Dow Theory Explained What It Is And How It Works

The Dow Theory Explained Pdf Market Trend Dow Jones Industrial What is the dow theory? the dow theory is a financial theory that says the market is in an upward trend if one of its averages (e.g., industrials or transportation) advances above a. The dow theory is a financial theory founded on a set of ideas derived from charles h. dow's editorials. it fundamentally states that a significant shift between bear and bull sentiment in a stock market will occur when multiple indices confirm it.

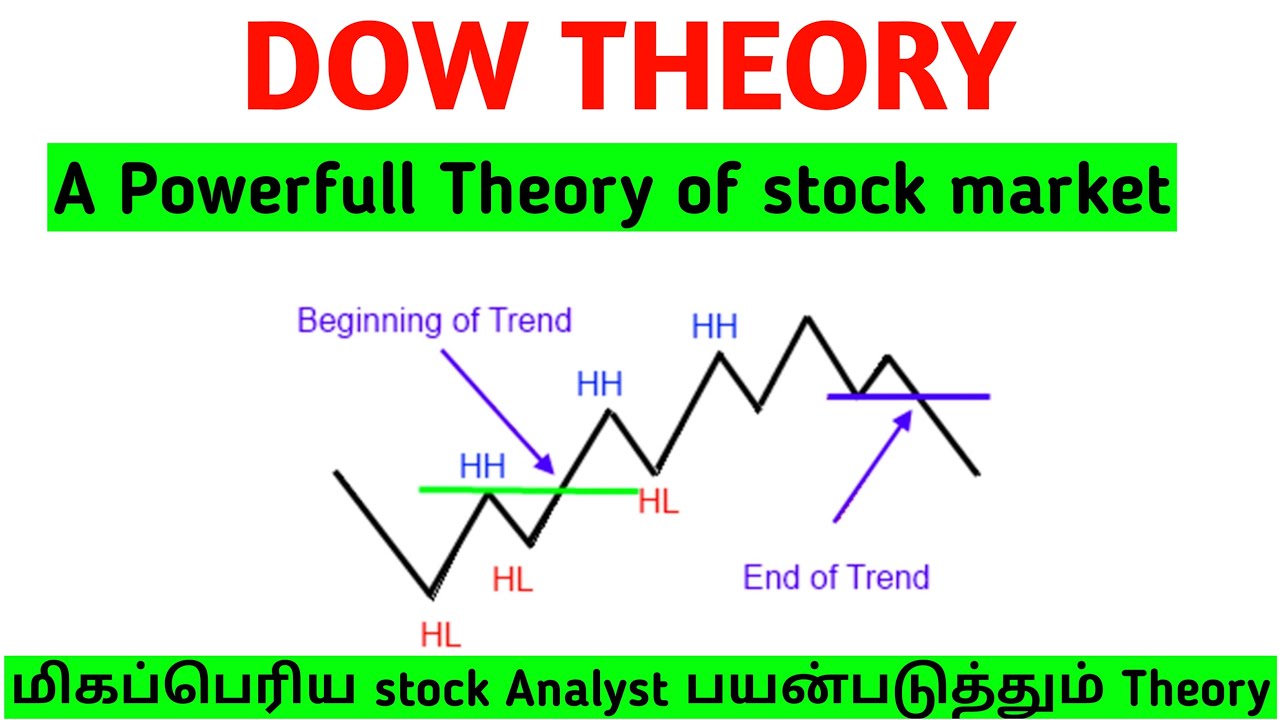

Dow Theory Pdf This article explores the dow theory in detail, covering its history, key principles, and how it works. we’ll also delve into the three primary kinds of market trends, the importance of indices confirming each other, the role of trading volume, and how trends persist. Dow theory is a technical analysis approach that suggests markets move in three self repeating phases called the accumulation phase, the markup phase, and the distribution phase. Dow theory helps investors to identify the facts and prevent them from making assumptions about the market which can be dangerous. dow theory can act as fundamental base for the investors to create a guideline to carefully investigate the stocks. Dow theory is an analysis that explores the relationship between the dow jones industrial average (djia) and the dow jones transportation average (djta). when one of these averages climbs to an intermediate high, then the other is expected to follow suit within a reasonable amount of time.

What Is Dow Theory Pdf Market Trend Technical Analysis Dow theory helps investors to identify the facts and prevent them from making assumptions about the market which can be dangerous. dow theory can act as fundamental base for the investors to create a guideline to carefully investigate the stocks. Dow theory is an analysis that explores the relationship between the dow jones industrial average (djia) and the dow jones transportation average (djta). when one of these averages climbs to an intermediate high, then the other is expected to follow suit within a reasonable amount of time. There are three movements of the averages. the first, and most important, is the primary trend. the second, and most deceptive is the secondary reaction. the third, and usually unimportant, is the daily movement. both the industrial and transportation averages must confirm a trend. The dow theory was developed to explain the concept that share market moves in trends that can be analyzed and predicted. dow jones theory provides a framework for understanding market behaviour and making informed investment decisions. What is the dow theory? the dow theory is a technical framework for understanding market trends by analysing rotation between major indices like dow jones industrial average (djia) and dow jones transportation average (djta). the dow theory was developed by charles dow. The dow theory is a financial theory used for technical analysis of the market. here's a breakdown of the dow theory principles and how investors can use them.

Dow Theory Explained What It Is And How It Works 49 Off There are three movements of the averages. the first, and most important, is the primary trend. the second, and most deceptive is the secondary reaction. the third, and usually unimportant, is the daily movement. both the industrial and transportation averages must confirm a trend. The dow theory was developed to explain the concept that share market moves in trends that can be analyzed and predicted. dow jones theory provides a framework for understanding market behaviour and making informed investment decisions. What is the dow theory? the dow theory is a technical framework for understanding market trends by analysing rotation between major indices like dow jones industrial average (djia) and dow jones transportation average (djta). the dow theory was developed by charles dow. The dow theory is a financial theory used for technical analysis of the market. here's a breakdown of the dow theory principles and how investors can use them.

Comments are closed.