Apr Vs Apy The Difference Explained Simple Guide

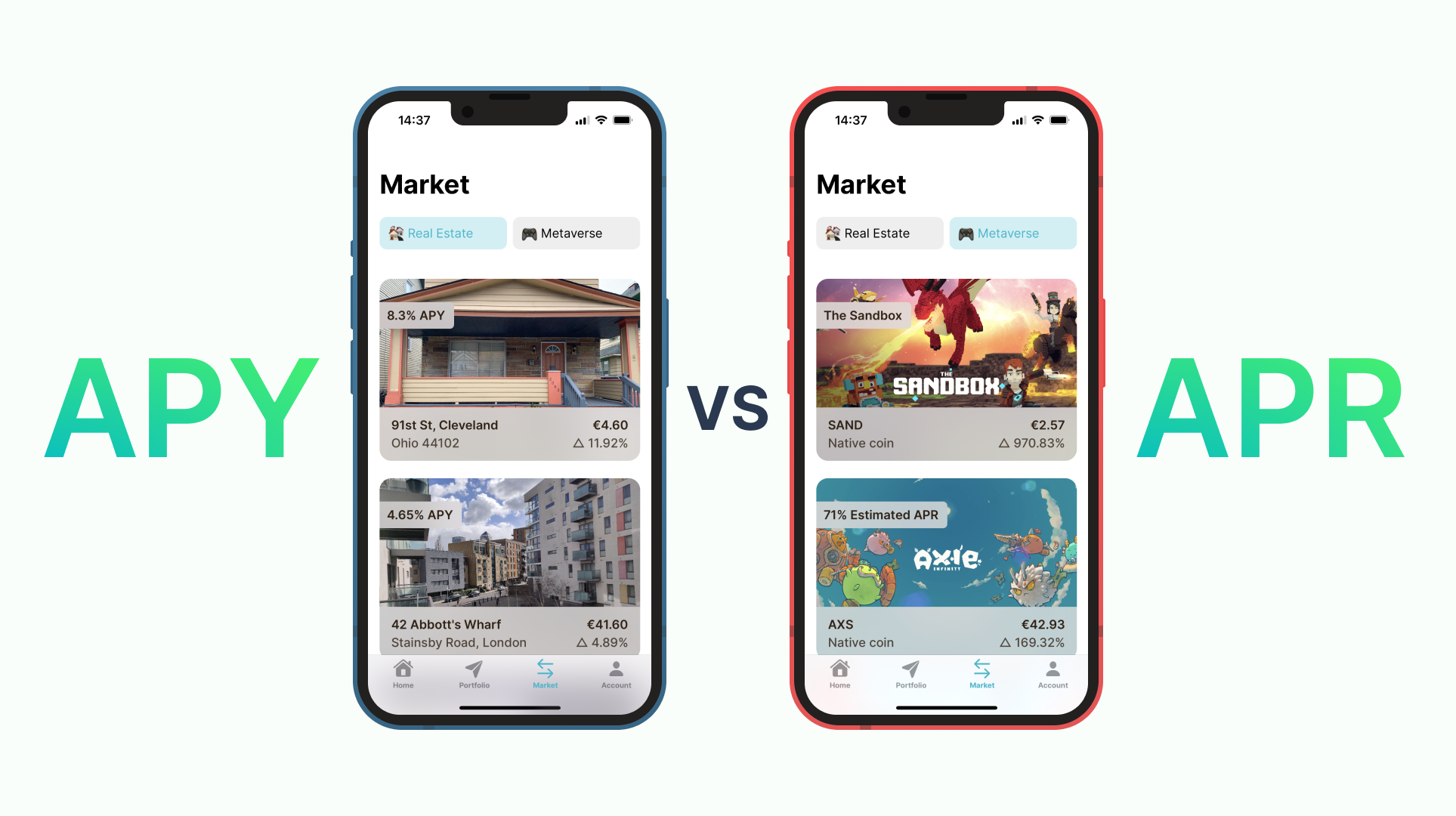

Apr Vs Apy What S The Difference An annual percentage rate (apr) is the interest rate charged on loans. an annual percentage yield (apy) is the rate of interest earned on investments. Apr (annual percentage rate) reflects the annual interest on loans or credit without compounding, commonly used for credit card and loan rates. apy (annual percentage yield) includes compounding, showing the effective annual return on your investment, but does not include fees.

Apr Vs Apy Understanding The Difference Made Simple Seriouscents Apr is primarily centered on borrowing and represents the true cost of taking out a loan or using a credit card. it provides an inclusive rate that incorporates both interest and associated fees. on the other hand, apy focuses on the earning potential of investments. Apr and apy: what’s the difference? apr and apy may differ by just one letter, but that small change can have a big impact on your financial future. whether you’re borrowing money or saving it, understanding the difference between annual percentage rate (apr) and annual percentage yield (apy) is key to making smart money decisions. in this guide, we explain how each term works, when to pay. Apr comes into play when you borrow money – it reflects the interest, costs, and fees you’re expected to pay on a loan over the course of a year. on the other hand, apy applies when you put money into a deposit account, and it shows the amount of interest, including compounding, you could earn in a year. To break it down, apy is the interest you earn on money stored in a savings account, while apr is the interest charged that you owe when you borrow money from the bank. it’s important to know the difference between these two key terms as they impact your finances, especially when investing or taking out a loan.

Apr Vs Apy Explained Apr comes into play when you borrow money – it reflects the interest, costs, and fees you’re expected to pay on a loan over the course of a year. on the other hand, apy applies when you put money into a deposit account, and it shows the amount of interest, including compounding, you could earn in a year. To break it down, apy is the interest you earn on money stored in a savings account, while apr is the interest charged that you owe when you borrow money from the bank. it’s important to know the difference between these two key terms as they impact your finances, especially when investing or taking out a loan. Apr is a simple interest rate whereas apy is the yield that considers the compounding effect of interest. this results in significantly different uses for both these rates. Annual percentage rate is the rate of interest paid or earned on investment without compounding of interest within the year. in contrast, the annual percentage yield is the rate of interest on a normalized basis, taking into account compounding of interest within the year. Annual percentage rate, or apr, is how much interest you pay each year on money you’ve borrowed. it can include fees. you would see apr on mortgages, personal loans and credit cards. annual percentage yield, or apy, is how much interest you earn yearly on money saved or invested.

Comments are closed.