How Futures Work Open Interest Respective Long And Short Positions

How Futures Work Open Interest Respective Long And Short Positions Unlike the traditional stock market, the crypto market never sleeps — it’s open 24/7 Long vs short positions in the cryptocurrency market Bitcoin futures allow directional trading without holding the underlying asset, including shorting in regulated markets Market composition is shaped by trader types, including leveraged money and

How Futures Work Open Interest Respective Long And Short Positions Learn how to long and short cryptocurrencies with margin trading and understand the risks and rewards associated with each approach How do perpetual futures contracts work? When the contract price is higher than the price of BTC, users with short positions are paid the funding rate, which is reimbursed by users with long Futures allow traders and others to wager on the price of commodities, metals, interest rates, currencies and more They’re popular because they offer the potential for fast profits, and traders DBMF currently has long positions in ex-US developed markets equities, gold and crude oil with a very minor position in emerging markets It has significant short positions in Treasuries all

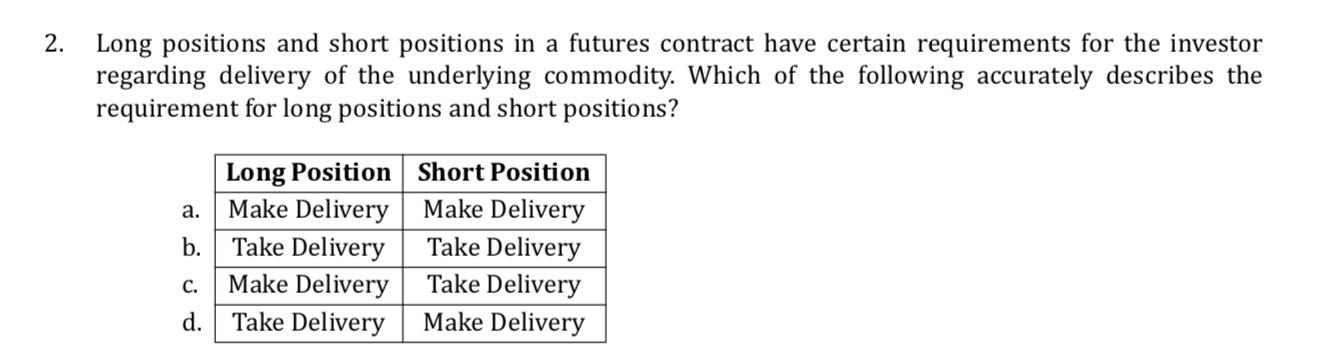

Solved Long Positions And Short Positions In A Futures Chegg Futures allow traders and others to wager on the price of commodities, metals, interest rates, currencies and more They’re popular because they offer the potential for fast profits, and traders DBMF currently has long positions in ex-US developed markets equities, gold and crude oil with a very minor position in emerging markets It has significant short positions in Treasuries all Chart 3: Short positions as a percent of market cap (by sector) The data above also shows that a handful of stocks have short interest above 25% of their shares outstanding We’ve talked about Silver futures are legally binding contracts where someone agrees to buy silver at an agreed-upon date at some point in the future Though investors can use them to speculate on silver price Bitcoin Futures Open Interest Surge Shows Investor Confidence on Trade Deals, Powell Bitcoin and ether saw notable price gains Tuesday as US officials raised hopes for a US-China trade deal LONDON, Dec 20 (Reuters) - Futures markets have seen a record-breaking run in cocoa prices in 2024, a surge exacerbated by the hedge funds that provide much of their liquidity heading for the exit

What Is The Difference Between Long And Short Positions In Futures Chart 3: Short positions as a percent of market cap (by sector) The data above also shows that a handful of stocks have short interest above 25% of their shares outstanding We’ve talked about Silver futures are legally binding contracts where someone agrees to buy silver at an agreed-upon date at some point in the future Though investors can use them to speculate on silver price Bitcoin Futures Open Interest Surge Shows Investor Confidence on Trade Deals, Powell Bitcoin and ether saw notable price gains Tuesday as US officials raised hopes for a US-China trade deal LONDON, Dec 20 (Reuters) - Futures markets have seen a record-breaking run in cocoa prices in 2024, a surge exacerbated by the hedge funds that provide much of their liquidity heading for the exit

Comments are closed.