience, here's how to build planning processes that actually stick. Key characteristics of an operating cfo include: core competencies: experience in m&a, erp implementation, operational efficiency, and leveraging data analytics for decision making. background: often mbas or professionals with cross functional experience in operations, supply chain, or it. Our research reveals four leadership styles that determine how cfos execute change. take action. and gain buy in. it is critical for cfos to understand the strengths of their style, as well as the blind spots that can potentially hold them back.

Comments are closed.