How Do Ceos Make Impulse Decisions Investments By %d1%80%d1%9f %d2%91tamal Roy%d1%80%d1%9f %d1%99

Why Do Ceos Make Bad Decisions Executives can improve their decision making skills by spending at least an hour a week reviewing their business and reviewing whether the organization is aligned with their strategy and. Career concerns are escalated during the early years of a ceo's tenure as the market is uncertain about the new ceo's ability. this study examines whether such increased career concerns induce investment inefficiency during the early years of a ceo's tenure in us firms.

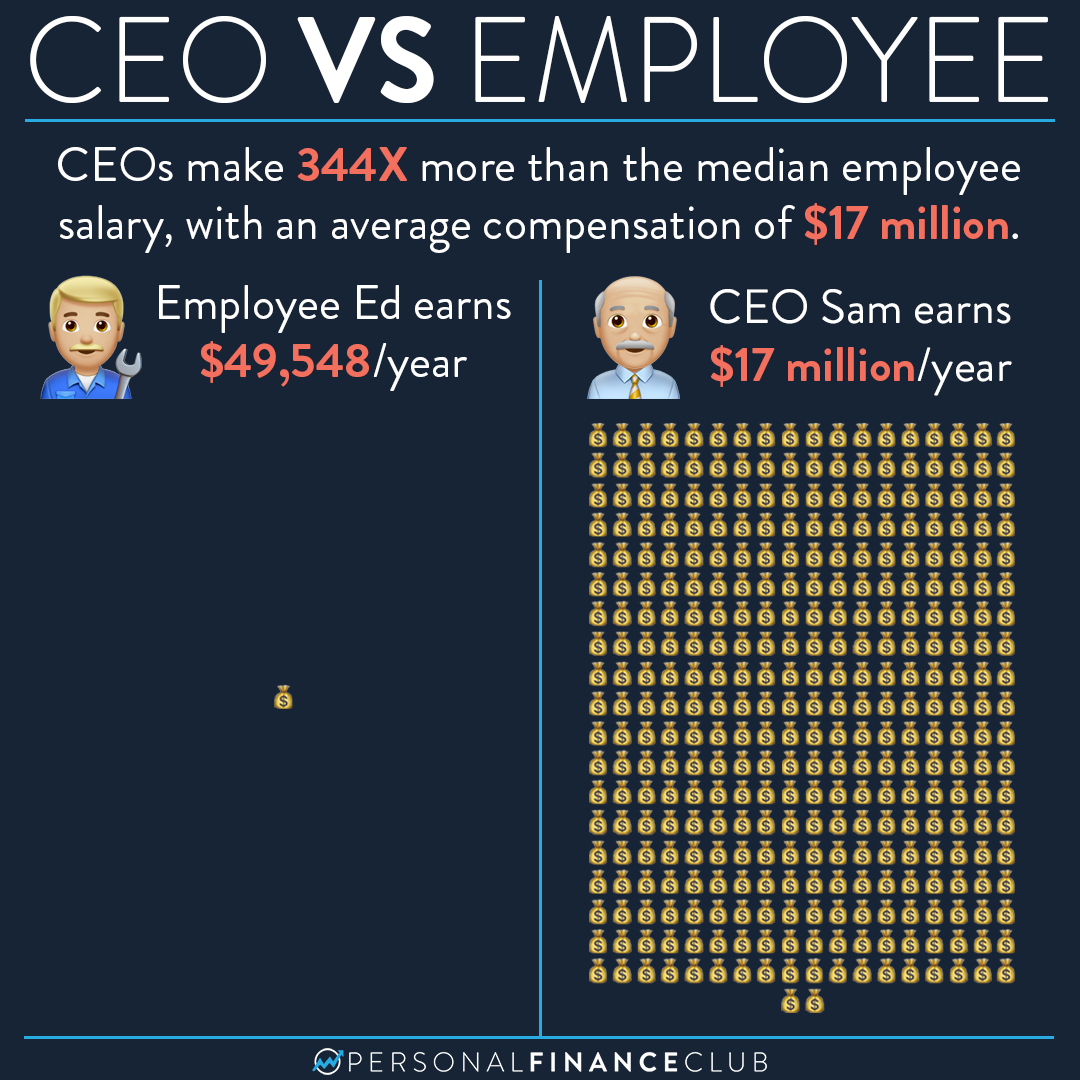

How Much More Do Ceos Make Than Employees Personal Finance Club Ceos are under pressure to turn turbulence into opportunity. activate five mindshifts to create clarity in crisis—and supercharge your organization’s growth with ai. Ceos are paid for their ability to make the right choices. with market conditions tightening, it is imperative that they demonstrate the rationale for their decisions. and it is not only shareholders who are interested in a company’s investments. Making decisions based on data analysis can help ceos reduce risks associated with investments, product launches, and other business operations. for example, a company can use data on market trends, customer preferences, and competitor analysis to identify potential risks and opportunities. This study investigates whether chief executive officers (ceos) with excessive power make efficient investment decisions. we employ a comprehensive measure of ceo power and find that highly powerful ceos tend to reduce investment efficiency by increasing overinvestment.

How Do Ceos Make Impulse Decisions Investments By рџ ґtamal Royрџ љ Making decisions based on data analysis can help ceos reduce risks associated with investments, product launches, and other business operations. for example, a company can use data on market trends, customer preferences, and competitor analysis to identify potential risks and opportunities. This study investigates whether chief executive officers (ceos) with excessive power make efficient investment decisions. we employ a comprehensive measure of ceo power and find that highly powerful ceos tend to reduce investment efficiency by increasing overinvestment. How ceos make decisions? for ceos, it’s important to recognize that their decision making process is often shaped by a combination of personal intuition, experience, and structured frameworks. Learn the top five financial decisions that ceos must navigate, including compensation strategies, investment allocation, m&a, divestitures, and cost cutting measures. But just because they have the right to make decisions, doesn’t mean their decisions are always right. every ceo can define their tenure by a handful of key decisions that contributed to the success of their organization—or its stagnation and failure. We find that powerful ceos reduce investment efficiency, and this investment inefficiency is mainly driven by overinvestment. we further provide evidence that the ownership and expert components of the ceo power measure contribute to the investment inefficiency, suggesting agency problem.

About Impulse Decisions How ceos make decisions? for ceos, it’s important to recognize that their decision making process is often shaped by a combination of personal intuition, experience, and structured frameworks. Learn the top five financial decisions that ceos must navigate, including compensation strategies, investment allocation, m&a, divestitures, and cost cutting measures. But just because they have the right to make decisions, doesn’t mean their decisions are always right. every ceo can define their tenure by a handful of key decisions that contributed to the success of their organization—or its stagnation and failure. We find that powerful ceos reduce investment efficiency, and this investment inefficiency is mainly driven by overinvestment. we further provide evidence that the ownership and expert components of the ceo power measure contribute to the investment inefficiency, suggesting agency problem.

About Impulse Decisions But just because they have the right to make decisions, doesn’t mean their decisions are always right. every ceo can define their tenure by a handful of key decisions that contributed to the success of their organization—or its stagnation and failure. We find that powerful ceos reduce investment efficiency, and this investment inefficiency is mainly driven by overinvestment. we further provide evidence that the ownership and expert components of the ceo power measure contribute to the investment inefficiency, suggesting agency problem.

About Impulse Decisions

Comments are closed.