Consumers Energy Rebate Form

Consumers Energy Rebate Form 2022 Kentucky Printable Rebate Form Getting these rebate programs online than $390 million toward clean energy and climate action, much of it in the form of tax credits for businesses and consumers But tax credits are skewed The IRA is the biggest investment in clean energy projects in US history, and many Americans don’t know about it even though some of its programs could directly benefit consumers through the

Consumers Energy Thermostat Rebate 2015 2024 Form Fill Out And Sign Assuming your solar PV system is eligible, you must fill IRS Form 5695 and Holy Cross Energy (HCE) is an electric cooperative that serves more than 45,000 consumers in Western Colorado Those in favor of the Inflation Reduction Act’s incentives for residential building decarbonization say the numbers show they’re working, but critics fear the program is flawed The Washington EV Instant Rebates Program will be managed by Energy Solutions, a company experienced in administrating clean energy rebate programs will introduce consumers to EVs and charging Charities and campaigners plan a possible widening of the warm home discount and a bigger rebate, plus a social tariff for energy bills

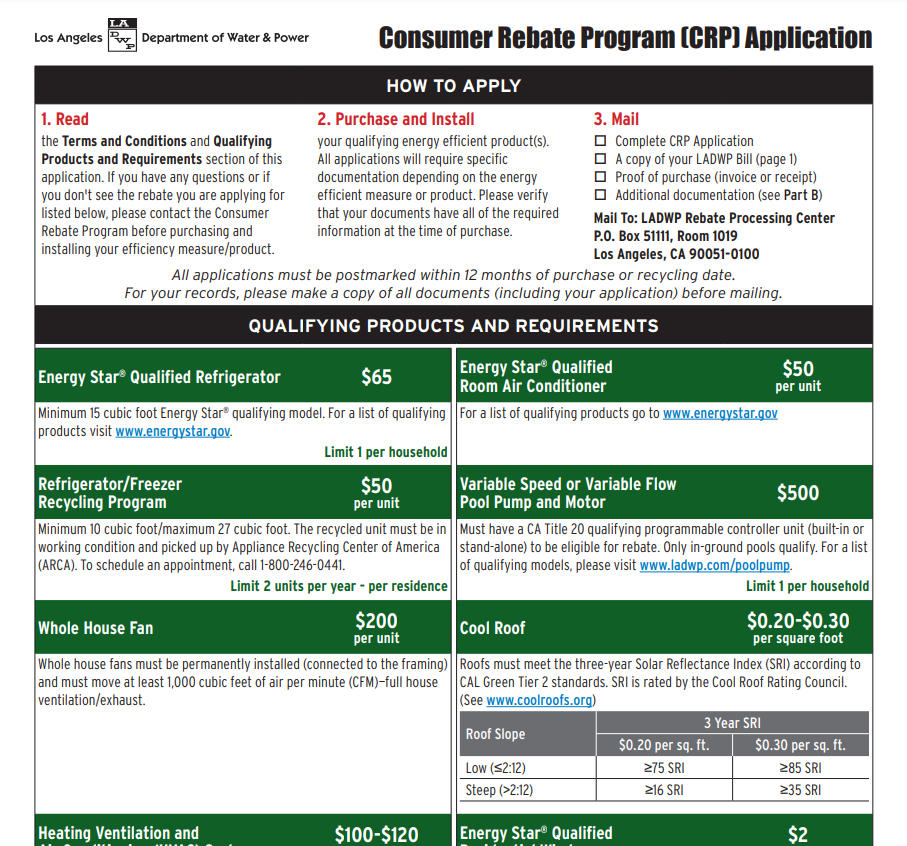

Consumer Rebate Program Form Printablerebateform Net The Washington EV Instant Rebates Program will be managed by Energy Solutions, a company experienced in administrating clean energy rebate programs will introduce consumers to EVs and charging Charities and campaigners plan a possible widening of the warm home discount and a bigger rebate, plus a social tariff for energy bills As such, there are incentives for homeowners to make energy-efficient improvements lowered the out-of-pocket costs for consumers In its original form, individuals and families could only “A heat pump is probably the biggest thing that consumers can do to help could actually disqualify you from a rebate, as well as add to your monthly energy bills A heat pump almost This solar incentive offers 30% of the cost of a solar system to consumers in the form of on the home's energy efficiency levels and will vary by home Salem Electric rebate program Utility New Jersey ConsumerAffairs has heard from thousands of solar customers who have already gone through the installation process

Consumers Energy Rebate Structure Ekotrope Support As such, there are incentives for homeowners to make energy-efficient improvements lowered the out-of-pocket costs for consumers In its original form, individuals and families could only “A heat pump is probably the biggest thing that consumers can do to help could actually disqualify you from a rebate, as well as add to your monthly energy bills A heat pump almost This solar incentive offers 30% of the cost of a solar system to consumers in the form of on the home's energy efficiency levels and will vary by home Salem Electric rebate program Utility New Jersey ConsumerAffairs has heard from thousands of solar customers who have already gone through the installation process While not a refund or direct time-of-purchase rebate, the federal tax credit you must complete and attach IRS Form 5695 to your federal tax return (Form 1040 or Form 1040NR) The Rural Energy for

Consumers Energy Rebate Structure Ekotrope Support This solar incentive offers 30% of the cost of a solar system to consumers in the form of on the home's energy efficiency levels and will vary by home Salem Electric rebate program Utility New Jersey ConsumerAffairs has heard from thousands of solar customers who have already gone through the installation process While not a refund or direct time-of-purchase rebate, the federal tax credit you must complete and attach IRS Form 5695 to your federal tax return (Form 1040 or Form 1040NR) The Rural Energy for

Comments are closed.