Form 1099 Int

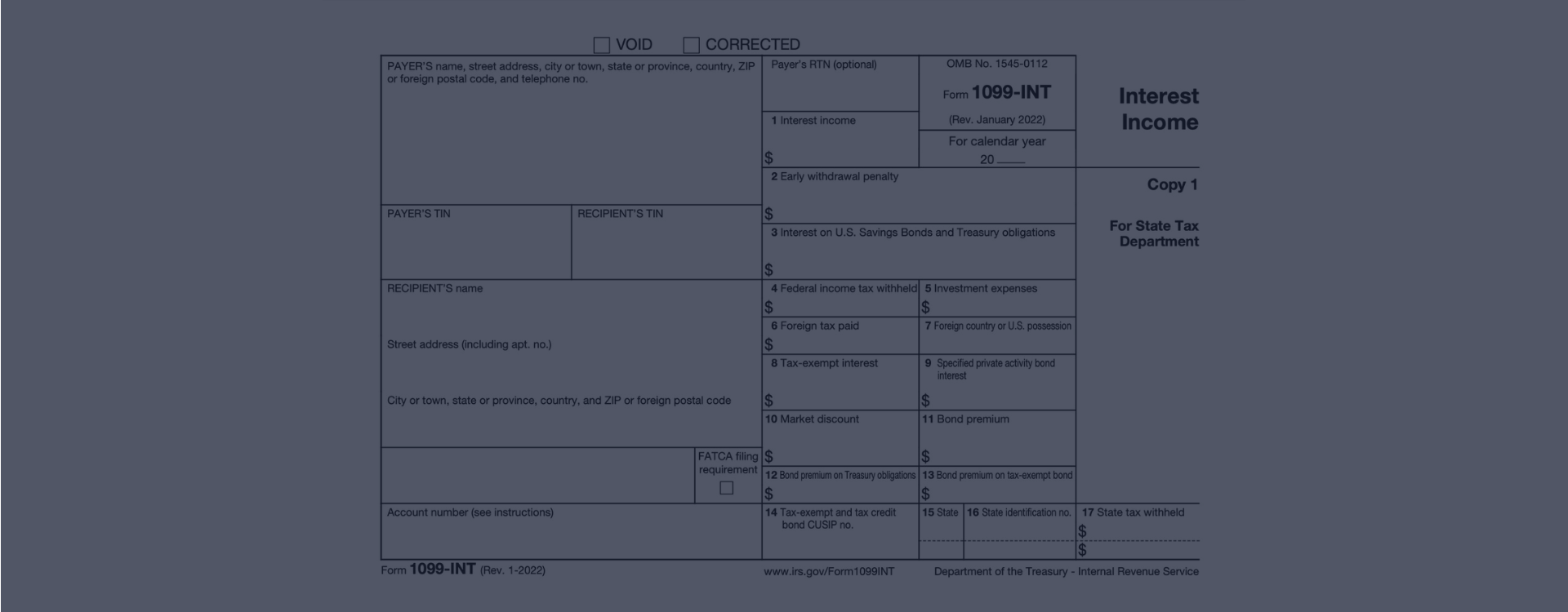

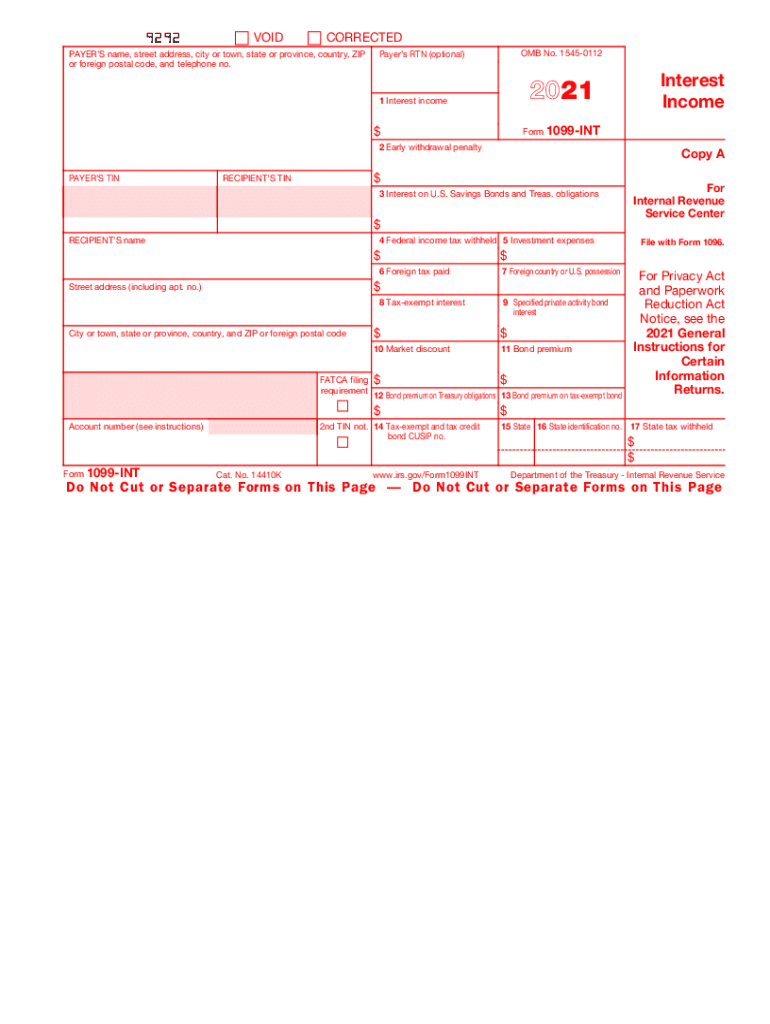

Tax Form 1099 Int Irs Fillable 1099 Int Form For 2023 Pdf To File Learn how to file form 1099 int for each person to whom you paid at least $10 in interest income or withheld federal tax. find the current revision, instructions, and other useful information on the irs website. Form 1099 int is an irs tax form used to report interest income received by taxpayers from various sources. learn who files it, who receives it, what types of interest are included, and how to report it on your tax returns.

1099 Int Software Software To Print And E File Form 1099int Learn what a 1099 int tax form is, who gets one and how to use it to file your income tax return. find out how interest income from banks, brokerages and other entities affects your tax bill and deductions. Learn what form 1099 int is, how to report interest income on your tax return, and what information is on the tax form. find out the difference between taxable and tax exempt interest, and how to avoid penalties for not reporting. Form 1099 int is an official tax document used to report interest income earned throughout the year. it is issued by banks, credit unions, brokerage firms, and other financial institutions to any individual who earns at least $10 in interest from a particular entity. Form 1099 int reports interest you've earned from various sources to the irs. learn what information it contains, when you should receive it, and how to report it on your tax return.

2021 Form Irs 1099 Int Fill Online Printable Fillable Blank Pdffiller Form 1099 int is an official tax document used to report interest income earned throughout the year. it is issued by banks, credit unions, brokerage firms, and other financial institutions to any individual who earns at least $10 in interest from a particular entity. Form 1099 int reports interest you've earned from various sources to the irs. learn what information it contains, when you should receive it, and how to report it on your tax return. Learn how to report interest income on tax form 1099 int, when you need to pay taxes on it, and how to include it on your tax return. find out the key details of each box of the form and the irs rules for reporting and compliance. Form 1099 int is an irs income tax form used by taxpayers to report interest income received. interest paying entities must issue form 1099 int to investors at year end and include a breakdown of all types of interest income and related expenses. Learn how to understand and report form 1099 int, a document that tracks your interest income from various sources. find out who gets it, how to read it, and what to do if you don't receive it. The 1099 int form documents interest income. the federal threshold for issuing a 1099 int is $10, meaning financial institutions must provide this form to individuals who earn $10 or more in annual interest income.

Comments are closed.