Consumer Credit Counseling Budget Worksheet

Consumer Credit Counseling Budget Worksheet вђ Db Excel A tool to organize your finances and gain an understanding of how you are spending your money. includes worksheets for budgeting, tracking, inventory, net worth, goals, and more. The personal financial workbook is a tool that you can use to organize your finances and gain an understanding of how you are spending your money. by using the worksheets, you’ll be able to paint a clear picture of your financial situation and make better decisions for the future. we recommend that you photocopy worksheets before using them.

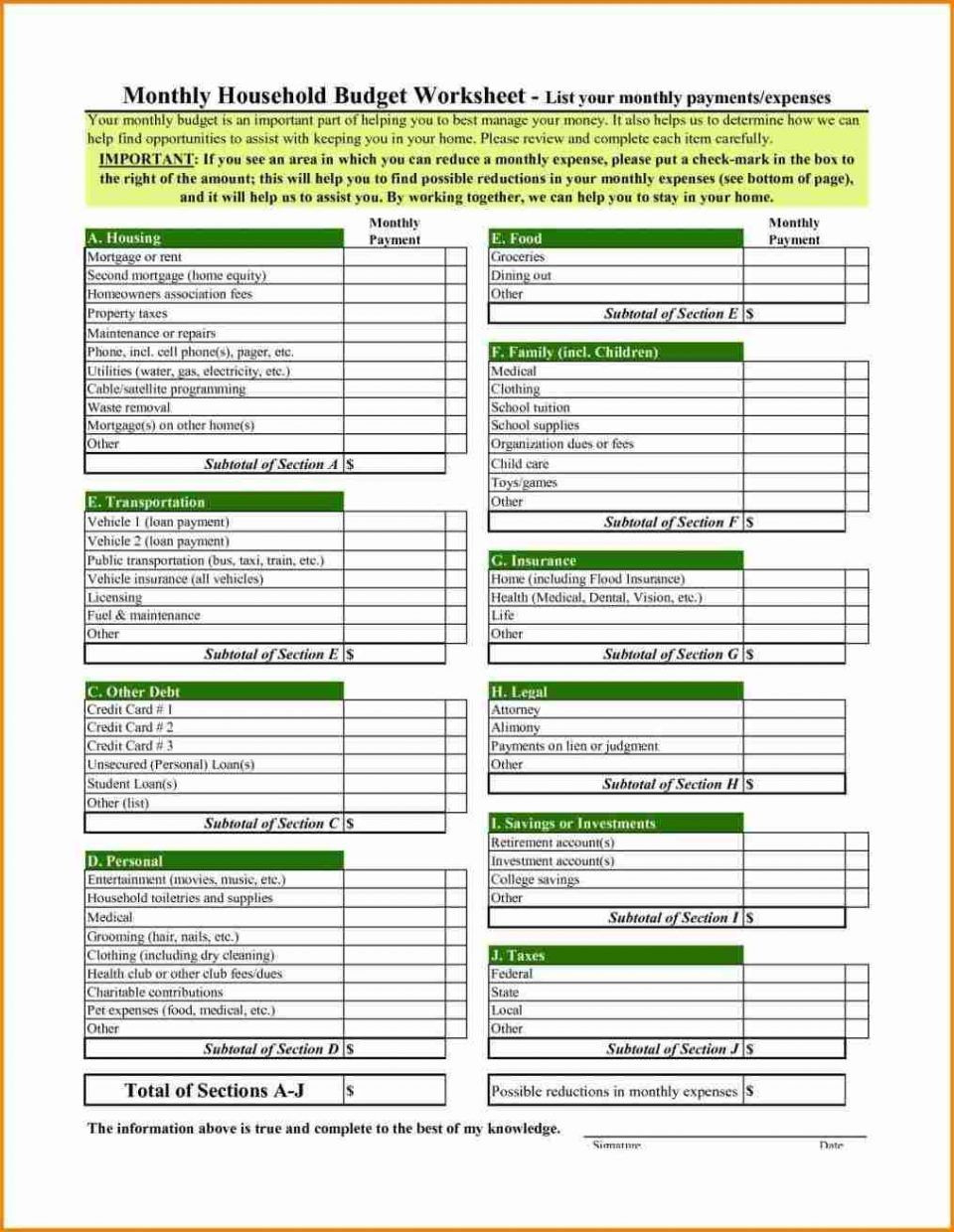

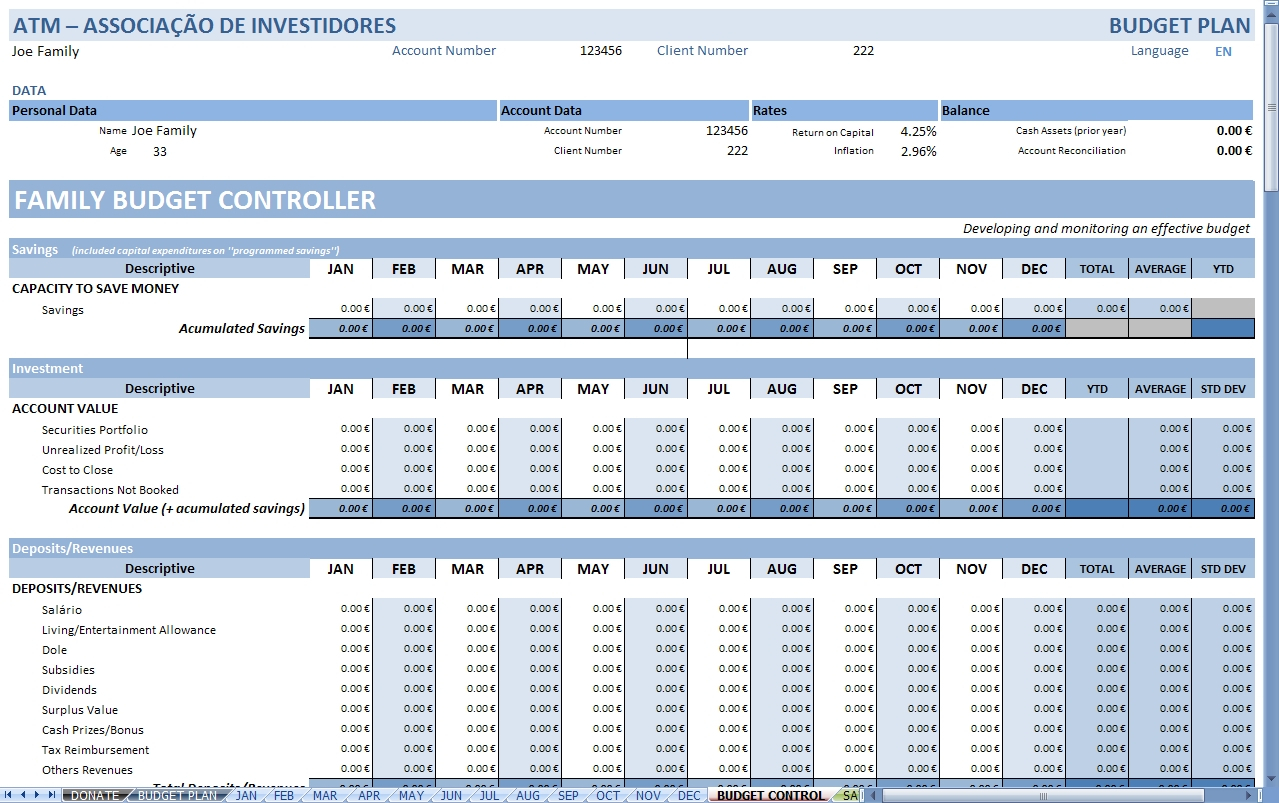

Best Personal Budget Spreadsheet With Consumer Credit Counseling Bu Household budgeting worksheet for more information about managing your finances call 800 769 3571 to speak to a credit counselor today make sure that you include all net or take home income and expenses as accurately as possible. each expense category has a recommended distribution of your income associated with it. household wages social security. 16. debt to income ratio worksheet 17. credit card options worksheet. 18. annual credit report request form 19. resources. american consumer credit counseling (accc) is a nonprofit 501(c)(3) organization. founded in 1991, accc offers confidential credit counseling, housing counseling, bankruptcy counseling, a debt management program,. We have put together a comprehensive guide to spending and budgeting that will help you understand the basics and make better decisions with your money. spending: budgeting: the consumer credit counseling foundation is here to provide you with the resources and guidance you need to make informed and responsible financial decisions. we know that. Monthly expenses planning tool. find out how budgeting applies to your money. 1. monthly income. net income no. 1 (income less taxes, social security, medicare) net income no. 2 (income less taxes, social security, medicare) child support received. spousal support received. military retirement.

Comments are closed.