The subject of yield curvedefinition finance encompasses a wide range of important elements. YieldCurve: What It Is, How It Works, and Types - Investopedia. What Is a Yield Curve? A yield curve is a line that plots the yields or interest rates of bonds that have equal credit quality but different maturity dates. Yield Curve Basics: How to Read the Bond Market | Britannica Money. Yield curves track interest rates across different time periods, from one month to 30 years, giving lenders and borrowers an idea of the cost of money over time.

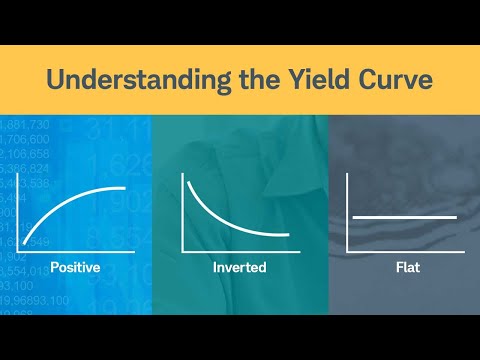

Yield Curve - Definition, Diagrams, Types of Yield Curves. Another key aspect involves, the Yield Curve is a graphical representation of the interest rates on debt for a range of maturities. It shows the yield an investor is expecting to earn if he lends his money for a given period of time. The Yield Curve Explained: Types, Economic Significance, and Its ....

It's important to note that, by understanding the definition of a yield curve, its various forms, and the underlying theories that shape it, you gain access to one of the clearest and most influential indicators available to financial analysts, central bankers, and seasoned investors. In this context, yield curve - Wikipedia. In practice the term usually refers to curves built from a single issuer or market segment so that credit quality and other features are as similar as possible, for example the U.S. Similarly, treasury curve for government bonds.

[1] Different markets publish related curves for different purposes. A yield curve (also known as treasury yields) is a graphical line representing the interest rates on Treasurys on various maturities. Usually, the longer the maturities, the higher the interest rate they offer, which means an upward-sloping curve. Understanding Yield Curve: Definition, Types, and Impact - Tickeron. One of the essential instruments for both investors and economists alike is the yield curve. It offers an insightful snapshot of the current financial climate by presenting the interest rates of bonds of similar credit quality but different maturity dates at a specific point in time.

Understanding the Yield Curve: A Guide to Interest Rates and Economic .... A yield curve plots the yields (interest rates) of similar fixed‑income securities against their maturities. Moreover, more than just a graph, it’s a powerful tool that reflects market expectations for growth, inflation, and monetary policy. Bonds Yield Curve Definition and Examples. A Bond Yield Curve, often simply called the "yield curve," is a graphical representation that shows the relationship between interest rates (yields) and the time to maturity for a set of similar bonds, typically government bonds, at a given point in time.

Yield Curve Definition & Examples - Quickonomics.

📝 Summary

To conclude, we've explored key elements related to yield curve definition finance. This overview provides important information that can guide you to grasp the topic.