How To Calculate Effective Interest Rate Vs Annual Interest Rate

How To Calculate Effective Interest Rate 7 Steps With Pictures Effective annual interest rate: the effective annual interest rate is the interest rate that is actually earned or paid on an investment, loan or other financial product due to the result of. Using the effective annual rate calculator you can find the following. at 7.24% compounded 4 times per year the effective annual rate calculated is. multiplying by 100 to convert to a percentage and rounding to 3 decimal places i = 7.439%. at 7.18% compounded 52 times per year the effective annual rate calculated is.

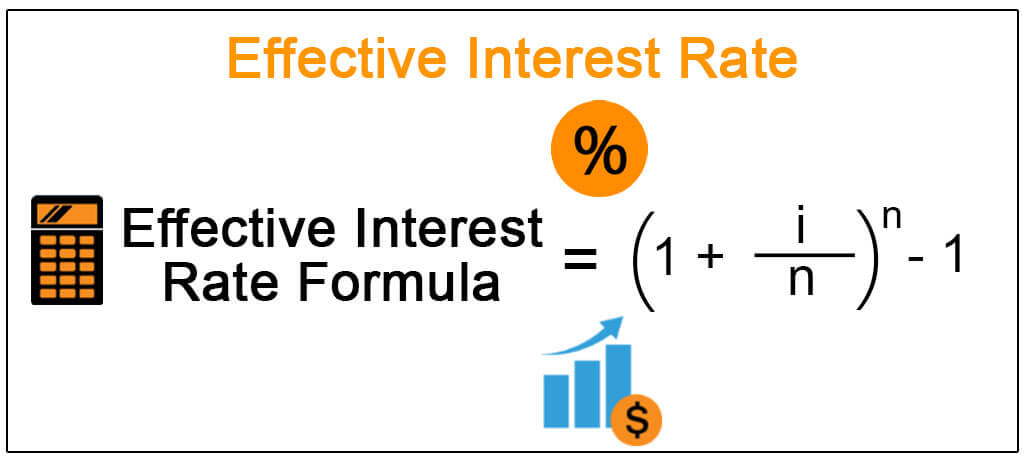

Effective Interest Rate Definition Formula How To Calculate To calculate the effective interest rate, you can follow these steps: divide the annual interest rate by the number of compounding periods (i.e., the frequency of compounding within a year). add 1 to the result obtained from step 1. raise the result of step 2 to the power of the number of compounding periods. subtract 1 from the calculated value. In this case, the formula is: effective interest rate = (1 (6% 12))^ (12) 1 ≈ 6.17%. this rate reflects the true cost of borrowing on an annual basis, accounting for monthly compounding. On the other hand, the effective annual interest rate for loan b is 6.1%. effective interest rate (eir), loan b = [1 (6.0% ÷ 2)]^2 – 1 = 6.09%; the effective annual interest rate for loan a is 6.0%, whereas the effective annual interest rate for loan b is approximately 6.2%, demonstrating the impact of compounding on the actual interest rate. 2. calculate the effective interest rate using the formula above. for example, consider a loan with a stated interest rate of 5% that is compounded monthly. plug this information into the formula to get: r = (1 .05 12) 12 1, or r = 5.12%. the same loan compounded daily yields: r = (1 .05 365) 365 1, or r = 5.13%.

Comments are closed.