Elss Vs Ppf A Brief Comparison

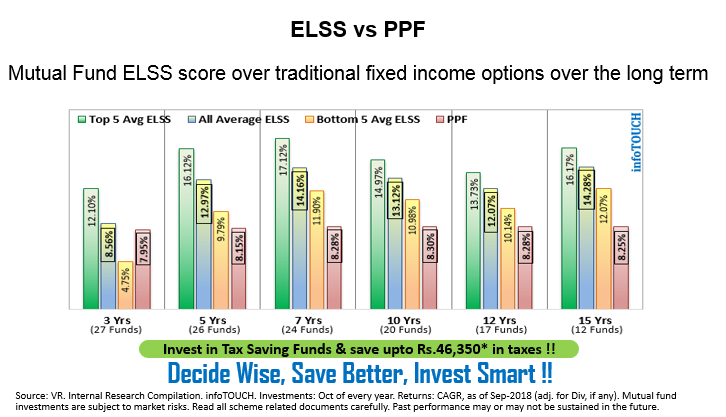

Ppf Vs Elss Pdf Equity linked savings scheme (elss) and public provident fund (ppf) are two such schemes that generate high returns and also offer income tax benefits. both these plans are ideal for those looking to maximise their savings through wealth appreciation and create a disciplined savings habit. Get detailed analysis on elss vs ppf. know about difference, comparison and which is better between equity linked savings scheme & public provident fund.

Elss Vs Ppf Pdf In this article, we will compare two different investments i.e. elss and ppf to help you determine which one is the most suitable for your financial goals. what is an equity linked savings scheme? elss is the only kind of mutual funds covered under section 80c of the income tax act, 1961. Ppf and elss, both schemes are fundamentally different from each other. each investment scheme comes with some individual pros and cons. public provident fund is a risk free debt oriented investment option, whereas elss mostly invests in equity stocks that can produce better returns than ppf. Section 80c of the income tax act, 1961 provides two tax saving options, namely equity linked savings scheme (elss) and public provident fund (ppf). tax benefits exist in these options, yet they differ profoundly regarding their level of risk and return structure, along with required lock in times. Compare elss vs ppf investments, explore their key differences, and discover which option suits your financial goals better in this detailed guide.

Elss Vs Ppf Things To Note Geojit Financial Services Blog Section 80c of the income tax act, 1961 provides two tax saving options, namely equity linked savings scheme (elss) and public provident fund (ppf). tax benefits exist in these options, yet they differ profoundly regarding their level of risk and return structure, along with required lock in times. Compare elss vs ppf investments, explore their key differences, and discover which option suits your financial goals better in this detailed guide. Compare elss vs ppf for tax saving in 2025. know returns, lock in, safety, and best choice for your goals under section 80c. Considering elss vs ppf, it is important to evaluate the features of elss. below are the features that you can get while investing in an elss: an elss is one of the best tax saving investment options that provides potentially higher returns and a shorter lock in period. Both elss and ppf offer tax saving benefits, but serve different investor profiles. elss suits aggressive investors aiming for long term capital growth, while ppf is ideal for conservative savers seeking stability and tax free returns. ⚠️ disclaimer: investment in mutual funds and market instruments is subject to risk. Elss: gains above rs.1 lakh from elss are subject to 10% long term capital gains (ltcg) tax. ppf: both interest earned and maturity proceeds are tax free. tip: if you want completely tax free returns, ppf is a better option. if you can handle ltcg tax for potentially higher earnings, go for elss.

Comments are closed.