Insights On Interest Rates And Inflation A Fixed Income Perspective

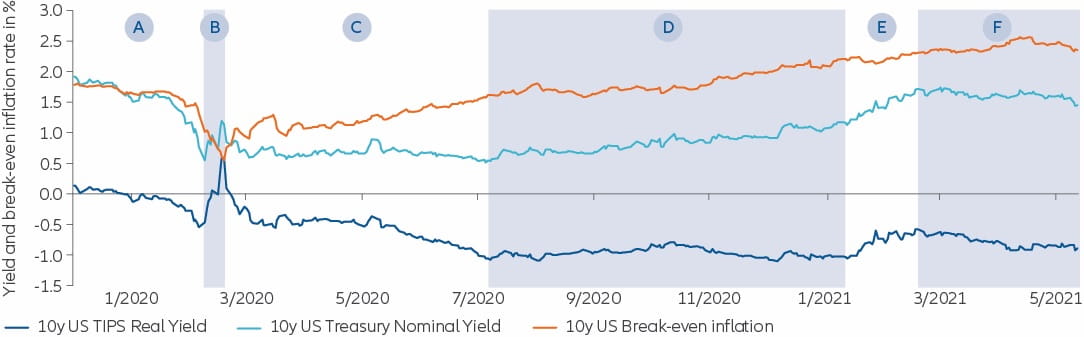

Chapter 6 Relationship Between Interest Rate And Inflation Pdf Mike gitlin interviews john queen, a fixed income portfolio manager based in our west l.a. office. as a longtime bond investor, john discusses his outlook for interest rates and. This chart vividly illustrates the notable upswing in yields. while interest rate volatility remains elevated, higher yields are likely to continue to support fixed income returns, particularly as it appears global central banks are approaching the end of monetary policy tightening.

