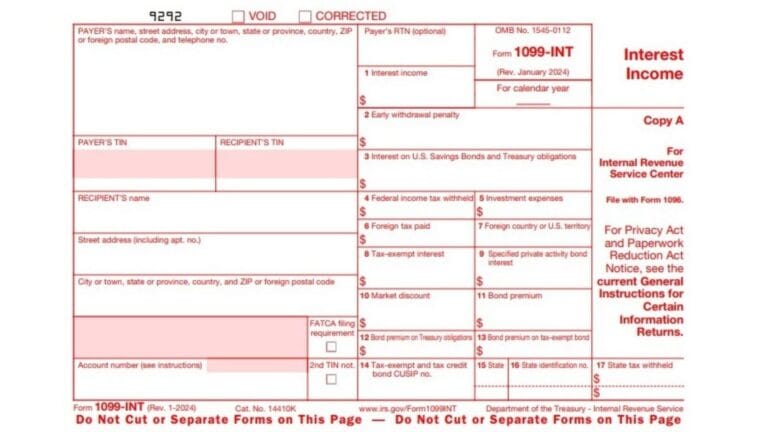

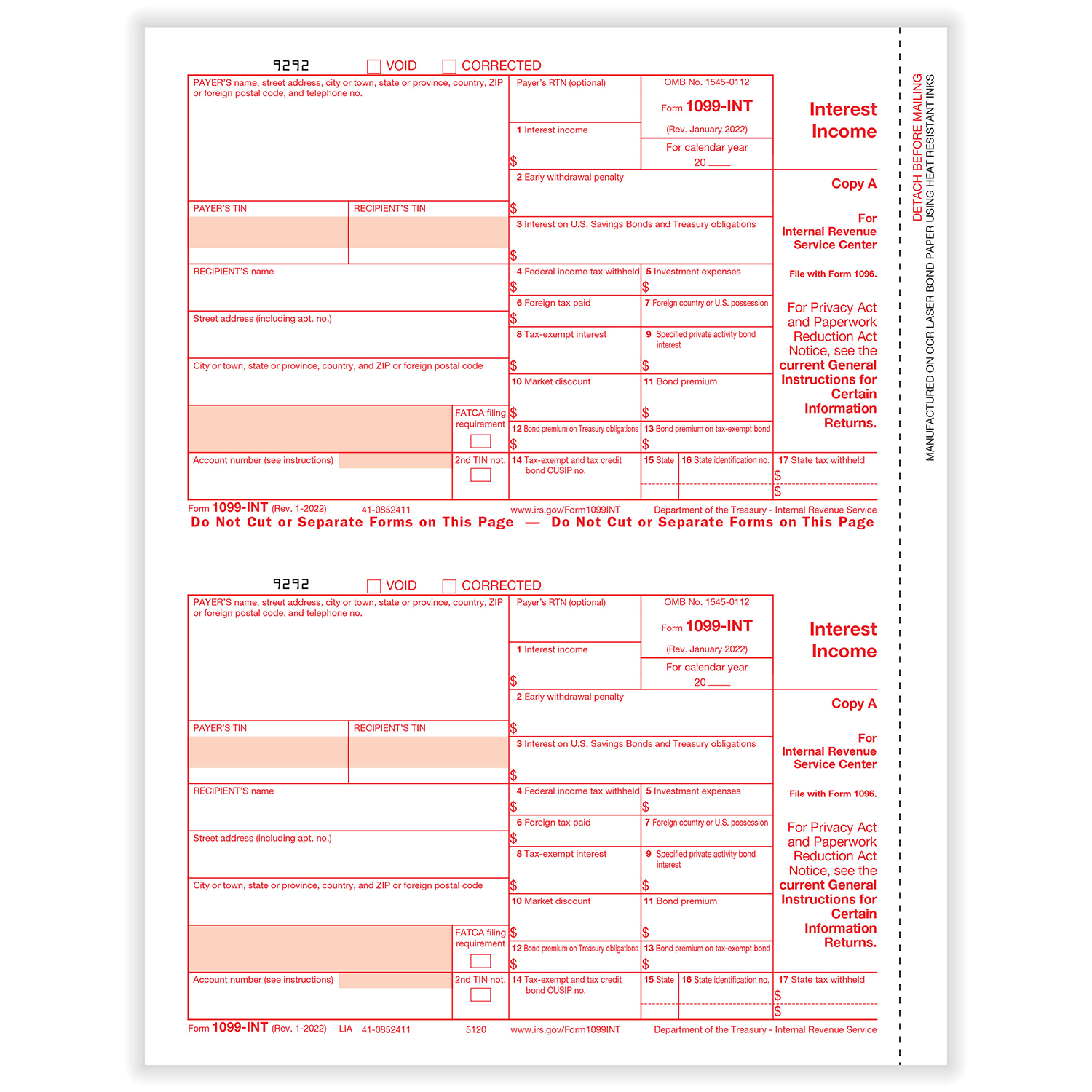

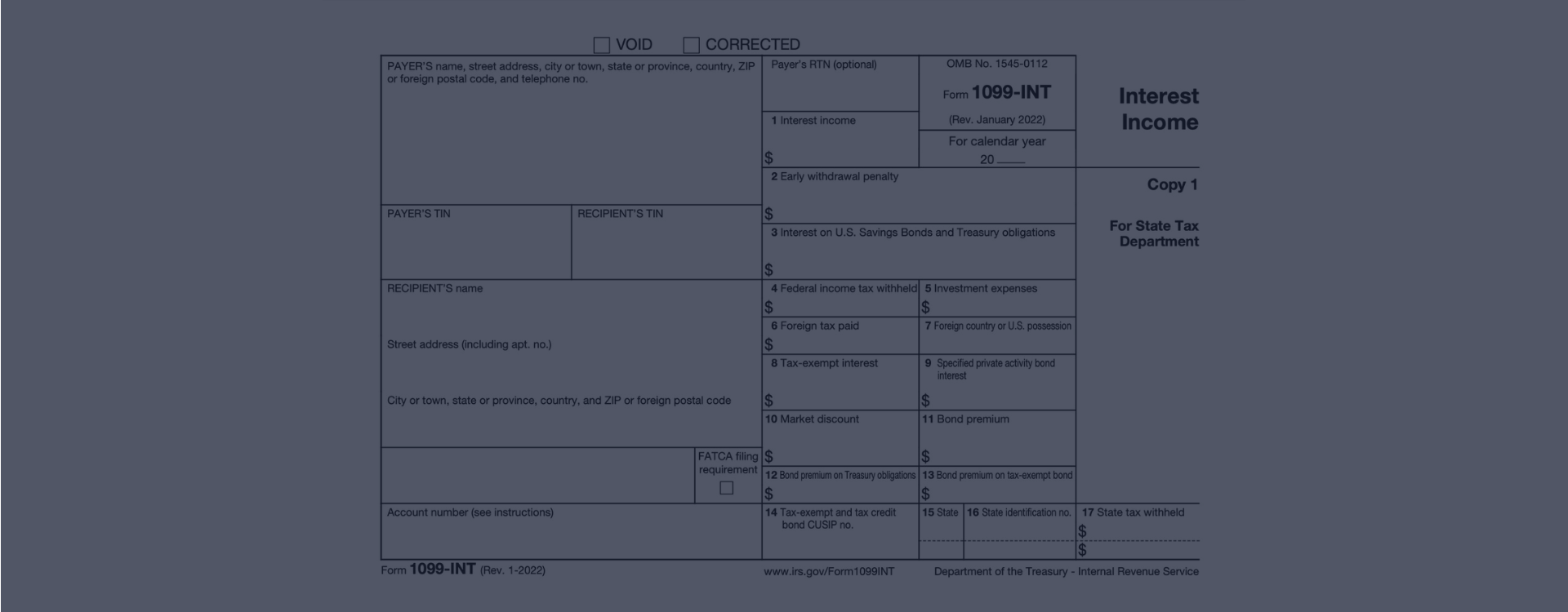

1099 Int Form Instructions 2024 2025

Form 1099 Int Instructions 2024 2025 A 1099-INT is the tax form used to report interest The IRS offers guidance on requesting the recipient's TIN as part of federal tax form instructions "Form 1099-INT (Rev January 2024)" Form 1099-INT: Interest Income Form 1099-INT is issued by all financial institutions 2024: $5,000: Any number: 2025: $ The full list of codes is listed in Table 1 of the instructions for

Form 1099 Int Instructions 2024 2025 A 1099-INT tax form is a record that someone paid you at least $10 in interest throughout the year Here's what to do with it Updated Dec 10, 2024 · 1 min read Fact Checked So, if you had a high-yield savings account in 2024 that paid an APY of 525% and you got a $200 bonus for opening the account, you'd pay taxes on the interest earned at 525% as well as the $200 Apple says that eligible customers should receive their 1099-INT forms by Jan 31, 2024 "Your 1099 tax forms include any reportable interest and income paid to you, which is shared with the IRS 2024 form 1099-NEC reporting with the IRS is due on or before January 31, 2025 for both paper and electronic filers Other forms such as 1099-MISC, 1099-INT, 1099-DIV and 1099-R are due on or

1099 Int Form 2025 Edward D Remer Apple says that eligible customers should receive their 1099-INT forms by Jan 31, 2024 "Your 1099 tax forms include any reportable interest and income paid to you, which is shared with the IRS 2024 form 1099-NEC reporting with