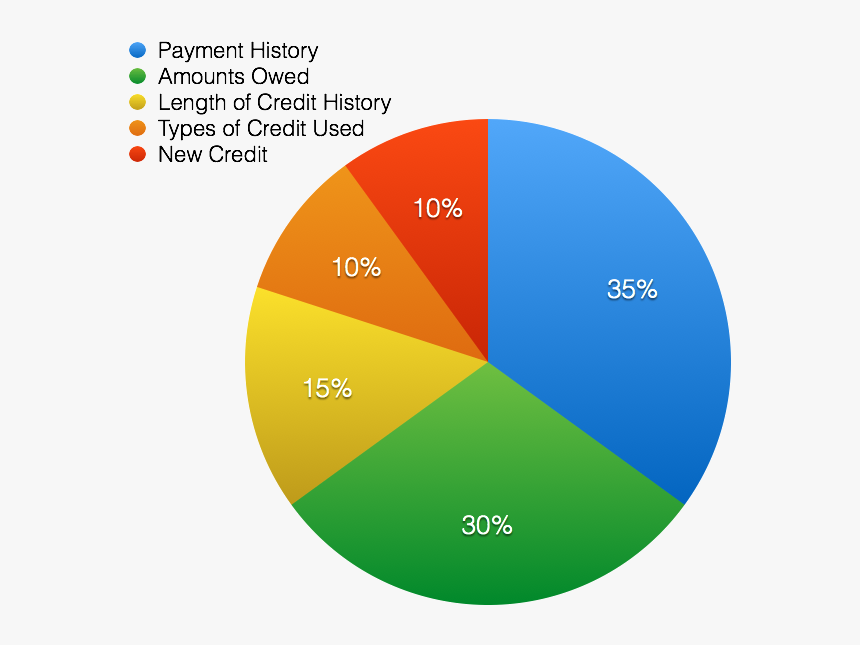

Components Of Fico Score

For Consumers Fico Score Fico scores are calculated using many different pieces of credit data in your credit report. this data is grouped into five categories: payment history (35%), amounts owed (30%), length of credit history (15%), new credit (10%) and credit mix (10%). Your credit score is made up of several elements. find out these elements with its percentage weightage in this simplified explanation by forbes advisor.

Fico Credit Score Components Explained Firsttuesday Journal Your credit score, which commonly refers to your fico score, is calculated based on five factors: payment history, amount owed, length of credit history, new credit, and. Here’s a breakdown of the five elements of the fico score: your payment history comprises 35% of the total credit score and is the most important factor affecting credit score calculations. according to fico, past long term behavior is used to forecast future long term behavior. Fico scores are made up of five components – payment history, amounts owed, length of credit history, credit mix and new credit. in this guide, you’ll discover what fico scores are and why they matter. Learn the 5 key components of your fico score: payment history, amounts owed, credit length, new credit, and credit mix. improve your credit health with actionable strategies and avoid common pitfalls.

Five Components Of The Fico Score Hd Png Download Kindpng Fico scores are made up of five components – payment history, amounts owed, length of credit history, credit mix and new credit. in this guide, you’ll discover what fico scores are and why they matter. Learn the 5 key components of your fico score: payment history, amounts owed, credit length, new credit, and credit mix. improve your credit health with actionable strategies and avoid common pitfalls. Understand how lenders evaluate credit risk for loans and other credit with fico scores. every year, lenders access billions of fico® scores to help them understand consumers’ credit risk and make better informed lending decisions. In this blog, we explore the components that make up your fico® score and break down why it matters in your financial life. what is a fico® score? your fico® score is a number that shows how trustworthy you are with credit, helping lenders decide if you’re likely to pay back what you borrow. Bottom line: your fico score can shape your financial landscape. maintaining a good score doesn’t just improve your borrowing power; it can also help you save money and open up new opportunities. fico scores are calculated from various pieces of your credit history. five factors drive the score, each carrying a different weight. While the fico formula is complex, the two most critical components—payment history and amount owed—comprise 65% of your score. prioritizing timely payments and responsible debt management is the most effective way to maintain or improve your fico score.

Comments are closed.