Fixed Annuity What Are Fixed Annuities How Do They Work

Fixed Annuity Annuity Broker A fixed annuity is a type of insurance contract that promises to pay the buyer a guaranteed interest rate on their contributions to the account. a variable. What is a fixed annuity? a fixed annuity, also known as a fixed term annuity or multi year guaranteed annuity (myga), is a contract with an insurance company. fixed annuities earn a fixed interest rate on an initial premium (s); the interest rate applied to the annuity is guaranteed, offering predictable growth.

Should You Get A Fixed Annuity Integrity Financial Planning Inc Fixed annuities provide a guaranteed income stream over a specific time period, with a predetermined rate of return. they offer a low risk, tax deferred way to supplement your retirement plans. What is a fixed annuity? a fixed annuity is a contract with an insurance company that is similar in many ways to a bank certificate of deposit. you pay one or more premiums to build up the account balance, and the insurer provides a guaranteed rate of return on that principal. How does a fixed annuity work? a fixed annuity is a type of annuity contract that provides a guaranteed return on contributions you make as a lump sum or over a set period of time. A fixed annuity is an insurance contract that guarantees your principal and pays interest at a fixed rate for a set period—typically 2 to 10 years. unlike stock market investments, fixed annuities offer predictable returns and protection from losses, making them ideal for conservative savers.

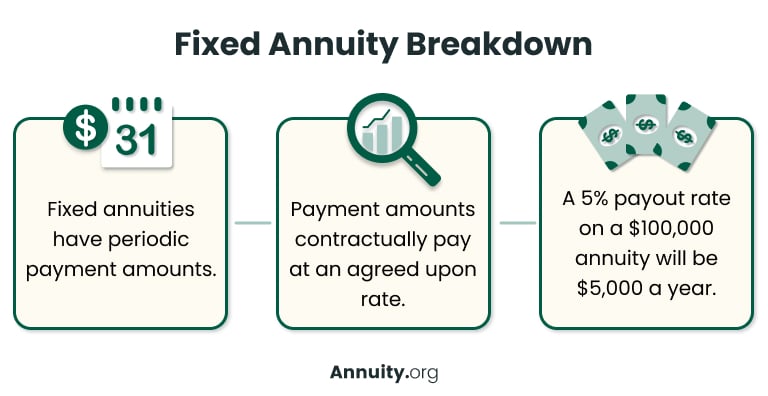

How Do Annuities Work Annuity Org Explains How does a fixed annuity work? a fixed annuity is a type of annuity contract that provides a guaranteed return on contributions you make as a lump sum or over a set period of time. A fixed annuity is an insurance contract that guarantees your principal and pays interest at a fixed rate for a set period—typically 2 to 10 years. unlike stock market investments, fixed annuities offer predictable returns and protection from losses, making them ideal for conservative savers. Fixed annuities are primarily used as a retirement planning tool, offering individuals a guaranteed income source, protecting their principal, and allowing them to accumulate earnings on a tax deferred basis. fixed annuities differ from variable and indexed annuities in that they guarantee a fixed interest rate. Fixed annuities are the most straightforward type of annuity. they also provide the most predictable and reliable income stream, usually with the lowest fees. you pay for a steady stream of income, and, in exchange, the insurance company guarantees your principal plus a minimum interest rate. This comprehensive guide explains exactly how fixed annuities work, compares current rate options, and helps you determine whether this conservative investment strategy aligns with your retirement goals. How does a fixed annuity work? fixed annuities work by converting your lump sum investment into guaranteed periodic payouts. there are two main ways to purchase them: lump sum purchase: you pay a single, large premium up front, and the annuity starts providing income based on the terms you choose.

How Annuities Work Examples By Type Considerations Fixed annuities are primarily used as a retirement planning tool, offering individuals a guaranteed income source, protecting their principal, and allowing them to accumulate earnings on a tax deferred basis. fixed annuities differ from variable and indexed annuities in that they guarantee a fixed interest rate. Fixed annuities are the most straightforward type of annuity. they also provide the most predictable and reliable income stream, usually with the lowest fees. you pay for a steady stream of income, and, in exchange, the insurance company guarantees your principal plus a minimum interest rate. This comprehensive guide explains exactly how fixed annuities work, compares current rate options, and helps you determine whether this conservative investment strategy aligns with your retirement goals. How does a fixed annuity work? fixed annuities work by converting your lump sum investment into guaranteed periodic payouts. there are two main ways to purchase them: lump sum purchase: you pay a single, large premium up front, and the annuity starts providing income based on the terms you choose.

Comments are closed.