the IRS is due on or before January 31, 2025 for both paper and electronic filers Other forms such as 1099-MISC, 1099-INT, 1099-DIV and 1099-R are due on or It's tax time Here's a look at what you need to know about due dates for your tax forms, including Forms W-2 and 1099, and what to do if you don't receive yours on time Reporting the income doesn’t require much work Most taxpayers can give the 1099-INT form to their tax preparer or type the number on the form into tax preparation software Those who fill out Your 1099 tax forms for 2023 will be generated by January 31, 2024, as required by IRS guidelines Your 1099 tax forms include any reportable interest and income paid to you, which is shared with

1099 Int Form 2024 Bryn Jillana It's tax time Here's a look at what you need to know about due dates for your tax forms, including Forms W-2 and 1099, and what to do if you don't receive yours on time Reporting the income doesn’t require much work Most taxpayers can give the 1099-INT form to their tax preparer or type the number on the form into tax preparation software Those who fill out Your 1099 tax forms for 2023 will be generated by January 31, 2024, as required by IRS guidelines Your 1099 tax forms include any reportable interest and income paid to you, which is shared with

1099 Int Form Instructions 2024 2025 Your 1099 tax forms for 2023 will be generated by January 31, 2024, as required by IRS guidelines Your 1099 tax forms include any reportable interest and income paid to you, which is shared with

Tax Form 1099 Int Irs Fillable 1099 Int Form For 2023 Pdf To File

Comments are closed.