Fico 101 The 5 Components Of Your Score The Meridian Real Estate

Fico 101 The 5 Components Of Your Score The Meridian Real Estate Your FICO auto score is a three-digit number, ranging from 250 to 900, and the higher your score, the more likely you are to qualify for a loan with a good interest rate and other terms Key Takeaways It’s important to understand how your FICO Score and other types of credit scores work Good credit scores can make your financial life easier to navigate and may help you save money along the way

Real Estate 101 Credit Score Jennifer Andrews Realtor Specifically, a FICO score uses the following weighting method to determine your credit score: Payment history on credit account: 35% of your FICO score The amounts you owe: 30% of your FICO score The five C’s of credit offer lenders a framework to evaluate a loan applicant’s creditworthiness—how worthy they are to receive new credit By considering a borrower’s character, capacity Payment history makes up 35% of your FICO Score, so staying on top of bills is crucial, especially in difficult times like medical emergencies or job loss Creditors report delinquencies in stages Jumbo loans are generally defined as loans over $766,550 You will typically need at least a 700 credit score, though the average score is 740, according to Bankrate Other types of loansLenders

Credit Scoring Models In Real Estate Comparing Vantagescore And Fico Payment history makes up 35% of your FICO Score, so staying on top of bills is crucial, especially in difficult times like medical emergencies or job loss Creditors report delinquencies in stages Jumbo loans are generally defined as loans over $766,550 You will typically need at least a 700 credit score, though the average score is 740, according to Bankrate Other types of loansLenders What's the highest credit score you can get? The highest FICO score possible to achieve is 850 That’s a perfect score and it’s not always necessary to get the best terms and rates when borrowing According to FICO® Score, 155% of the population has a credit score below 600, while the average credit score sits at 716 Having a 600 credit score places you below the national average and The homebuying process can be nerve-wracking, especially if you have bad credit Lenders typically want to see at least a 620 FICO score for a conventional mortgage, but some will consider The FICO credit score was created by the former Fair Isaac Corp (now FICO) in 1989, and it’s used by 90% of top lenders Three credit bureaus provide this score: Equifax, Experian, and TransUnion

Learncre Real Estate 101 Real Estate Metrics Ppt What's the highest credit score you can get? The highest FICO score possible to achieve is 850 That’s a perfect score and it’s not always necessary to get the best terms and rates when borrowing According to FICO® Score, 155% of the population has a credit score below 600, while the average credit score sits at 716 Having a 600 credit score places you below the national average and The homebuying process can be nerve-wracking, especially if you have bad credit Lenders typically want to see at least a 620 FICO score for a conventional mortgage, but some will consider The FICO credit score was created by the former Fair Isaac Corp (now FICO) in 1989, and it’s used by 90% of top lenders Three credit bureaus provide this score: Equifax, Experian, and TransUnion Your credit utilization ratio is part of the "amounts owed" category, which determines about 30% of your FICO score, the most widely used credit scoring model among creditors VantageScore 30

Components Of Fico Score The homebuying process can be nerve-wracking, especially if you have bad credit Lenders typically want to see at least a 620 FICO score for a conventional mortgage, but some will consider The FICO credit score was created by the former Fair Isaac Corp (now FICO) in 1989, and it’s used by 90% of top lenders Three credit bureaus provide this score: Equifax, Experian, and TransUnion Your credit utilization ratio is part of the "amounts owed" category, which determines about 30% of your FICO score, the most widely used credit scoring model among creditors VantageScore 30

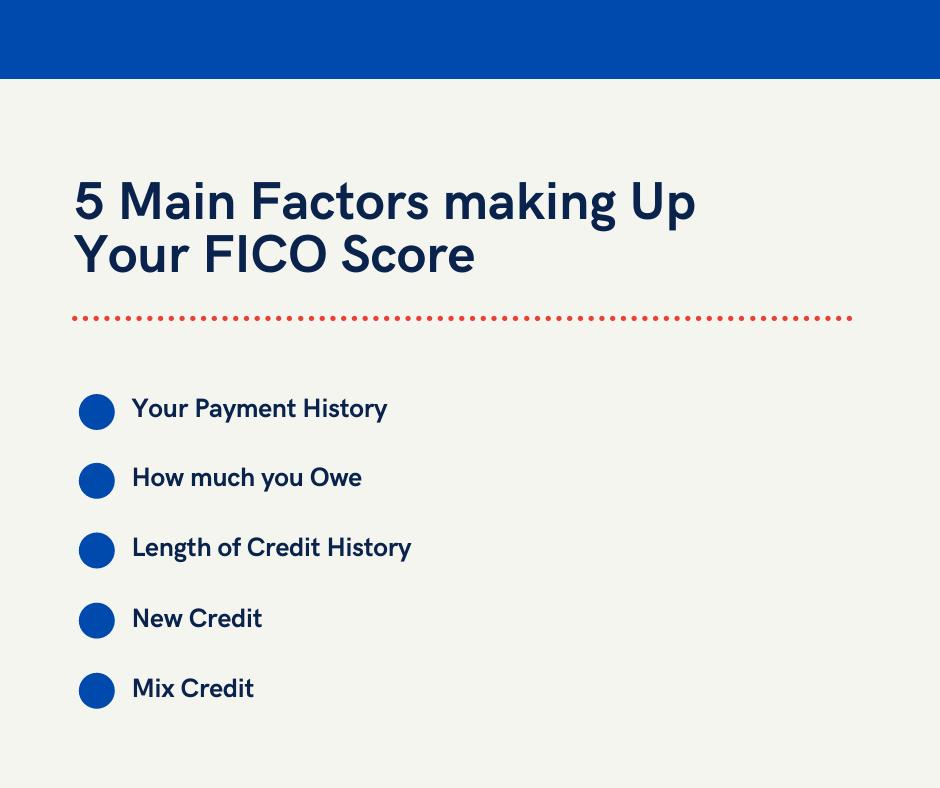

5 Main Factors Making Up Your Fico Score Your credit utilization ratio is part of the "amounts owed" category, which determines about 30% of your FICO score, the most widely used credit scoring model among creditors VantageScore 30

Comments are closed.