Leverage Explained In 2 Minutes In Basic English

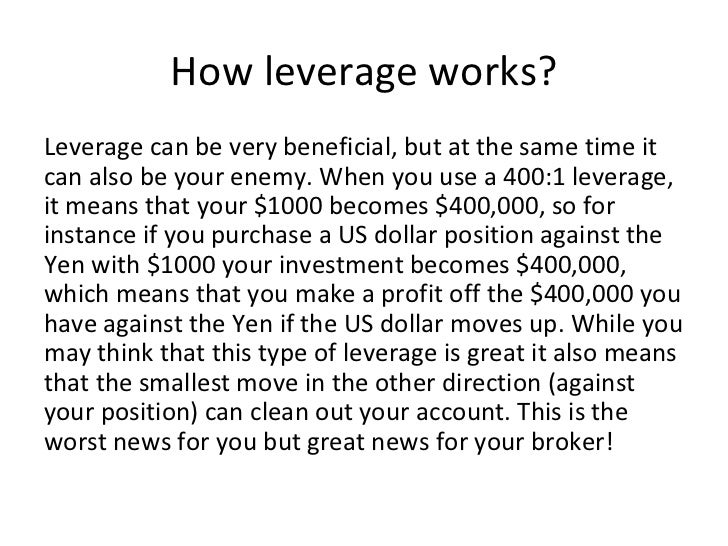

Leverage Explained Pdf Leverage explained in 2 minutes in basic english afzal hussein 160k subscribers 417. Leverage is a financial tool that companies and investors use to increase their potential returns by borrowing money or using other financial instruments. it allows you to control more assets or make larger investments than you could with your own money alone.

Leverage Definition 1 Pdf Leverage Finance Investing Leverage is nothing more or less than using borrowed money to invest. leverage can be used to help finance anything from a home purchase to stock market speculation. Leverage is the use of borrowed money to amplify the results of an investment. companies use leverage to increase the returns of investors' money, and investors can use leverage to invest in various securities; trading with borrowed money is also known as trading on " margin.". Leverage refers to the use of borrowed capital or debt to increase the potential return on an investment. in simpler terms, it's the strategy of using borrowed money to amplify the outcome of a financial decision. Leverage is a financial strategy that involves using borrowed money to increase potential returns on investment. whether applied in the stock market, real estate, or business operations, leverage magnifies gains and losses.

Leverage 1 Pdf Leverage Finance Equity Finance Leverage refers to the use of borrowed capital or debt to increase the potential return on an investment. in simpler terms, it's the strategy of using borrowed money to amplify the outcome of a financial decision. Leverage is a financial strategy that involves using borrowed money to increase potential returns on investment. whether applied in the stock market, real estate, or business operations, leverage magnifies gains and losses. Leverage (verb): to use something, such as resources or influence, to maximum advantage. the term "leverage" is widely used across different fields, from business and finance to physics and everyday life. In short, the term ‘leverage’ is used to describe the ability of a firm to use fixed cost assets or funds to increase the return to its equity shareholders. In this video, we will explore what is a leverage. leverage means using something to maximum advantage and therefore making quicker progress. 🚀 secure offers for spring weeks, internships and graduate schemes paying $50k to $100k starting salaries in 90 days or less. join my private community: http.

The Leverage Explained Simply Leverage (verb): to use something, such as resources or influence, to maximum advantage. the term "leverage" is widely used across different fields, from business and finance to physics and everyday life. In short, the term ‘leverage’ is used to describe the ability of a firm to use fixed cost assets or funds to increase the return to its equity shareholders. In this video, we will explore what is a leverage. leverage means using something to maximum advantage and therefore making quicker progress. 🚀 secure offers for spring weeks, internships and graduate schemes paying $50k to $100k starting salaries in 90 days or less. join my private community: http.

Leverage Meaning Explained How It Affects Trading Ea Trading Academy In this video, we will explore what is a leverage. leverage means using something to maximum advantage and therefore making quicker progress. 🚀 secure offers for spring weeks, internships and graduate schemes paying $50k to $100k starting salaries in 90 days or less. join my private community: http.

Forex Leverage Explained

Comments are closed.