Deduction Vs Induction Deductive Inductive Reasoning Definition Meaning Explanation Examples

Inductive Reasoning Deduction Vs Induction Unraveling 50 Off Claim credits and deductions when you file your tax return to lower your tax. make sure you get all the credits and deductions you qualify for. Tax deductions allow people to exclude certain income and account for losses when calculating the amount of federal income tax they owe, according to the tax foundation. some deductions were.

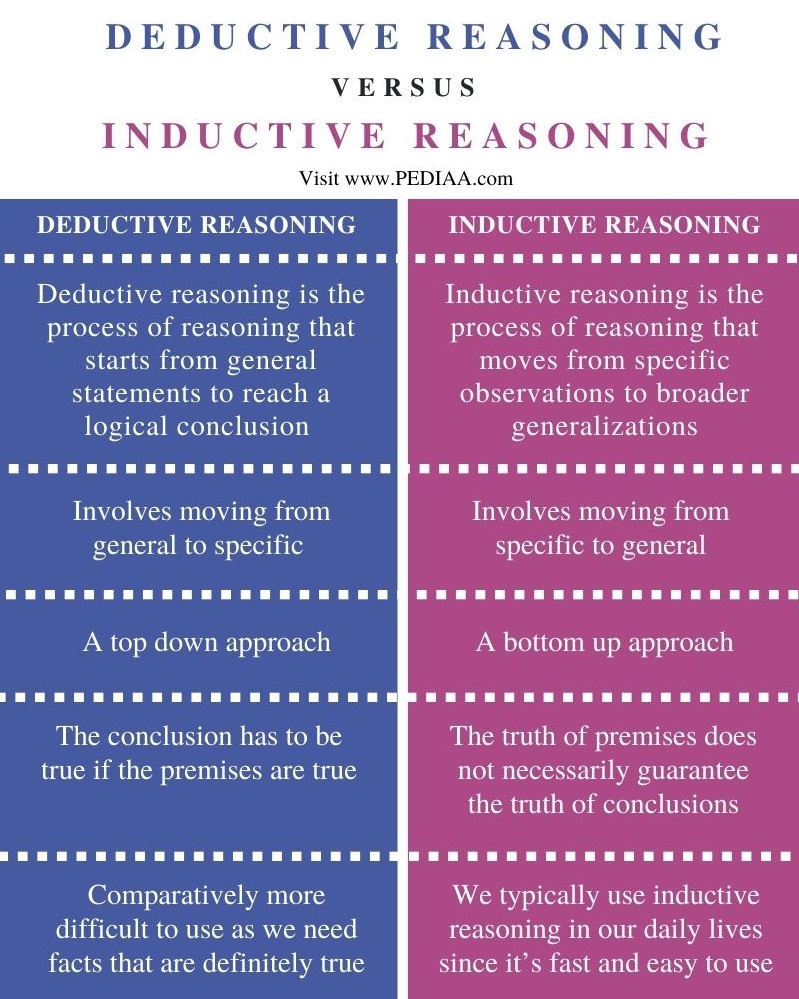

Deductive Inductive Reasoning Definition Differences Example Deductive reasoning, or deduction, is making an inference based on widely accepted facts or premises. if a meal is described as "eaten with a fork" you may use deduction to determine that it is solid food, rather than, say, a bowl of soup. what is the difference between deduction and adduction?. A tax deduction is an expense that can be subtracted from your income to reduce how much of your money is taxed by the government. by lowering your taxable income, tax deductions can lower your tax bill. What does tax deductible mean, and what are common deductions? are irs penalties tax deductible? the answer may surprise you. a tax deduction is an item you can subtract from your taxable. Learn how tax deductions work – and which ones you might be able to take for tax year 2024. you can deduct qualified home equity loan interest if you used the loan proceeds to buy, build or.

Inductive Vs Deductive Reasoning 7esl What does tax deductible mean, and what are common deductions? are irs penalties tax deductible? the answer may surprise you. a tax deduction is an item you can subtract from your taxable. Learn how tax deductions work – and which ones you might be able to take for tax year 2024. you can deduct qualified home equity loan interest if you used the loan proceeds to buy, build or. Deduction definition: 1. the process of reaching a decision or answer by thinking about the known facts, or the decision…. learn more. A tax deduction allows taxpayers to subtract certain deductible expenses and other items to reduce how much of their income is taxed, which reduces how much tax they owe. What is a tax deduction? a tax deduction occurs when a certain expense can be used to reduce the amount of your income subject to income taxes. A tax deduction is a qualified expense that reduces your taxable income, indirectly lowering your income taxes. tax filers choose between the standard deduction or itemizing their deductions.

What Is Deduction Deduction Definition Meaning 55 Off Deduction definition: 1. the process of reaching a decision or answer by thinking about the known facts, or the decision…. learn more. A tax deduction allows taxpayers to subtract certain deductible expenses and other items to reduce how much of their income is taxed, which reduces how much tax they owe. What is a tax deduction? a tax deduction occurs when a certain expense can be used to reduce the amount of your income subject to income taxes. A tax deduction is a qualified expense that reduces your taxable income, indirectly lowering your income taxes. tax filers choose between the standard deduction or itemizing their deductions.

Inductive Deductive Reasoning 45 Off Www Micoope Gt What is a tax deduction? a tax deduction occurs when a certain expense can be used to reduce the amount of your income subject to income taxes. A tax deduction is a qualified expense that reduces your taxable income, indirectly lowering your income taxes. tax filers choose between the standard deduction or itemizing their deductions.

Comments are closed.