Apr Vs Apy In Excel What The Effect Function Reveals

Apr Vs Apy What S The Difference The effect function calculates the effective annual interest rate based on a given nominal rate and compounding frequency. while the apr is the stated interest rate, the apy accounts for how often the interest is compounded (monthly, quarterly, daily, etc.), making it a more accurate measure of cost or return. In this excel tutorial, jeff walks you step by step through the effect function, showing how to convert a nominal interest rate (apr) into the effective annual rate (apy) — a key skill.

Apr And Apy Apr Vs Apy Interactive For 10th 12th Grade Lesson Planet This gives you an apy of about 5.116%. excel’s effect function makes this even easier: =effect(nominal rate, npery) where ‘nominal rate’ is your apr and ‘npery’ is the number of compounding periods per year. pro tip: create a comparison table in excel to see how different compounding frequencies affect your returns. it’s eye opening!. The effect function offers an easy way to calculate the effective interest rate for people who are not from business and finance, and it can be used for more complex calculations when combined with logical functions like if statements!. The excel effect function returns the effective annual interest rate, given a nominal interest rate and the number of compounding periods per year. effective annual interest rate is the interest rate actually earned due to compounding. Excel provides multiple methods to calculate the effective interest rate. here are the most commonly used formulas: 1. using the effect function. the effect function in excel calculates the effective annual interest rate given a nominal rate and the number of compounding periods per year. syntax: nominal rate: the nominal interest rate.

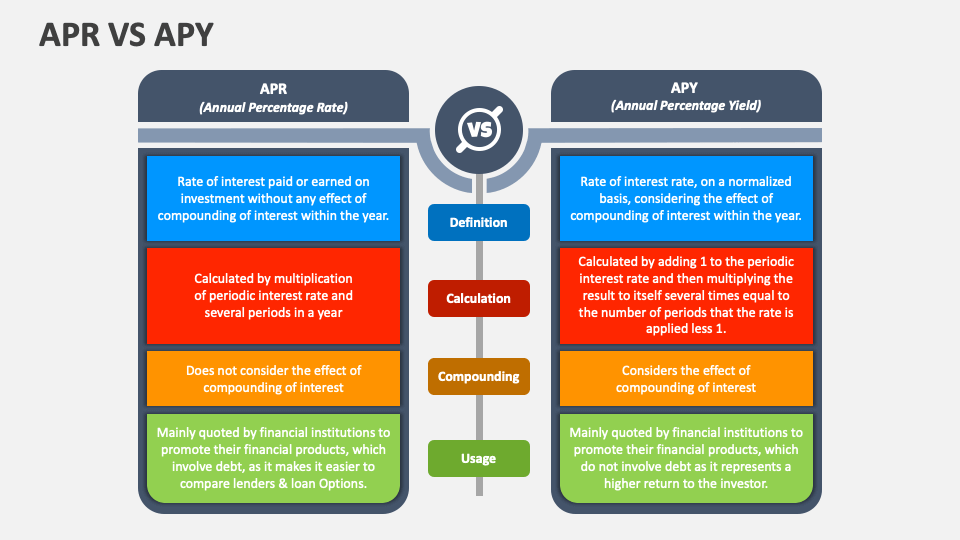

Apr Vs Apy Powerpoint And Google Slides Template Ppt Slides The excel effect function returns the effective annual interest rate, given a nominal interest rate and the number of compounding periods per year. effective annual interest rate is the interest rate actually earned due to compounding. Excel provides multiple methods to calculate the effective interest rate. here are the most commonly used formulas: 1. using the effect function. the effect function in excel calculates the effective annual interest rate given a nominal rate and the number of compounding periods per year. syntax: nominal rate: the nominal interest rate. Function overview: effect in excel calculates the effective annual interest rate from nominal interest rate and compounding periods. practical utility: useful for financial analysis, facilitating comparison of investment options and assessing growth trends. The apy (annual percentage yield), or aer (annual equivalent rate) is 7.76%. the compounding effect results in a slightly higher rate than you’re quoted by the lender. The effect function hones in on providing a more precise measure of interest rates, taking into account compounding periods. the function differs from traditional financial functions like pmt or npv, which focus on specific calculations such as loan payments or net present value. Learn how to use excel’s effect function to calculate the effective annual interest rate. this guide includes examples and best practices for effective financial decision making.

Apr Vs Apy What Are They And How Do They Differ Function overview: effect in excel calculates the effective annual interest rate from nominal interest rate and compounding periods. practical utility: useful for financial analysis, facilitating comparison of investment options and assessing growth trends. The apy (annual percentage yield), or aer (annual equivalent rate) is 7.76%. the compounding effect results in a slightly higher rate than you’re quoted by the lender. The effect function hones in on providing a more precise measure of interest rates, taking into account compounding periods. the function differs from traditional financial functions like pmt or npv, which focus on specific calculations such as loan payments or net present value. Learn how to use excel’s effect function to calculate the effective annual interest rate. this guide includes examples and best practices for effective financial decision making.

Comments are closed.