How To Calculate Average Annual Growth Rate Aagr In Excel

Average Annual Growth Rate Aagr In Excel Excelbuddy Learn what CAGR (Compound Annual Growth Rate) means, how to calculate it, and why it matters for investors Explore its importance in measuring growth over time Learn what CAGR (Compound Annual Growth Rate) means, how to calculate it, and why it matters for investors Explore its importance in measuring growth over time

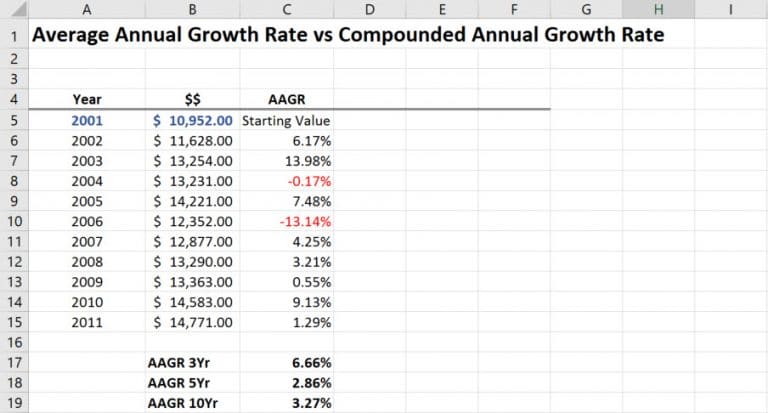

Average Annual Growth Rate Aagr In Excel Excelbuddy The growth rate of an investment shows how much its value increases over time, helping to evaluate performance A common way to calculate this is by using the compound annual growth rate (CAGR CAGR, or compound annual growth rate, allows investors to calculate and compare the rate of return of investments Learn how its calculated and used by investors A] Calculating Weighted Average when the weights add up to 100% The above image shows the data set where the weights add up to 100% To calculate the weighted average of this data set in Excel The average annual growth rate in that scenario is 40% The math begins with summing four zeros and 200 for the annual growth rates You then divide 200 by five years to get to 40

Average Annual Growth Rate Aagr In Excel Excelbuddy A] Calculating Weighted Average when the weights add up to 100% The above image shows the data set where the weights add up to 100% To calculate the weighted average of this data set in Excel The average annual growth rate in that scenario is 40% The math begins with summing four zeros and 200 for the annual growth rates You then divide 200 by five years to get to 40 Many companies use their weighted average cost of capital (WACC) as their base hurdle rate For example, if a company's WACC is 5% and an investment has an IRR of 10%, then it could be worth The rule of 72 works for any investment size or rate of return While the rule is most frequently used to solve for Y – determining how many years it will take to double your money at any To calculate AAGR, we’re simply going to take the average of these ten annual growth rates In this example, our calculation (2600% + 1349% + 1119%, etc divided by ten) equals 1179% The 11 This time, we’ll calculate the year-over-year growth for each individual year: To calculate AAGR, we’re simply going to take the average of these ten annual growth rates In this example, our

Comments are closed.