1 Financial Instruments Classification And Measurement Pdf

1 Financial Instruments Classification And Measurement Pdf The board made limited amendments to the classification and measurement requirements for financial assets by addressing a narrow range of application questions and by introducing a ‘fair value through other comprehensive income’ measurement category for particular simple debt instruments. This publication considers the changes to classification and measurement of financial assets. further details on the new impairment model are included in in depth us2014 06, ifrs 9 expected credit losses. the general hedging model is covered in dataline 2014 03, accounting for hedging activities iasb new general hedge accounting requirements.

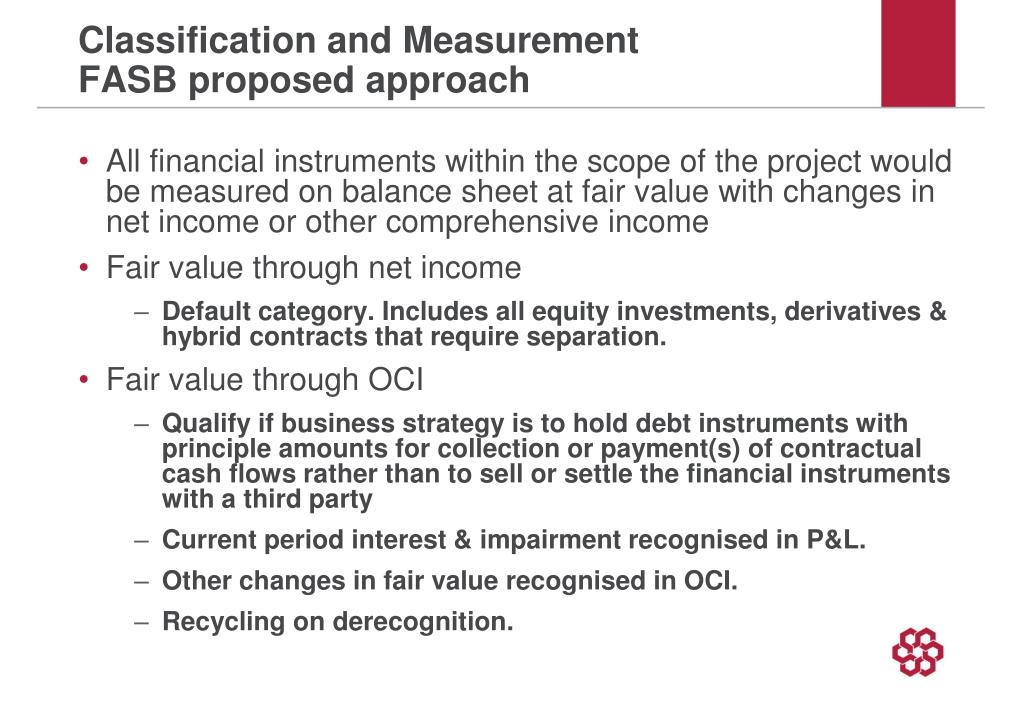

Financial Instruments Pdf Bonds Finance Securities Finance Classification and measurement of financial assets ifrs 9 replaces the rules based model in ias 39 with an approach which bases classification and measurement on the business model of an entity, and on the cash flows associated with each financial asset. The new standard includes revised guidance on the classification and measurement of financial assets, including a new expected credit loss model for calculating impairment, and supplements the new general hedge accounting requirements published in 2013.1. This article covers all niches and aspects of ifrs 9, such as ifrs 9 classification and measurement, ifrs 9 hedging, ifrs 9 provisioning, and ifrs 9 disclosure requirements. ifrs 9 financial instruments explains how classification and measurement for financial instruments work. Disclosure of the level of the fair value hierarchy within which the fair value measurements of amortized cost financial instruments are categorized in their entirety (level 1, 2, or 3).

Ppt Financial Instruments Classification And Measurement Powerpoint This article covers all niches and aspects of ifrs 9, such as ifrs 9 classification and measurement, ifrs 9 hedging, ifrs 9 provisioning, and ifrs 9 disclosure requirements. ifrs 9 financial instruments explains how classification and measurement for financial instruments work. Disclosure of the level of the fair value hierarchy within which the fair value measurements of amortized cost financial instruments are categorized in their entirety (level 1, 2, or 3). This includes amended guidance for the classification and measurement of financial assets by introducing a fair value through other comprehensive income category for certain debt instruments. The iasb’s new financial instrument standard, ifrs 9, applies for years beginning on or after 1 january 2018 and introduces significant changes to classification and measurement, impairment and hedge accounting. 5.1 an introduction to this chapter will note instruments, functional categories, maturity, several different parts of the international classification, namely to develop aggregates items with different characteristics and. This article highlights how the financial assets and liabilities are to be classified and measured in accordance with ifrs 9: financial instruments and how this classification and measurement may impact financial instruments of an organisation.

Comments are closed.