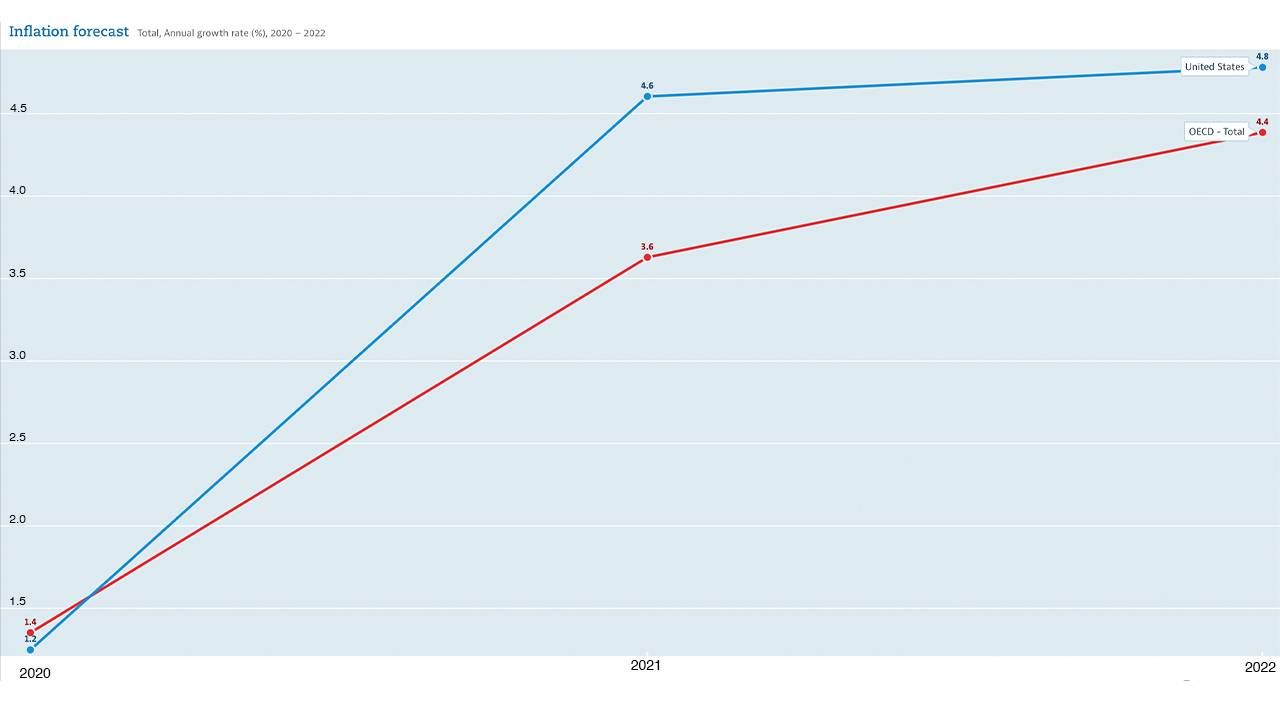

How Inflation Can Be An Opportunity For Active Fixed Income Investors Understand how inflation affects fixed income investments by influencing real returns, interest rates, and purchasing power, and explore strategies to mitigate its impact. fixed income investments, such as bonds and annuities, are often seen as safe and predictable. Year end target: federal funds rate likely to fall to 3.25%−4.00%. inflation monitoring: assessing tariff related price increases for transitory or medium term effects. policy easing: will consider easing if medium term inflation expectations remain stable and labor market weakens. vanguard's active fixed income team stance. Stay ahead with the quarterly fixed income outlook. understand how interest rates, geopolitics, and changing policies are driving the bond market today. Sticky inflation, a resilient economy, and tempered federal reserve (fed) rate cut expectations have pulled 5 and 10 year u.s. treasury yields more than 80 basis points (0.80%) higher this year. as a result, these yields have retraced roughly two thirds of their q4 2023 declines.

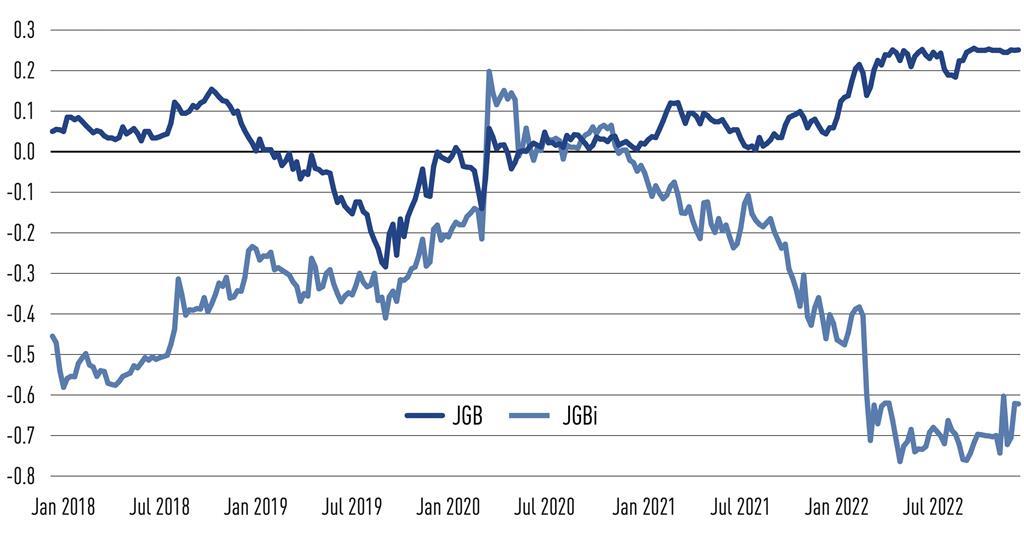

Fixed Income Rates Currency Inflation Strengthens Its Grip Stay ahead with the quarterly fixed income outlook. understand how interest rates, geopolitics, and changing policies are driving the bond market today. Sticky inflation, a resilient economy, and tempered federal reserve (fed) rate cut expectations have pulled 5 and 10 year u.s. treasury yields more than 80 basis points (0.80%) higher this year. as a result, these yields have retraced roughly two thirds of their q4 2023 declines. Strong economic growth coupled with inflation risks from potential policy shifts have paved the way for a prolonged period of higher interest rates. that could be a good thing for fixed income investors. as of 11 15 24. source: bloomberg, factset, voya im. * advanced estimate. ** second estimate. Fixed income investments are significantly impacted by inflation. as inflation rises, the interest rates for fixed income instruments remain the same, triggering investors to. Strong recent us jobs data and a commitment by the federal reserve to taming inflation indicate interest rates may stay higher for longer – and investors may now be starting to believe that outlook. From the perspective of a saver, higher interest rates offer the potential for increased returns on savings accounts, cds, and other fixed income investments. conversely, borrowers face higher costs when interest rates rise, which can dampen spending and investment.

Money Advice For Retirees On Fixed Incomes When Inflation Is Soaring Strong economic growth coupled with inflation risks from potential policy shifts have paved the way for a prolonged period of higher interest rates. that could be a good thing for fixed income investors. as of 11 15 24. source: bloomberg, factset, voya im. * advanced estimate. ** second estimate. Fixed income investments are significantly impacted by inflation. as inflation rises, the interest rates for fixed income instruments remain the same, triggering investors to. Strong recent us jobs data and a commitment by the federal reserve to taming inflation indicate interest rates may stay higher for longer – and investors may now be starting to believe that outlook. From the perspective of a saver, higher interest rates offer the potential for increased returns on savings accounts, cds, and other fixed income investments. conversely, borrowers face higher costs when interest rates rise, which can dampen spending and investment.

Comments are closed.