Letter Of Credit L C Process Explained L C Transaction Process With Flow Chart

Letter Of Credit Process Flow Chart Pdf A Visual Reference Of Charts In this video, i explained each process with animation and flow chart. 00:00 00:11 what is l c? 00:31 first time deal risk 01:15 advantage for exporters 01:45 advantage for importers. Learn what is a letter of credit and how it works with this article covering the entire process and the parties involved along with a flowchart to summarize it all.

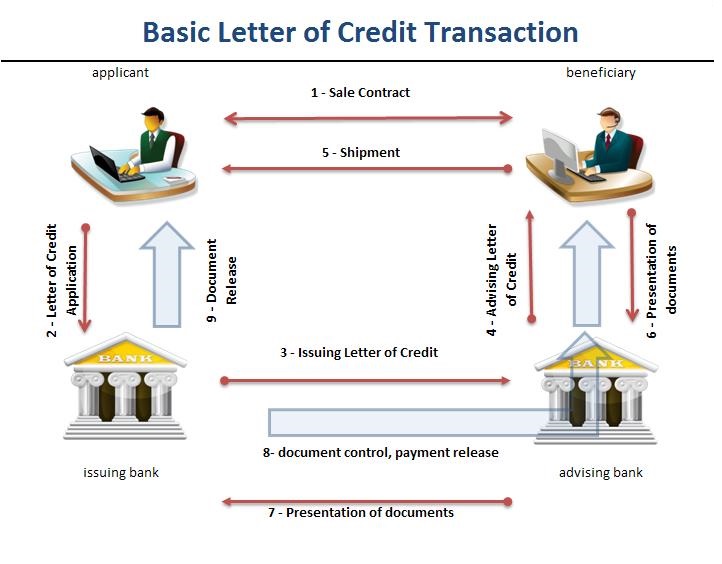

Letter Of Credit Process Flow Chart To understand the letter of credit mechanism process, we will discuss all the factors that aid the working of an l c. step by step process is explained. Visualize the letter of credit process with a flow chart from sriya enterprise, ensuring clear and efficient trade transactions. the flow chart outlines the steps involved, from the buyer’s application and issuance by the bank to document presentation and payment. There are four major steps in lc process and or lc flow chart. step 1 – issue the lc in order to issue the lc, below lc application and or lc swift draft need to verify according to the sales contract with both parties (applicant and beneficiary); once below verification is completed lc can be issued by applicant. In sap we follow the following menu path to map in system: purchase requisition → purchase order → lc request → lc opening → lc document retire→ foreign vendor invoice → lc bank payment to foreign vendor → stock in transit → goods arrived at port→ invoice & payment of local vendors → goods receipt.

Letter Of Credit Process Flow Chart There are four major steps in lc process and or lc flow chart. step 1 – issue the lc in order to issue the lc, below lc application and or lc swift draft need to verify according to the sales contract with both parties (applicant and beneficiary); once below verification is completed lc can be issued by applicant. In sap we follow the following menu path to map in system: purchase requisition → purchase order → lc request → lc opening → lc document retire→ foreign vendor invoice → lc bank payment to foreign vendor → stock in transit → goods arrived at port→ invoice & payment of local vendors → goods receipt. Letter of credit (lc) explained: a step by step guide to lc transactions in international trade, covering all stages from issuance to payment. A letter of credit, also known as a documentary credit, is a method of payment that makes international sales more secure for both the buyer and the seller. predominantly, the letter of credit process is used for international sales contracts. Here’s a comprehensive step by step guide on how an lc is issued and used in international trade: negotiation: the buyer (importer) and seller (exporter) agree on the terms of the transaction, including price, delivery, and payment. inclusion of lc clause: the contract specifies that payment will be facilitated through an lc. The lc process commences with the buyer and seller agreeing on the terms of the transaction. the buyer then approaches their bank to initiate the lc process by submitting an application, detailing the specifics of the transaction and the terms to be met.

Comments are closed.