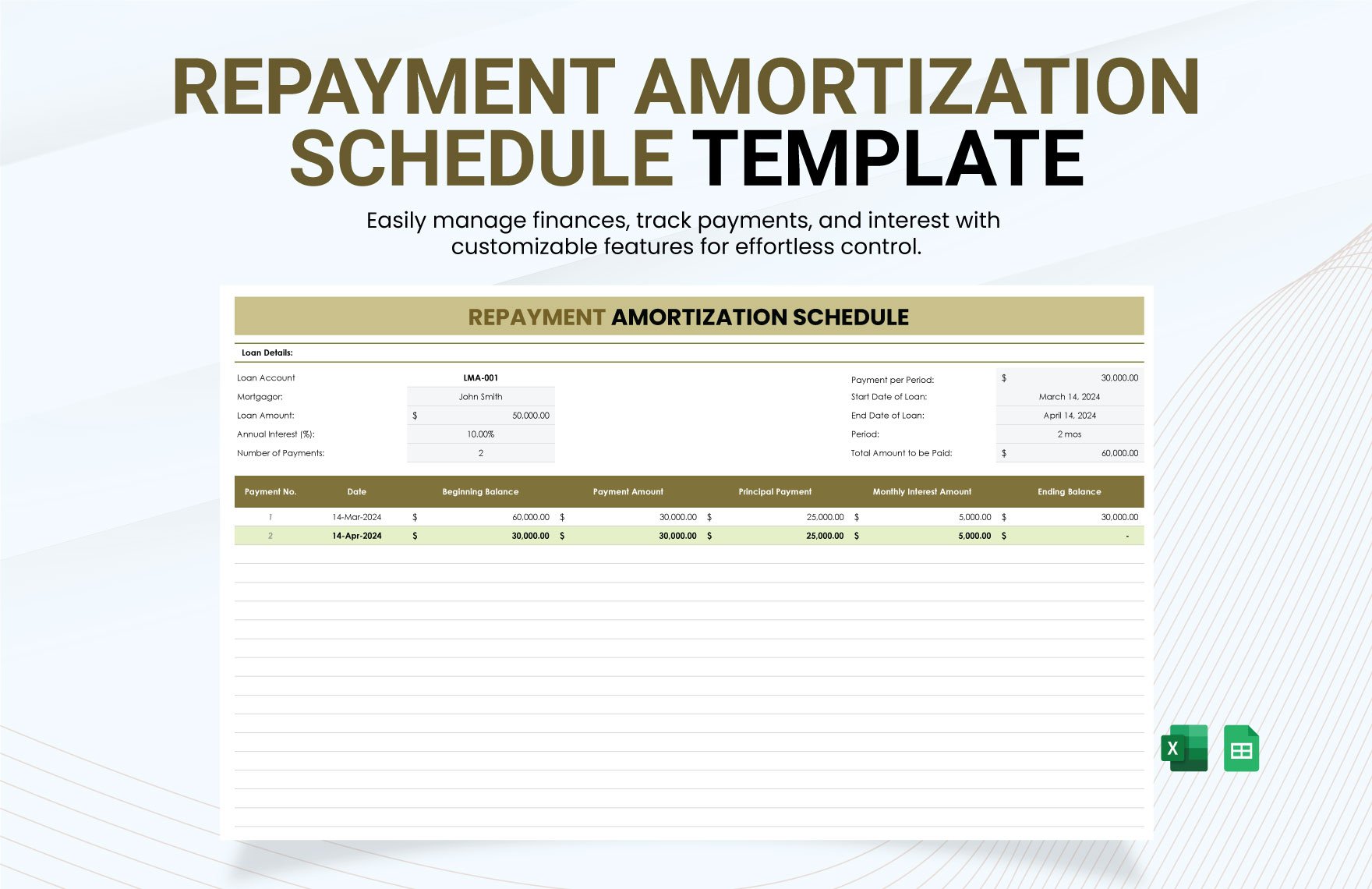

Amortization Schedule Template In Excel Google Sheets Download

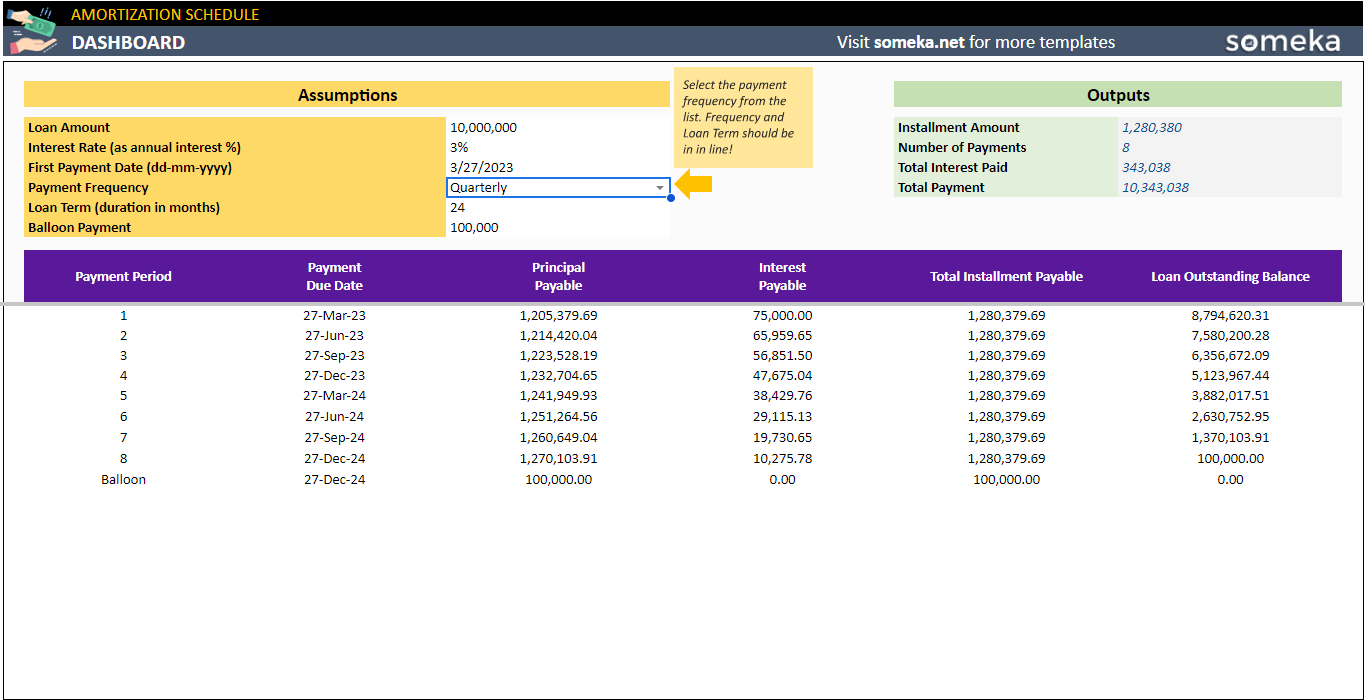

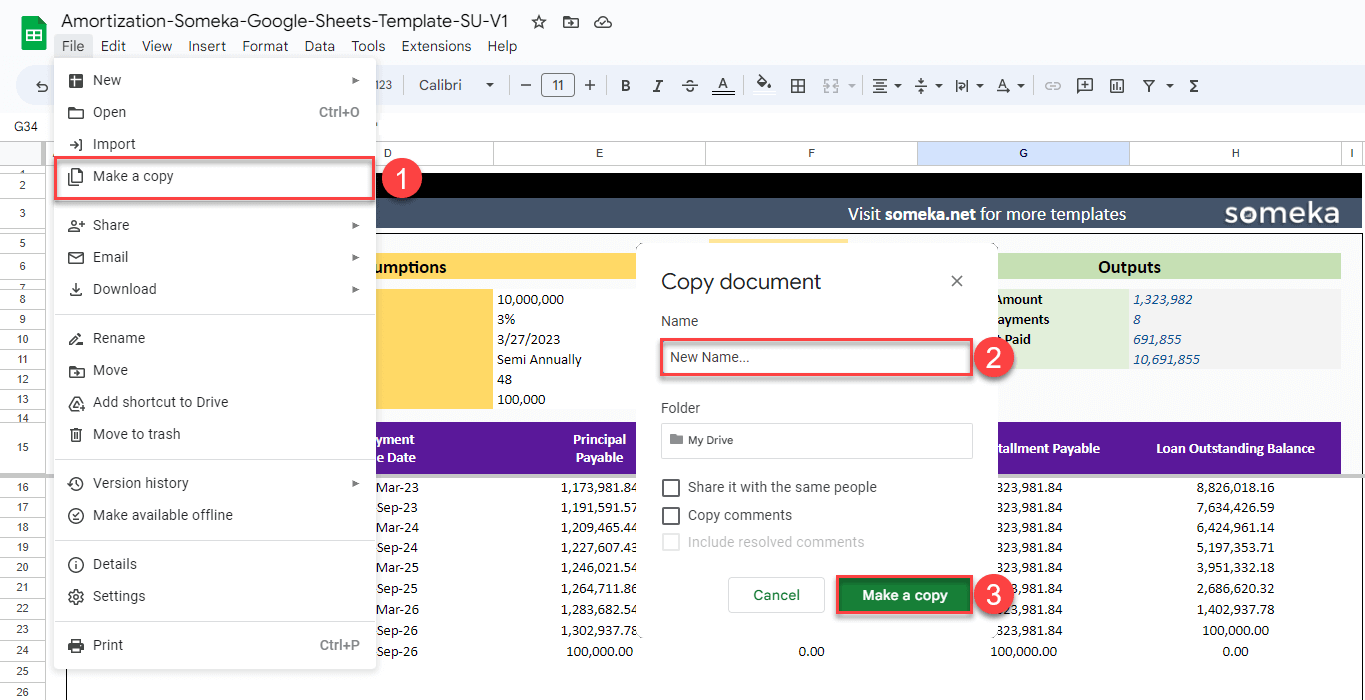

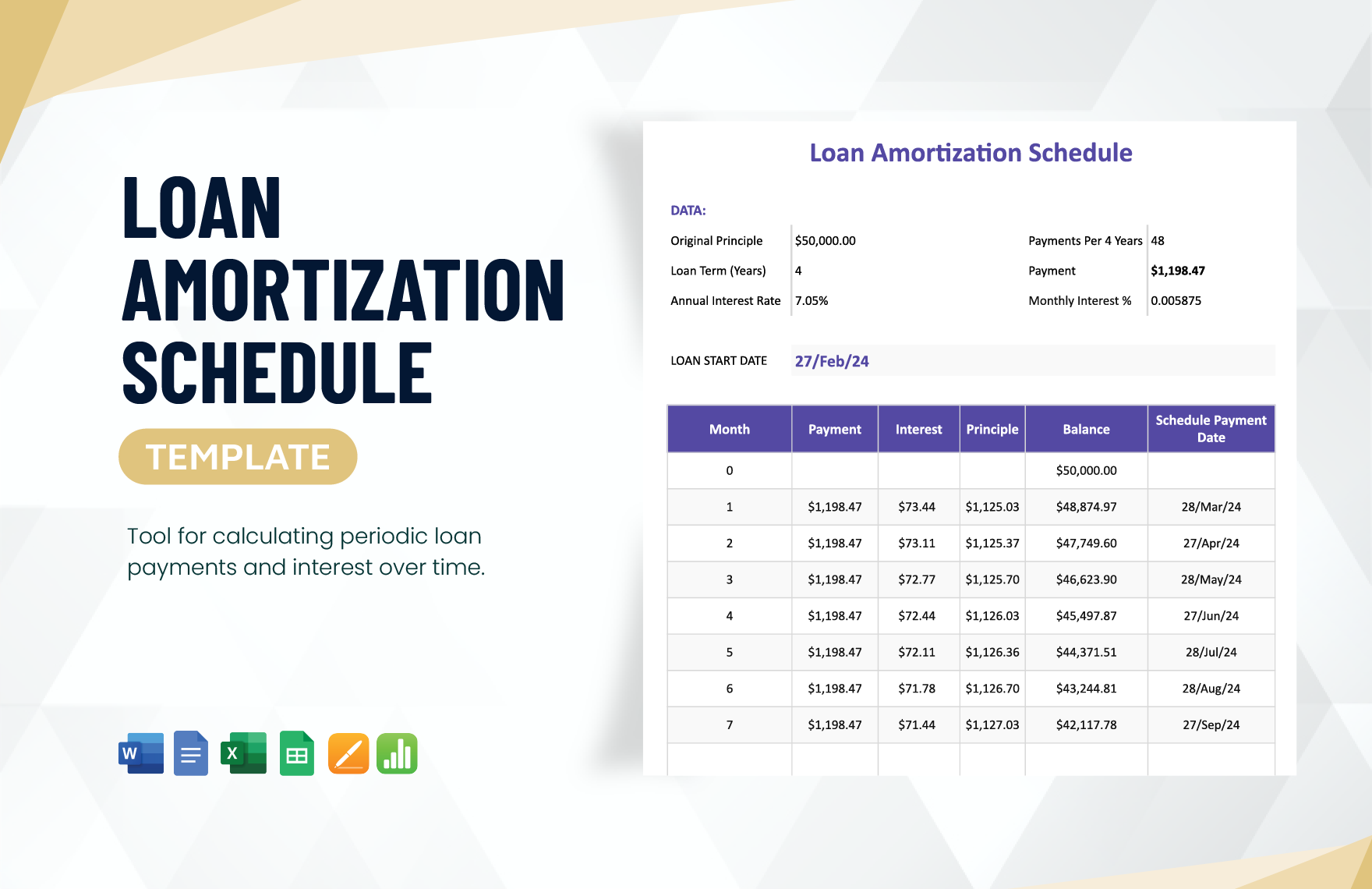

Google Sheets Amortization Schedule Loan Payment Calculator This amortization calculator returns monthly payment amounts as well as displays a schedule, graph, and pie chart breakdown of an amortized loan. This loan calculator also known as an amortization schedule calculator lets you estimate your monthly loan repayments. it also determines out how much of your repayments will go towards the principal and how much will go towards interest.

Google Sheets Amortization Schedule Loan Payment Calculator An amortization schedule is a chart that tracks the falling book value of a loan or an intangible asset over time. for loans, it details each payment’s breakdown between principal and interest. Amortization is the process of paying off a debt or loan over time in predetermined installments. for help determining what interest rate you might pay, check out today’s mortgage rates. Amortization is the way loan payments are applied to certain types of loans. typically, the monthly payment remains the same, and it's divided among interest costs (what your lender gets paid for the loan), reducing your loan balance (also known as "paying off the loan principal"), and other expenses like property taxes. Amortization is a systematic method to reduce debt over time or allocate the cost of an intangible asset, providing a structured approach to financial management for businesses and individuals.

