Explain The Value Added Method Of Calculating Gdp Depreciation Gdp

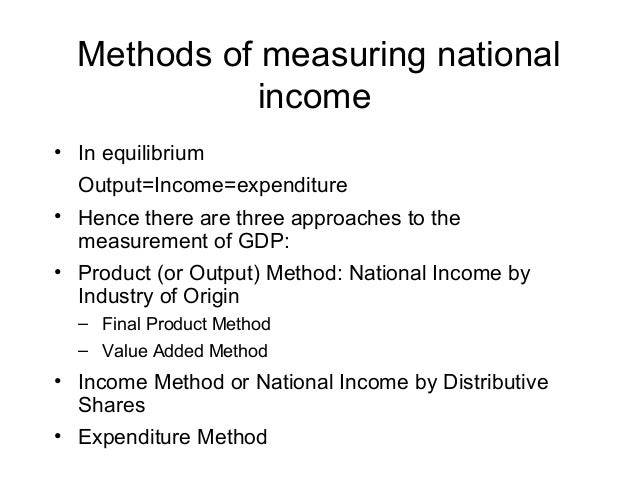

Explain The Value Added Method Of Calculating Gdp Depreciation Gdp The explanatory notes on the new GDP may throw you off track for a moment by using a new term — value added — to explain the difference between the old and the new method Learn the best method for calculating depreciation for tax reporting purposes according to generally accepted accounting principles, or GAAP

Solved Which Equation Is Correct A ï Gdp Depreciation Ndpb Chegg Calculating Depreciation Using the Units of Production Method Formula: (asset cost - salvage value)/estimated units over asset's life x actual units made Method in action: ($25,000 - $500)/50,000 The problem is not just that it is hard to make these calculations It is that what the calculations produce is a measure put to too many purposes, and, though useful, not truly fit for any of them Discrepancy is a statistical input in the expenditure side of calculating GDP – which is used to match the difference between GDP calculated via the gross-value-added (GVA) and demand side

What Is The Net Value Of Gdp After Deducting Depreciation From Gdp Discrepancy is a statistical input in the expenditure side of calculating GDP – which is used to match the difference between GDP calculated via the gross-value-added (GVA) and demand side

How To Measure Gdp Using The Value Added Approach Pdf Good

Solved Gdp By Value Added Method Can Be Calculated Gdp Va Chegg

Comments are closed.