How To Make Service Invoice In Tally Prime Service Invoice For Gst Sales And Purchase Entry

Gst Invoicing In Tally Prime In this video i have explained how to make service invoice in tally prime and how to do sales and purchase invoice entry in tally prime more. In case of service oriented business, they also product invoice with their service charges plus gst. in this case tallyprime maintain accounting invoice where list of accounts displays instead of items and goods.

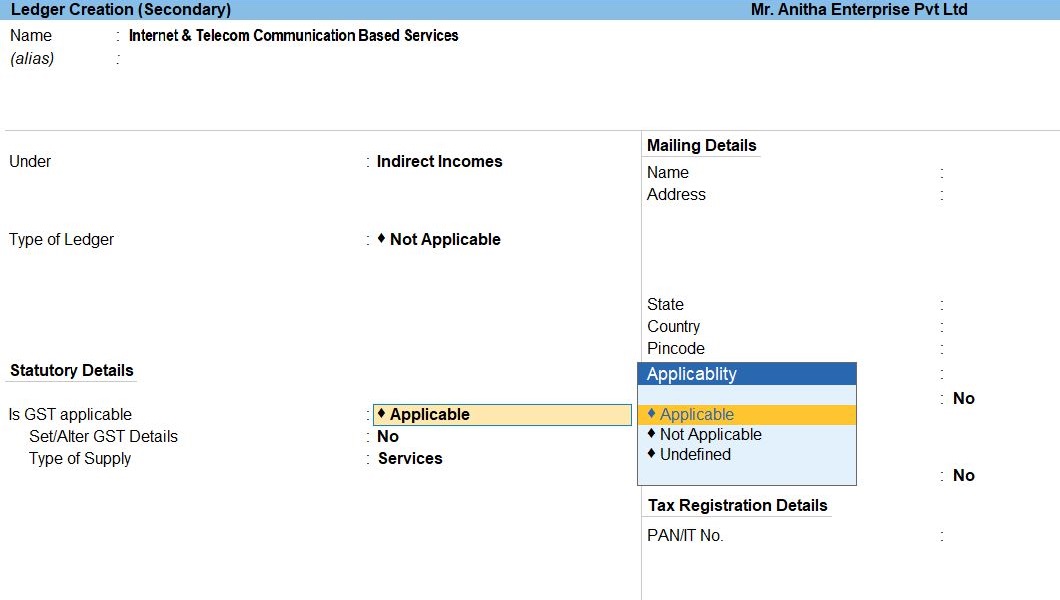

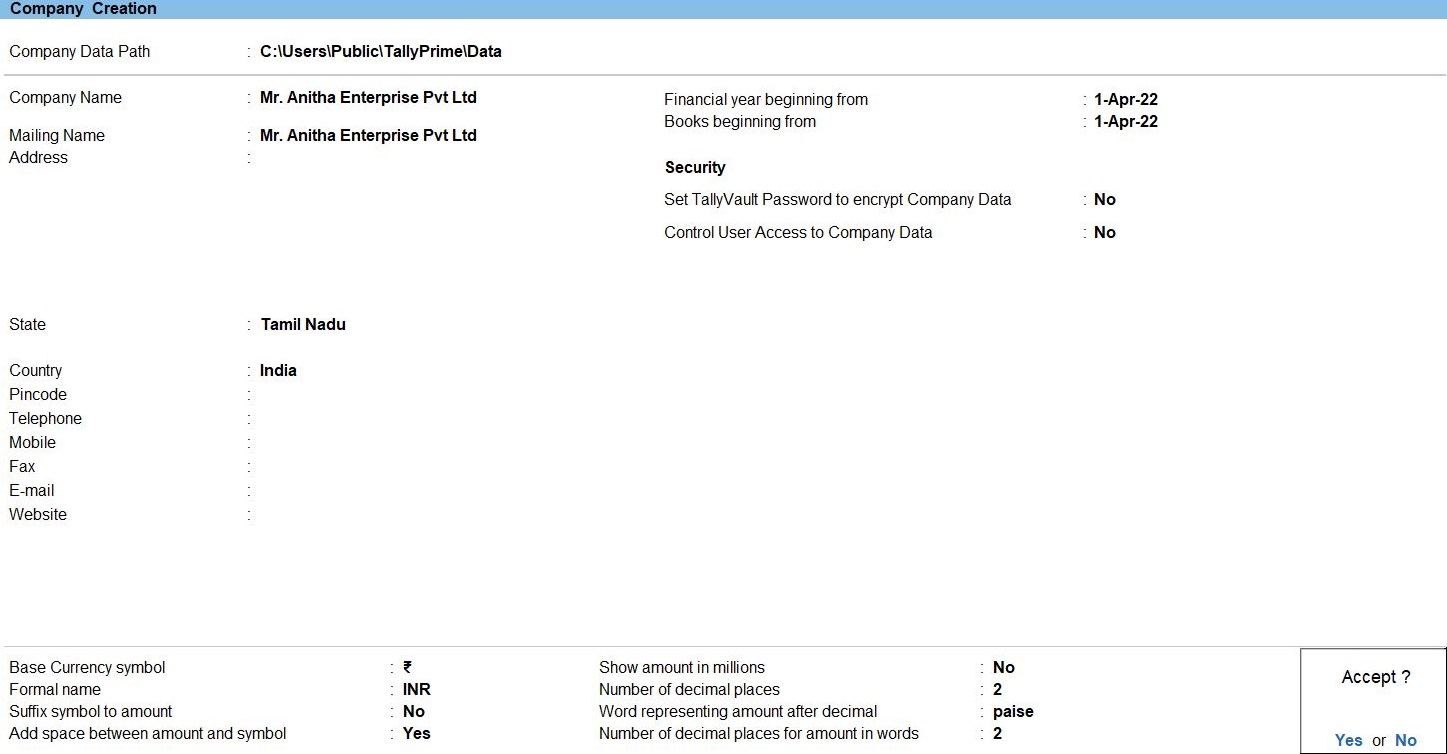

Service Example Sum 1 In Tally Prime Tamil In case of service oriented business, they also product invoice with their service charges plus gst. in this case tallyprime maintain accounting invoice where list of accounts displays instead of items and goods. After recording the transactions, you can print the sales invoice. you can configure your sales voucher and cancel the vouchers, if needed. any modifications made to the recorded transactions can also be tracked. every business involves the sales of goods or services which can be either cash or credit sales. Accounting invoice mode in tallyprime is primarily used for recording sales of services, as it doesn’t require detailed stock item allocation. it’s a simplified method for businesses that primarily sell services. After you have recorded the sales transactions, you can print the invoices, including the gst details. the gst invoice must have details like the name, address, and gstin of the supplier and registered buyer, name of the item or service, unique tax invoice number, hsn sac codes, gst rates and more.