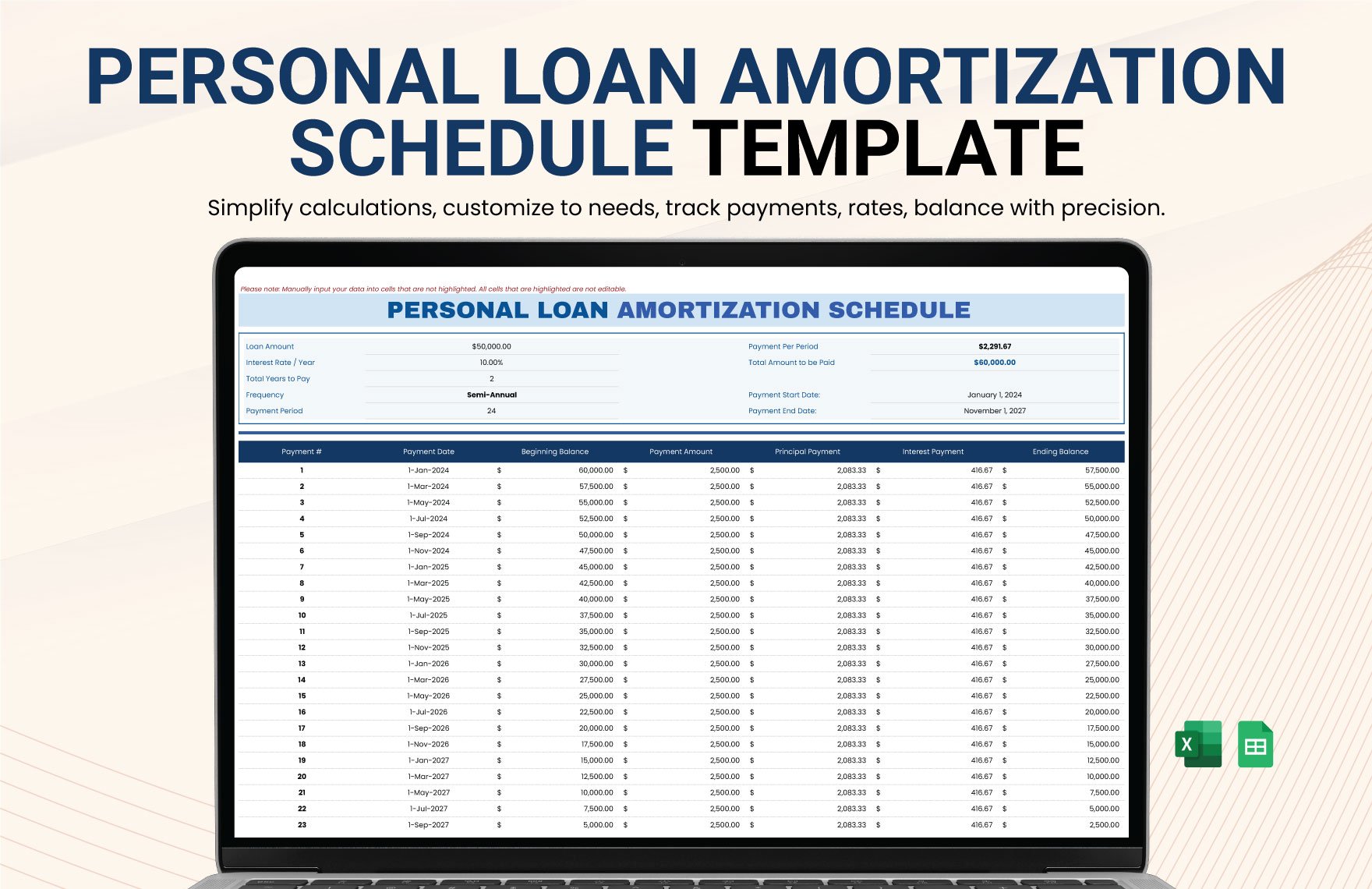

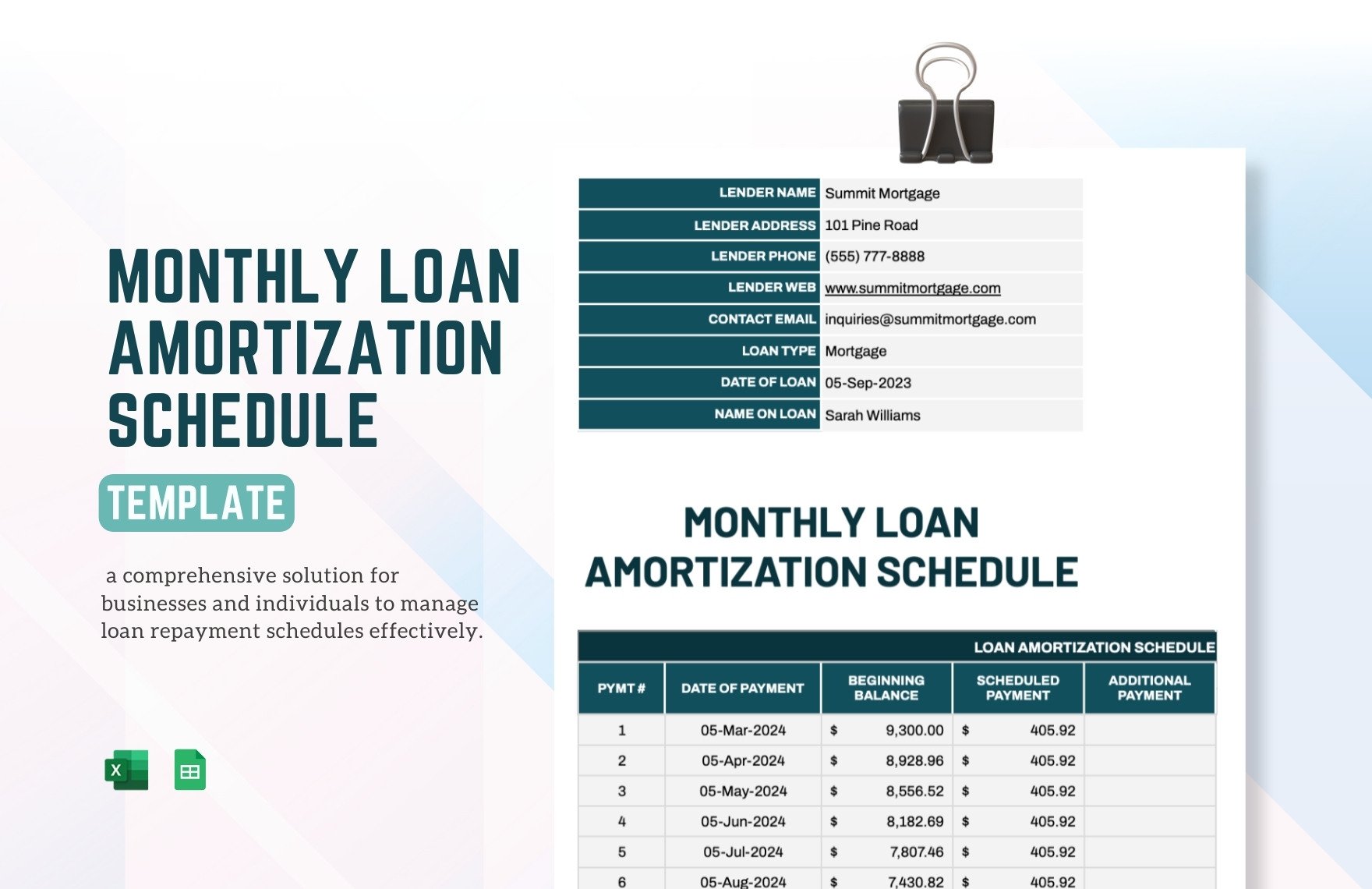

Payment Schedule Templates In Google Sheets Free Download Template Net Amortization is the way loan payments are applied to certain types of loans. typically, the monthly payment remains the same, and it's divided among interest costs (what your lender gets paid for the loan), reducing your loan balance (also known as "paying off the loan principal"), and other expenses like property taxes. Amortization is a systematic method to reduce debt over time or allocate the cost of an intangible asset, providing a structured approach to financial management for businesses and individuals. Amortization is the process of spreading out the cost of an asset over a period of time. there are different methods and calculations that can be used for amortization, depending on the situation. Generate detailed amortization schedules instantly. see payment by payment breakdown of principal vs interest, track loan balance over time, and visualize your payoff timeline. free calculator with downloadable schedules for mortgages, auto loans, and personal loans. Learn what amortization is, how it applies to loans and intangible assets, and why it matters. explore examples, methods, and its impact on financial statements. Amortization refers to the systematic allocation of a lump sum amount over a set period of time. in finance, this term has two primary applications: 1) the gradual reduction of a loan balance through regular payments of principal and interest, and 2) the accounting process of spreading the cost of an intangible asset over its useful life.

Loan Templates In Google Sheets Free Download Template Net Amortization is the process of spreading out the cost of an asset over a period of time. there are different methods and calculations that can be used for amortization, depending on the situation. Generate detailed amortization schedules instantly. see payment by payment breakdown of principal vs interest, track loan balance over time, and visualize your payoff timeline. free calculator with downloadable schedules for mortgages, auto loans, and personal loans. Learn what amortization is, how it applies to loans and intangible assets, and why it matters. explore examples, methods, and its impact on financial statements. Amortization refers to the systematic allocation of a lump sum amount over a set period of time. in finance, this term has two primary applications: 1) the gradual reduction of a loan balance through regular payments of principal and interest, and 2) the accounting process of spreading the cost of an intangible asset over its useful life.

Loan Templates In Google Sheets Free Download Template Net Learn what amortization is, how it applies to loans and intangible assets, and why it matters. explore examples, methods, and its impact on financial statements. Amortization refers to the systematic allocation of a lump sum amount over a set period of time. in finance, this term has two primary applications: 1) the gradual reduction of a loan balance through regular payments of principal and interest, and 2) the accounting process of spreading the cost of an intangible asset over its useful life.

Editable Loan Templates In Google Sheets To Download

Comments are closed.