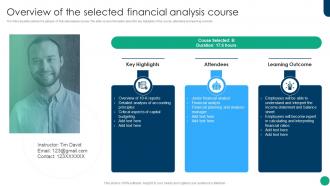

Financial Planning And Analysis Best Practices Overview Of The Selected

Financial Planning And Analysis Pdf Sales Budget Fp&a (financial planning and analysis) best practices include adopting agile forecasting, collaborating across departments, leveraging advanced analytics, and prioritizing cash flow management. they also involve rolling forecasts, scenario planning, and ongoing performance tracking. Financial planning and analysis (fp&a) is the process businesses use to plan and monitor their financial activities. it merges data driven analysis with strategic planning to ensure a company's fiscal well being.

Six Financial Planning And Analysis Roles Pdf Financial Analyst Learn the top 10 best practices in financial planning and analysis (fp&a) to strengthen forecasting, budgeting, and strategic financial decision making. Financial planning & analysis (fp&a) creates strategies for various departments to reach financial goals. understand the best fp&a practices & how they benefit businesses. This guide comprises articles from the “12 principles of best practice in financial planning and analysis” series, originally published on the board international blog. Below, you’ll find 10 best practices for overhauling your fp&a processes. implementing these will give everyone in your organization a better view of its financials, allowing for more strategic decisions, stronger goal setting, and a better fiscal year.

Financial Planning And Analysis Best Practices Overview Of The Selected This guide comprises articles from the “12 principles of best practice in financial planning and analysis” series, originally published on the board international blog. Below, you’ll find 10 best practices for overhauling your fp&a processes. implementing these will give everyone in your organization a better view of its financials, allowing for more strategic decisions, stronger goal setting, and a better fiscal year. Well developed and documented fp&a best practices deliver stronger reporting, improved risk mitigation, and a better understanding of the key drivers behind revenue growth. Doing the primary functions of a financial planning and analysis (fp&a) team is table stakes. the business expects you to build models, run scenarios for different business outcomes, handle ad hoc analysis requests, and add the financial perspective to growth strategies. Now let’s take a look at the 12 principles of best practice fp&a. not only do high performing companies follow these principles, but they do a better job of carrying out the actions and concepts involved in each one. Here are seven best practices in financial planning & analysis: 1. measure financial impact of strategic objectives. fact: 60% of organizations do not link operation plans to strategy. when companies have a clear plan on the steps they need to take and track and measure their successes to that plan, they are more successful.

Comments are closed.