Amortization Schedule Explained

What Is An Amortization Schedule Pdf Amortization Business Loans An amortization schedule is a chart that tracks the falling book value of a loan or an intangible asset over time. for loans, it details each payment’s breakdown. What is an amortization schedule? an amortization schedule is a chart that shows the amounts of principal and interest due for each loan payment of an amortizing loan. an amortizing loan is a loan that requires regular payments, where each payment is the same total amount.

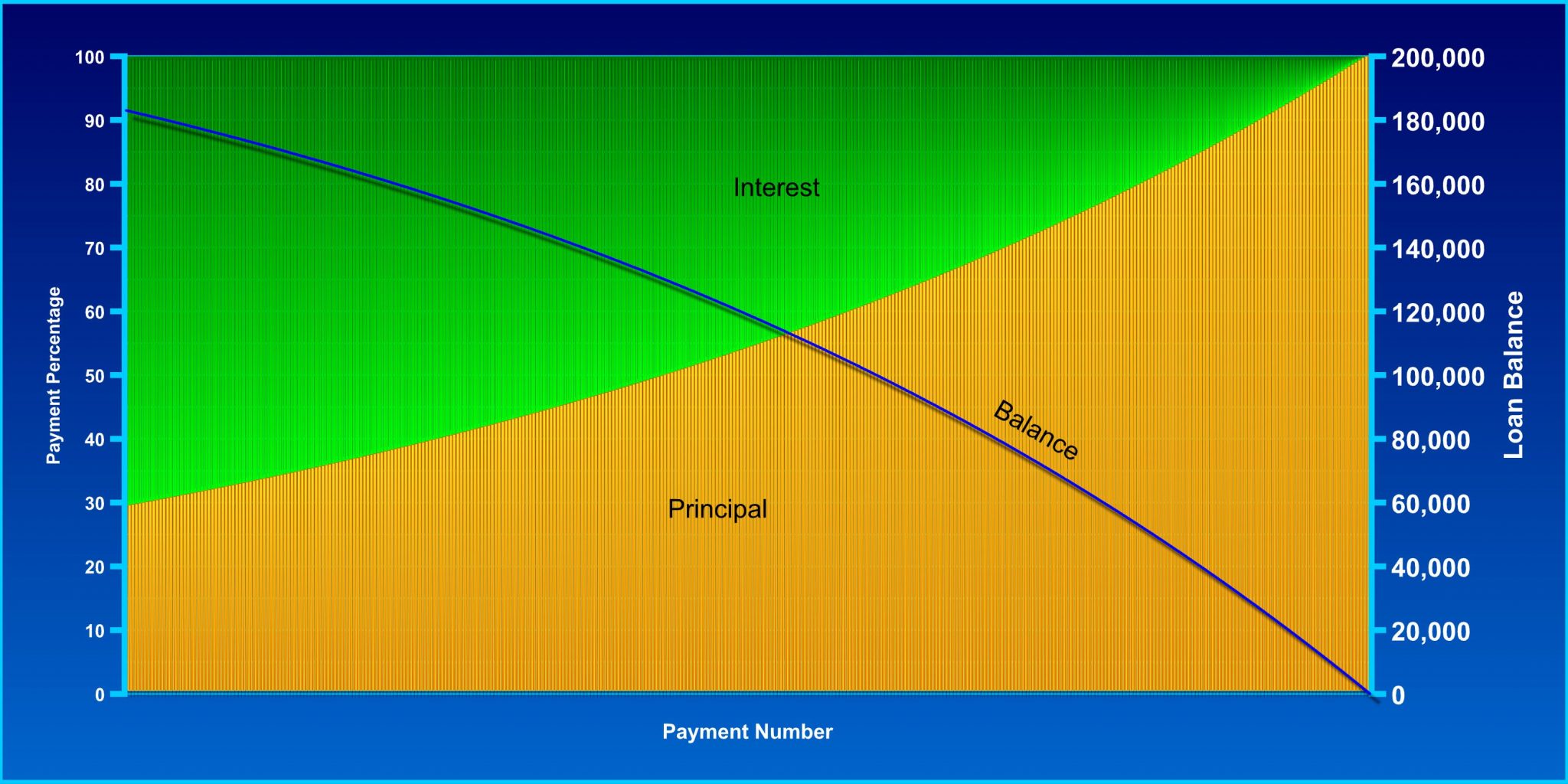

Amortization Schedule Explained Mortgagecalculator Io What is an amortization schedule? an amortization schedule is a table that provides both loan and payment details for a reducing term loan. What is an amortization schedule and how does it work? an amortization schedule outlines each loan payment until the end of your mortgage, showing how much goes toward interest and how much reduces the principal. to calculate amortization, first multiply your principal balance by your interest rate. An amortization schedule is a table or chart that outlines the periodic payments, principal repayment, interest allocation, and remaining balance for a loan or mortgage over its term. this schedule helps borrowers and lenders understand how payments are applied towards reducing the loan balance over time. 1. purpose and importance. 2. An amortization schedule is a tool used in finance to track the repayment of a loan over time. it provides a detailed breakdown of each payment, showing how much goes towards the principal (the original loan amount) and how much goes towards interest.

Amortization Schedule 1 An amortization schedule is a table or chart that outlines the periodic payments, principal repayment, interest allocation, and remaining balance for a loan or mortgage over its term. this schedule helps borrowers and lenders understand how payments are applied towards reducing the loan balance over time. 1. purpose and importance. 2. An amortization schedule is a tool used in finance to track the repayment of a loan over time. it provides a detailed breakdown of each payment, showing how much goes towards the principal (the original loan amount) and how much goes towards interest. An amortization schedule is a table or chart that shows each loan payment throughout the life of the loan. these payments are broken down to show how much will be allocated to the loan’s principal and accrued interest charges, as well as the new loan balance after each subsequent payment. What is a loan amortization schedule? loan amortization schedule refers to the schedule of repayment of the loan in terms of periodic payments or installments that comprise of principal amount and interest component until the end of the loan term or up to which full amount of loan is paid off. An amortization schedule is a detailed plan that shows how a loan is repaid over time through regular payments. it breaks down each payment into principal and interest, helping borrowers understand how their balance decreases with each installment. An amortization schedule is the plan for monthly repayment. it sets out how much the homeowner will pay off the principal and interest charges every month for the duration of the loan agreement.

Key Factors And Calculation Of Amortization Schedule Explained Excel An amortization schedule is a table or chart that shows each loan payment throughout the life of the loan. these payments are broken down to show how much will be allocated to the loan’s principal and accrued interest charges, as well as the new loan balance after each subsequent payment. What is a loan amortization schedule? loan amortization schedule refers to the schedule of repayment of the loan in terms of periodic payments or installments that comprise of principal amount and interest component until the end of the loan term or up to which full amount of loan is paid off. An amortization schedule is a detailed plan that shows how a loan is repaid over time through regular payments. it breaks down each payment into principal and interest, helping borrowers understand how their balance decreases with each installment. An amortization schedule is the plan for monthly repayment. it sets out how much the homeowner will pay off the principal and interest charges every month for the duration of the loan agreement.

Comments are closed.