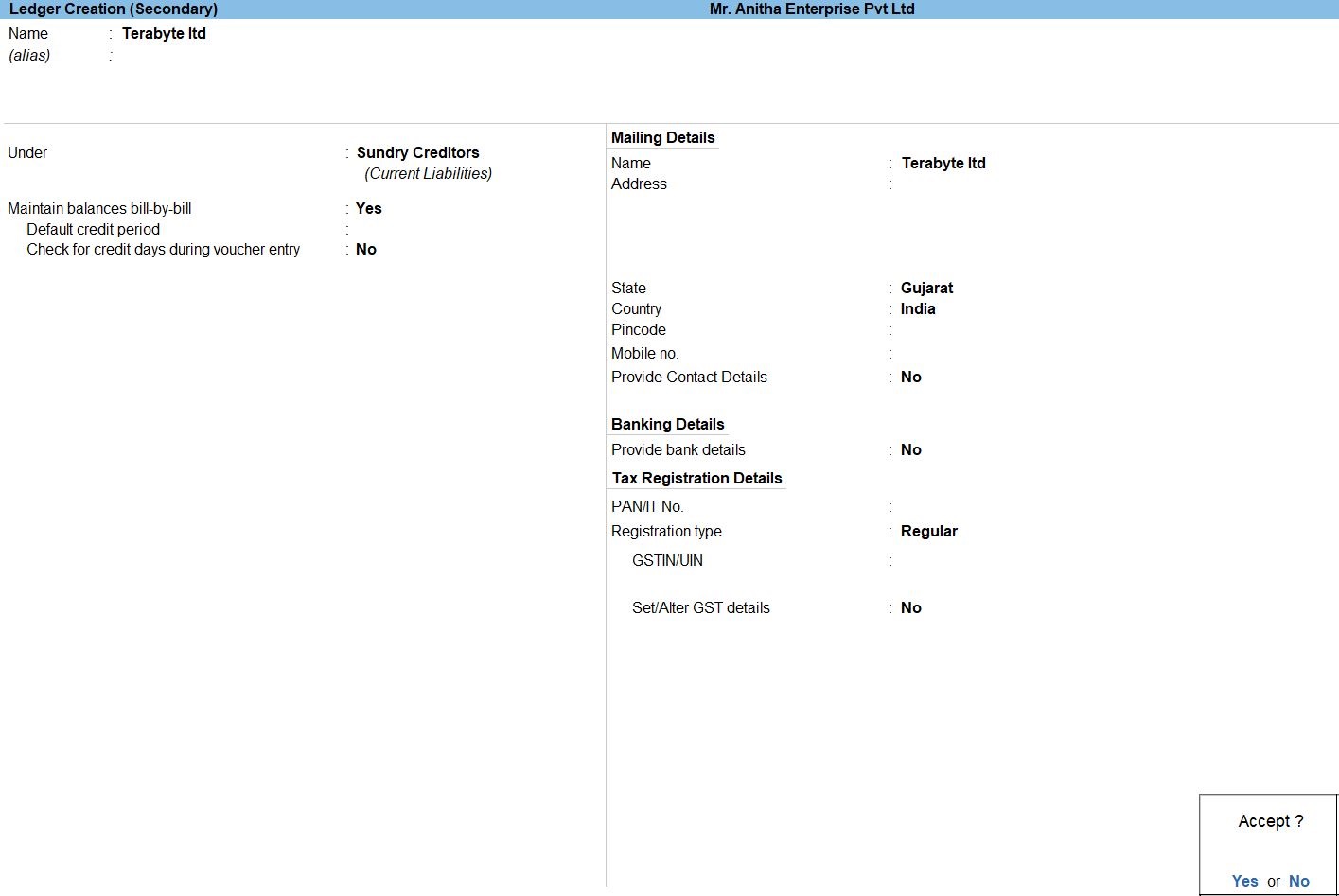

Service Example Sum 1 In Tally Prime Tamil Accounting invoice mode in tallyprime is primarily used for recording sales of services, as it doesn’t require detailed stock item allocation. it’s a simplified method for businesses that primarily sell services. After you have recorded the sales transactions, you can print the invoices, including the gst details. the gst invoice must have details like the name, address, and gstin of the supplier and registered buyer, name of the item or service, unique tax invoice number, hsn sac codes, gst rates and more. Now when you do the invoicing in tallyprime you will get the service items which can be billed in numbers as per invoice requirements and it will not show negative stock in stock summary, you can create any service ledger and link with the item. In this guide, we’ll walk you through the updated process of creating invoices in tally prime (2025), incorporating the latest gst rules, customization tips, and automation tools. whether you’re a beginner or an experienced user, this guide will help you make the most of tally for your invoicing needs. Learn how to create service invoices in tally prime . whether you're a beginner or an experienced tally user, this easy step by step tutorial will help you streamline your. Generate purchase bills: record a cash bill or invoice when you make an instant payment to the supplier, using cash or any other mode like a cheque or credit debit card. if it is a purchase on credit, record a credit purchase by using the supplier ledger.

Service Example Sum 1 In Tally Prime Tamil Now when you do the invoicing in tallyprime you will get the service items which can be billed in numbers as per invoice requirements and it will not show negative stock in stock summary, you can create any service ledger and link with the item. In this guide, we’ll walk you through the updated process of creating invoices in tally prime (2025), incorporating the latest gst rules, customization tips, and automation tools. whether you’re a beginner or an experienced user, this guide will help you make the most of tally for your invoicing needs. Learn how to create service invoices in tally prime . whether you're a beginner or an experienced tally user, this easy step by step tutorial will help you streamline your. Generate purchase bills: record a cash bill or invoice when you make an instant payment to the supplier, using cash or any other mode like a cheque or credit debit card. if it is a purchase on credit, record a credit purchase by using the supplier ledger.

Comments are closed.