Cs8501 Theory Of Computation L T P C Cs8501 Theory Of Computation L T

Cs8501 Theory Of Computation L T P C 3 0 0 3 Pdf Out of 102 banks operating in the netherlands, the three largest banks ing bank, rabobank, and abn amro hold 74.71 % of total banking assets, with additional 14.14 % held by the next seven largest banks. this high concentration reflects the dominant role these institutions play in the dutch banking landscape. Here is a list of the largest banks in the netherlands ranked by total assets. ing, rabobank and abn amro are the three largest banking institutions in the country.

Theory Of Computation Cs8501 2017 Regulation Semester Question By 2007, abn amro was the second largest bank in the netherlands and the eighth largest in europe by assets. at that time, the magazine the banker and fortune global 500 placed it 15th [14] in the list of world's biggest banks and it had operations in 63 countries, with over 110,000 employees. Abn amro group from amsterdam, netherlands is ranked in the top 1000 world banks by tier 1 2025 ranking, rising places from the previous ranking. this ranking is based on a tier 1 capital of us$ at 31 dec 2024, which indicates a growth of on the previous ranking. Abn amro bank n.v.'s ratings reflect its strong and fairly diversified universal banking business model, complemented by a solid european private banking foothold, and its moderate risk profile, which results in resilient asset quality. Abn amro offers investors exposure to the oligopolistic dutch banking system where it and its two main rivals hold more than 90% of all dutch current accounts.

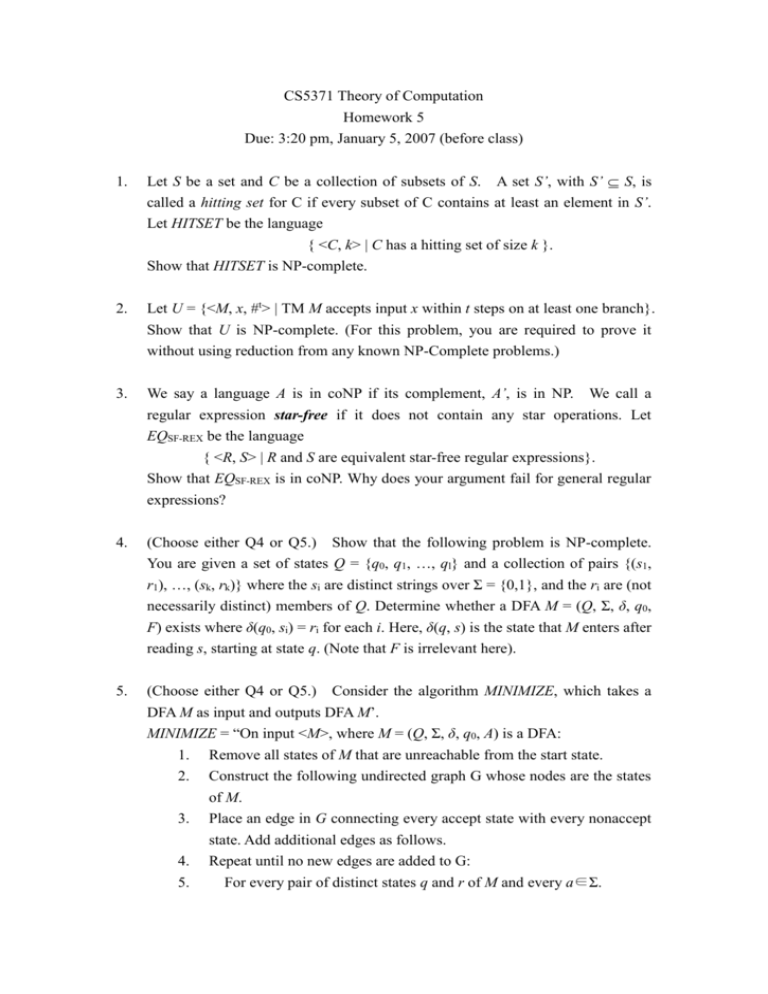

Theory Of Computation Homework 5 Abn amro bank n.v.'s ratings reflect its strong and fairly diversified universal banking business model, complemented by a solid european private banking foothold, and its moderate risk profile, which results in resilient asset quality. Abn amro offers investors exposure to the oligopolistic dutch banking system where it and its two main rivals hold more than 90% of all dutch current accounts. 1. general characteristics abn amro is an international bank, its history going back to 1824. abn amro ranks 11th in europe and 20th in the world based on tier 1 capital, with over 3,000 branches in more than 60 countries, a staff of more than 97,000 full time equivalents and total assets of eur 855.7 billion (as at 30 june 2005)1. As of 31 december 2021, abn amro bank's assets represented 15% of the total aggregated consolidated assets of dutch credit institutions. as of 30 june 2022, abn amro bank’s consolidated assets stood at €421.5 billion. the bank's primary market are the netherlands and north west europe. The ecb supervises more than 110 large banks across europe. combined, they hold just over 80% of all banking assets in europe. they include seven dutch banks: ing, rabobank, abn amro, de volksbank, bng bank, nwb bank and leaseplan. european banking supervision and the banking union. An important characteristic of the banking sector in the netherlands is that a few institutions are significantly larger than others. the assets of ing, rabobank and abn amro were much higher.

Cs8501 Theory Of Computation Important Questions For Nov Dec 2019 1. general characteristics abn amro is an international bank, its history going back to 1824. abn amro ranks 11th in europe and 20th in the world based on tier 1 capital, with over 3,000 branches in more than 60 countries, a staff of more than 97,000 full time equivalents and total assets of eur 855.7 billion (as at 30 june 2005)1. As of 31 december 2021, abn amro bank's assets represented 15% of the total aggregated consolidated assets of dutch credit institutions. as of 30 june 2022, abn amro bank’s consolidated assets stood at €421.5 billion. the bank's primary market are the netherlands and north west europe. The ecb supervises more than 110 large banks across europe. combined, they hold just over 80% of all banking assets in europe. they include seven dutch banks: ing, rabobank, abn amro, de volksbank, bng bank, nwb bank and leaseplan. european banking supervision and the banking union. An important characteristic of the banking sector in the netherlands is that a few institutions are significantly larger than others. the assets of ing, rabobank and abn amro were much higher.

Pdf Cs3452 Theory Of Computation Toc Books Lecture Notes 2 Marks The ecb supervises more than 110 large banks across europe. combined, they hold just over 80% of all banking assets in europe. they include seven dutch banks: ing, rabobank, abn amro, de volksbank, bng bank, nwb bank and leaseplan. european banking supervision and the banking union. An important characteristic of the banking sector in the netherlands is that a few institutions are significantly larger than others. the assets of ing, rabobank and abn amro were much higher.

Comments are closed.